Accounting

CPA Led Accounting Built for Growing Companies

EA delivers accurate, timely, audit ready, and stress free financials through a trusted United States CPA led team.

We support small businesses through Fortune 500 enterprises across Accounting and Bookkeeping, Order to Cash, Purchase to Pay, Trade Promotions, Demand & Supply Planning, Inventory Management, and FP&A.

Our CPA led teams support CPG, manufacturing, e-commerce, retail, and real estate businesses.

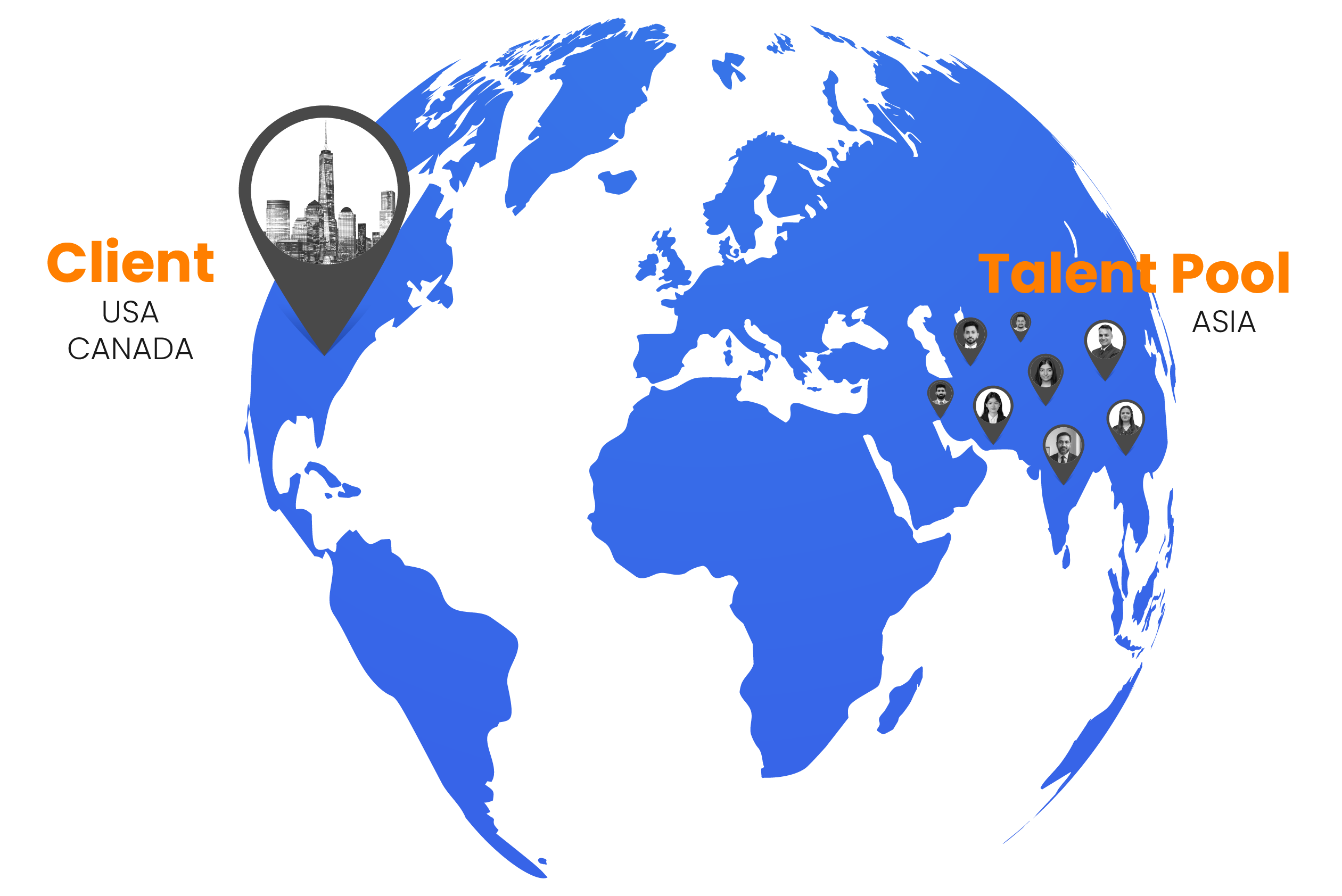

By tapping into our global talent pool, clients can reduce accounting costs by up to 60 percent. Book a no-obligation consultation call to learn more.

