Accounts payable refers to a business’ short-term obligations, i.e., the money owed to the vendors for purchases made on credit. AP optimization has an important role in a company’s financial/cash flow management, as timely and accurate payment of such obligation helps with maintaining cordial working ties with the suppliers.

As we move into 2023, there are several accounts payable trends in businesses should be aware of and consider adopting to stay competitive and efficient.

Table of Contents

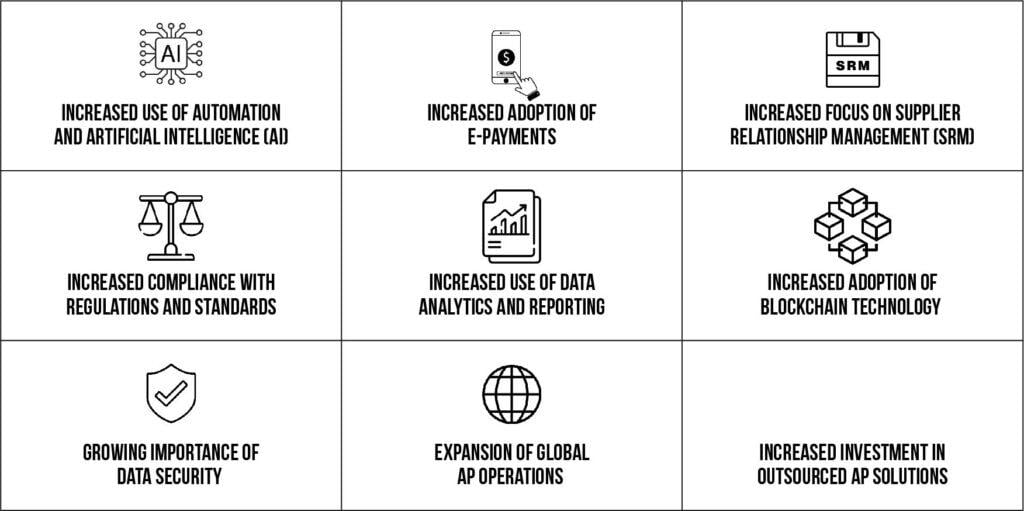

Increased use of artificial intelligence (AI)

Expertise Accelerated publication titled “The Future of Accounting: Demand and Evolving Technology 2022 ” highlights Robotics and AI as an enduring feature of the accounting profession in the future. One of the strongest accounts payable trends in the growing use of automation and AI to streamline and optimize the payment process.

Automation can help reduce the time and resources spent on manual and mundane tasks such as data entry and vendor communication, while AI can help the management analyze and interpret data to identify trends and patterns and make recommendations for improvement.

Examples of automation in accounts payable services include the use of software to automatically match invoices to purchase orders and contracts, and the use of electronic invoicing and payment systems to eliminate the need for manual processing of paper documents.

Increased adoption of e-payments

Electronic payments, or e-payments, are becoming increasingly popular in the accounts payable process as they offer a range of benefits compared to traditional payment methods.

E-payments can be made using various methods such as credit or debit cards, mobile payments, and online banking, and can be processed faster and more securely than paper-based payments.

In addition to the added convenience, speed and security that comes with e-payments, they also help reduce the risk of fraud and errors and provide businesses with enhanced visibility and control over their cash flows.

Increased focus on supplier relationship management (SRM)

Supplier relationship management (SRM) is the process of managing and optimizing the interactions and transactions between a business and its suppliers. In the context of accounts payable, SRM can help improve the efficiency and effectiveness of the payment process, as well as foster better relationships with suppliers.

Effective SRM involves communication and collaboration with suppliers, the establishment of clear and mutually beneficial terms and conditions, and the use of tools and technologies such as supplier portals and e-invoicing systems.

Increased compliance with regulations and standards

In recent years, there has been an increase in the number and complexity of regulations and standards related to accounts payable, such as the Payment Card Industry Data Security Standard (PCI DSS) and the Sarbanes-Oxley Act (SOX).

Businesses must ensure compliance with these regulations and standards in order to protect their reputation and avoid costly fines and penalties. To do so, they may need to adopt new technologies and processes, such as secure e-payment systems and internal controls to prevent fraud and errors.

Increased use of data analytics and reporting

Data analytics and reporting are becoming increasingly important in accounts payable as they can help businesses gain insights into their payment processes and identify areas for improvement. PwC reports that 68% of CFOs recognize the growth in this trend and are investing in analytics technology for a competitive foothold in the future. By analyzing data such as payment timeliness, supplier performance, and trends in invoice volumes and amounts, businesses can identify bottlenecks and inefficiencies, and make informed decisions about their accounts payable strategies.

To effectively leverage data analytics for improved and refined reporting in accounts payable, businesses may need to invest in data management and visualization tools as well as train their employees in data analysis and interpretation.

Increased adoption of blockchain technology

Blockchain technology has the potential to revolutionize the way that businesses manage their AP processes. By using a decentralized, secure ledger to track financial transactions, businesses can reduce the risk of fraud and errors and improve transparency in their AP processes. In 2023, we can expect to see more businesses adopting blockchain technology in their AP processes.

Growing importance of data security

As businesses increasingly adopt technology to manage their AP processes, the importance of data security will continue to grow. Hackers and cybercriminals are constantly looking for ways to access sensitive financial data, and it is essential that businesses take steps to protect themselves from such financial catastrophes. In 2023, we can expect to see businesses investing in stronger cybersecurity measures to protect their AP data.

Expansion of global AP operations

With businesses like e-commerce enabling access to a global market, managing AP across multiple countries can become a complex and time-consuming process. In 2023, we can expect to see more businesses adopting global AP solutions to manage their financial obligations across transnational jurisdictions. These solutions may include the use of technology such as electronic invoicing and cross-border payment platforms.

Increased investment in outsourced AP solutions

As we highlighted in one of our prior publications titled “Does Outsourcing Really Benefit Companies?” the Great Resignation following the COVID-19 pandemic left economies with a dearth of professional talent. Even today, when the adversities associated with the pandemic have subsided considerably, hiring high-quality talent remains a challenge for many companies because of growing inflation and the persisting labor market crunch.

With the proven success of the WFH model during the pandemic, as well as investments into technology like cloud accounting, many businesses have begun investing heavily in outsourced accounting professionals.`

However, even though the accounting function has amazing compatibility with the WFH model, not all businesses can benefit from staff augmentation or outsourcing solutions because in many cases, cost savings come at the cost of quality. However, EA’s niche outsourcing and staff augmentation solutions that leverage the US CPG industry experience and expertise of its onshore leadership with the high-quality offshore professional talent guarantee quality with affordability, thus enabling client companies to realize substantial payroll savings without compromising on the quality of the service.

In addition to complex areas such as trade spend management, EA also offers such solutions in lesser complex areas such as the accounts receivable and accounts payable. Expertise Accelerated’s accounts payable services include staff augmentation and outsourcing solutions that help optimize the client company’s AP function, supporting cash flow and vendor relationship management.

Conclusion

In a nutshell, the accounts payable landscape is constantly evolving in the prevailing times, and in 2023 we can expect to see a number of exciting trends emerging. From the increasing adoption of AI and ML (machine learning) technologies to the growing importance of data security, there are many exciting developments to look forward to in the world of AP. By staying at pace with these trends, embracing the latest technologies, and leveraging high-quality staff augmentation solutions such as the ones that EA offers, businesses can optimize their AP processes for improved cash flow and vendor relationship management.