Let’s imagine some years into the future when we find ourselves having a similar conversation with a chatbot financial advisor:

Chatbot: Good afternoon, how can I assist you today?

Human Client: Hi Good morning, I was wondering if you could help me plan for my retirement.

Chatbot: Of course, I’d be happy to help. Have you thought about when you would like to retire and how much income you’ll need in retirement?

Client: I was thinking of retiring in about 15 years and I would like to have enough income to maintain my current lifestyle.

Chatbot: That’s a good starting point. Can you tell me a bit about your current financial situation? Do you have any savings or investments set aside for retirement?

Client: I have a 401(k) through my employer, but I haven’t been contributing as much as I should. I also have a small savings account, but it’s not much.

Chatbot: OK, that’s a good start, but to reach your goal of maintaining your current lifestyle in retirement, you’ll need to increase your savings. Based on your current contributions and your projected retirement date, it looks like you’ll need to start saving at least 15% of your income each year.

Client: That sounds like a lot. How can I do that?

Chatbot: One option is to increase the amount you’re contributing to your 401(k). You could also look into other retirement savings options, such as an individual retirement account (IRA). Additionally, you may want to consider consulting a financial planner to help you create a budget and plan to reach your savings goals.

Client: That all makes sense. I’ll look into increasing my contributions to my 401(k) and possibly opening an IRA.

I have also just started investing in index funds, upon your advice. How do I know when to buy or sell these investments?

Chatbot: I use advanced algorithms and machine learning models to analyze market trends and recommend when to buy or sell. However, you can also set up alerts for specific investments and review your portfolio regularly to ensure it’s aligned with your goals.

Client: That’s great, thank you for the advice.

Chatbot: You’re welcome. Remember to always do your research and consult a human financial advisor if you have any doubts. I’ll be here to assist you whenever you need it, and I’ll keep monitoring your portfolio and reviewing your retirement plan, and making any adjustments as needed.

Client: Thank you for your help. I appreciate it.

This conversation gives us a glimpse of how A.I. will impact the role of financial advisors in the (perhaps, near!) future. Read here to know more about how Chat-GPT can be trained on financial models to provide great financial advice and may take the jobs of the average financial advisor. You can also learn more here about how the Bank of America is using chatbots to deliver banking activities such as bill payments, and fund transfers.

Table of Contents

What is ChatGPT-3

Let’s read what Chat-GPT3 is from the language model itself.

“ChatGPT is a language model developed by OpenAI. It is a variant of the GPT (Generative Pre-training Transformer) model and is fine-tuned for conversational AI tasks such as question-answering, dialogue generation, and text completion. The model is trained on a large text dataset and can generate human-like responses to prompts given to it.”

ChatGPT-3 was predicted by some analysts to be the future of AI in the last few years, but few expected it to become a reality so soon. The language generation model has the potential to impact not just programmers and writers (hope my editor isn’t reading this!) but also the finance sector.

Use of ChatGPT in Finance

ChatGPT is a powerful language model that has been fine-tuned for conversational A.I. tasks, including question answering, dialogue generation, and text completion. One of the ways it has impacted the finance sector is by enabling the development of more advanced chatbots. These chatbots can understand and respond to natural language inputs, making them more effective at handling customer inquiries and providing financial advice. ChatGPT is automating routine tasks such as account management and balance inquiries and improving the overall customer experience.

In the weeks since its arrival, different sectors are learning how to utilize this powerful tool. In the finance sector, financial institutions are using it to derive more accurate and granular data insights to analyze large amounts of financial data. Financial data could include market trends, customer behaviors, and predictions of market conditions. Analyzing such data can help financial institutions to make better investment decisions, identify frauds and improve their risk management. Financial analysts and investors are using Chat-GPT3 to generate financial reports and summaries. I, too, decided to test this robust tool and have some fun with it. (In fact, some parts of this article have been written by ChatGPT-3. I will tell you which ones later in the guide).

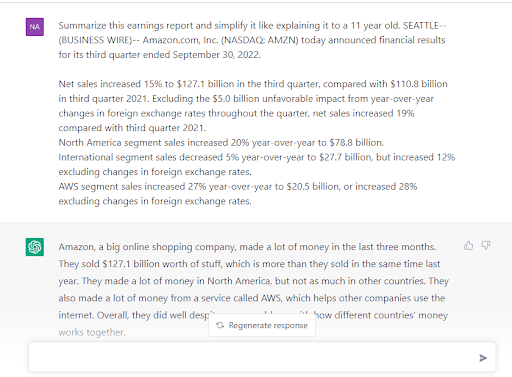

Here’s how I used Chatgpt-3 to create summaries of earnings reports for my better understanding:

And that’s how we can use Chat GPT to convert complex financial data into a more easily understandable format. Similarly, experts suggest that Chat GPT can be trained to identify key information and trends with any financial data. This will help provide finance and accounting professionals of expertise accelerated with insights and summaries. Hence, helping them analyze large amounts of data and make informed decisions.

Benefits of Chat GPT in Finance & Accounting

Chat GPT can significantly improve the finance sector’s efficiency, accuracy, and compliance. Here is a summary of some of the benefits of ChatGPT in finance and accounting:

- Automating repetitive tasks such as data entry, invoice processing, and report generation.

- Less human errors and more accuracy in data entry and report generation tasks.

- Access to real-time financial information and insights will allow accounting professionals to make more informed decisions in less time.

- Automated tasks reduce overall costs as it reduces the need for manual labor.

- Chat GPT can help companies stay more compliant by automatically identifying any data that is not complying with the regulatory standards for example.

Key Takeaways

Instead of burying our heads under the sand, it is better to harness Chat GPT. Rather than avoiding it. As the demands of consumers evolve, AI is becoming more and more important in the financial sector to keep up with expectations. In any business, customer support and satisfaction are essential components for success. Many financial institutions are exploring the use of chatbots to provide better services and customer support. Chat GPT in finance not only improves the overall user experience but also helps control costs. Incorporating AI chatbots in finance allows for handling routine tasks such as balance inquiries and payment information, reducing the workload of call center staff and allowing them to focus on more complex and specialized tasks and strategies. Overall, companies in the financial sector can use AI to improve their operations, gain a competitive advantage, and create new growth opportunities.

P.S. The conversation between a chatbot (financial advisor) and the client has been written by Chat GPT.