Book Now View Our ServicesSign Up To Cut Accounting Costs by 60%

Our Client Portfolio

Serving 50+ Clients Across USA

Accounting Firm Built on Experience

EA delivers a blend of deep U.S. industry knowledge, professional expertise, and proven best practices to streamline your financial operations, from routine accounting to complex areas such as deductions management.

US CPA Management Team

U.S. CPA-led teams delivering accurate, compliant, and reliable financial oversight.

Up to 60% Payroll Savings

Premium accounting services at significantly lower cost

U.S. Eastern Time Availability

Our accounting experts work U.S. Eastern Time, fully aligned with you.

QuickBooks & Xero Experts

Proven expertise in QuickBooks and Xero software.

Specialized Knowledge

Industry Specific Accounting Services

From startups to mid-sized companies and large enterprises, we deliver accounting services tailored to every stage of your business.

Ensure accurate recording and reporting of a company’s financial transactions.

- Categorization of expenses

- Preparation of financial statements

- Timely decision making

Protect your Trade Promotion campaigns from low ROIs. Leverage EAs for effective monitoring of Trade Promotions.

- Data driven planning

- Chargeback verification

Maintain healthy supply of cash across operational spectrum.

- Follow-up of aging receivables

- Resolution of customer queries

- Credit memo processing

Enhances finance insights, cash flow management and supplier relationships through timely payments.

- Vendor master and maintenance

- Timely vendor bill processing

- Payment processing

Improve your company’s financial well-being without the price tag and commitment of a full-time CFO.

- Flexible pricing models

- Flexible engagements that align with your needs.

- Master Data – Item, Customer, Pricing

- Accurate sales order processing

- Timely customer invoicing

Global Talent Pool Delivering:

Comprehensive Accounting Services

Our team handles everything from bookkeeping and inventory to AP, AR, and specialized industry accounting, giving you accurate, compliant financials and the confidence to grow your business.

30+ Years of Professional Excellence

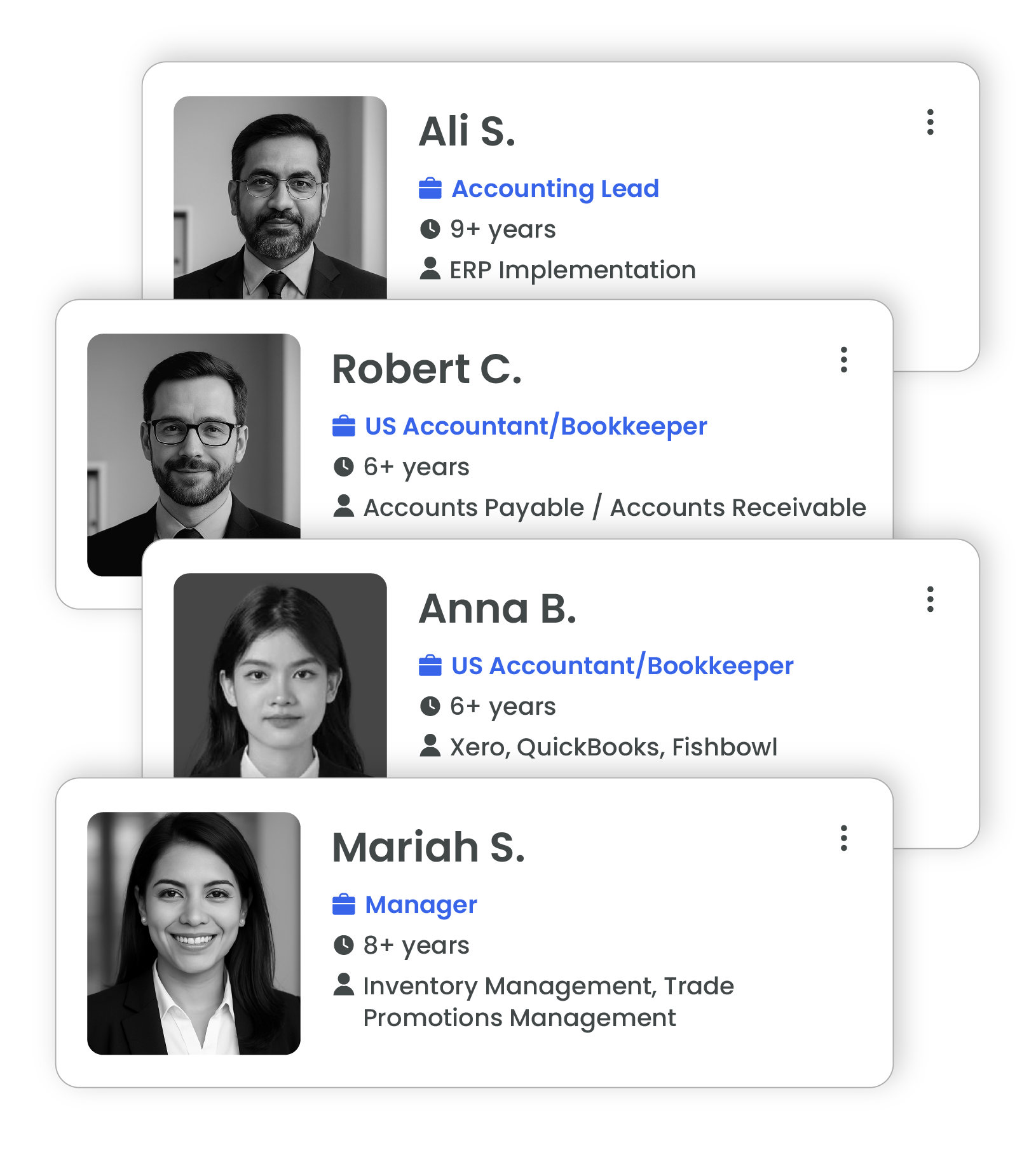

Certified Accountants You Can Rely On

Our carefully vetted accountants bring broad industry experience and undergo ongoing professional training to stay current with U.S. accounting standards and best practices.

An Accounting Company That Delivers Efficiency, Performance, and Peace of Mind

Continuous Training

Expertise Accelerated’s accounting team is made up of rigorously screened professionals with deep, cross-industry expertise.

We invest in ongoing training and development so every accountant stays fully up to date on U.S. standards, regulations, and best practices.

Seamless Collaboration

Our collaboration is smooth, structured, and responsive. Asynchronous communication flows through email and Teams channels for real-time updates and flexibility.

After every call, you’ll receive a clear, concise recap to keep everyone in sync. It’s not just a service, it’s a high-performance extension of your existing team.

From Complex to Routine, We Handle It All

From day one, EA combines deep expertise with precise, reliable accounting support, handling both the complex and the routine.

Our experienced team provides the guidance and insight your business needs, supporting you every step of the way, from accountant to controller.

Global Talent Pool, Professional Excellence, and Proven Cost Savings

45+

Satisfied Clients

150+

Deployed Resources

30+

Years of Leadership Experience

≤60%

Cost Savings

Don't Just Take Our Word For It

Read What Our Clients Are Saying

Latest Blogs

Frequently Asked Questions

At Expertise Accelerated, we deliver measurable value through specialized expertise, cost efficiency, and U.S.-based oversight. Here’s what sets us apart:

U.S.-Based Leadership & Location

- Headquartered in Stamford, Connecticut, with U.S.-based management overseeing every engagement

- Direct access to senior leadership throughout the relationship

30+ Years of U.S. Industry Experience

- Led by seasoned professionals with decades of hands-on experience in U.S. markets

- Deep expertise in CPG, manufacturing, wholesale, distribution, and fast-growing brands

Up to 60% Payroll Savings

- Our hybrid onshore–offshore model delivers premium accounting talent at a fraction of the cost

- Reduce accounting and bookkeeping expenses without sacrificing quality

U.S. Eastern Time Availability

- Teams work your hours, ensuring real-time communication and quick turnaround

- No delays, time zone gaps, or overnight waiting

CPA-Led Accounting Teams

- All engagements are guided by senior CPAs

- GAAP-compliant processes, accurate reporting, and reliable monthly closes

Certified QuickBooks & Xero Experts

- Certified accountants trained in QuickBooks, Xero, and CPG-specific accounting workflows

- Proper setup, categorization, reconciliation, and monthly maintenance

U.S.-Based Management & Quality Control

- Strategic oversight from U.S.-based leaders

- Strong communication, consistent delivery, and accountability at every step

Our teams operate in the client environment using shared folders. Our clients share folders with us that they want us to see. If a client removes anything from that shared folder it becomes out of our sight and access.

Similarly, we never take access to client’s banking or credit card info or rights to initiate a transaction. If needed, at most, we take read-only access to the client’s payroll, banking, and credit card interfaces.

A team-based approach means that more than one professional is assigned to manage each client’s account.

At Expertise Accelerated (EA), a trusted CPA firm, this approach ensures your bookkeeping and accounting needs are handled with accuracy, efficiency, and consistency. Our flexible, ad hoc services also allow us to respond quickly to any changes or immediate needs in your business.

Our bookkeepers are proficient and certified in QuickBooks, Xero, Sage, NetSuite, and Odoo.

When you engage our accounting services, Haroon and a dedicated manager oversee your account from day one to ensure a smooth onboarding process.

Our manager selects and leads a specialized team of outsourced accountants to handle day-to-day accounting tasks efficiently.

When you use our accounting services, our CEO, Haroon Jafree, is personally involved at the initial point of contact to ensure a smooth onboarding experience. During this phase, your dedicated engagement manager introduces the specialized team of accountants and sets up structured communication channels, including regular updates and progress reports.

Once your accounting processes are stabilized, the engagement manager takes full ownership of your account, coordinating all day-to-day activities while remaining available for guidance.

Yes! Our accounting services cater to companies of all sizes, from startups, small businesses to global brands. Whether you need comprehensive full-service accounting or targeted solutions, we customize our approach to support your unique business goals.

When we start working with a new client, our first and most important focus is stabilizing their accounting. This means ensuring key areas such as:

- Revenue and expenses are recorded correctly

- Transactions are maintained on an accrual basis

- Financial statements, including PNL and cash flow statements, are accurate and reliable

Once the accounting is stabilized, clients may want to build on that foundation to avail further services tailored to their business needs. This can include:

- Financial projections and forecasting

- Budgeting and scenario planning

- Detailed management reports

- Analysis for strategic decision-making

We want to give our clients clear visibility of both their current financial health and future opportunities through our accounting services.

Our priority is to stabilize your accounting and bring your financials up to date. For clients whose books may not be fully organized, we start by reviewing the current state of their accounting systems, such as QuickBooks or any other transactional platforms.

We typically begin with the current year-to-date bookkeeping. For example, starting from January 1, and work month by month to ensure all transactions are properly categorized and reconciled. This includes integrating data from invoicing systems, POS, and any other relevant channels.

Even if your prior year’s financials exist for tax purposes, we make sure that your current year’s books are fully accurate and organized, establishing a reliable foundation for ongoing accounting, financial reporting, and decision-making.

This approach allows us to efficiently support growing or fast-expanding businesses, even if previous bookkeeping was minimal or partially managed.