Revenue generation is always a top priority for any business. Customer satisfaction is, therefore, immensely important for businesses if they wish to maintain customer loyalty and build a strong brand. Evaluating and optimizing the order-to-cash fulfilment process is the best way you can achieve this.

The order fulfilment process is the business operation that customers have the most direct contact with, and therefore it must be robust and easy to use if the business wishes to generate more profit by enhancing customer experience.

This is precisely why any entrepreneur today needs to have a good grasp on what the order-to-cash process is, as well as an understanding of how to develop the business’ own custom O2C process to better suit its customer needs.

This article discusses the O2C process at length and helps entrepreneurs gain an understanding of what it is and how it can be optimized.

What is the order-to-cash process?

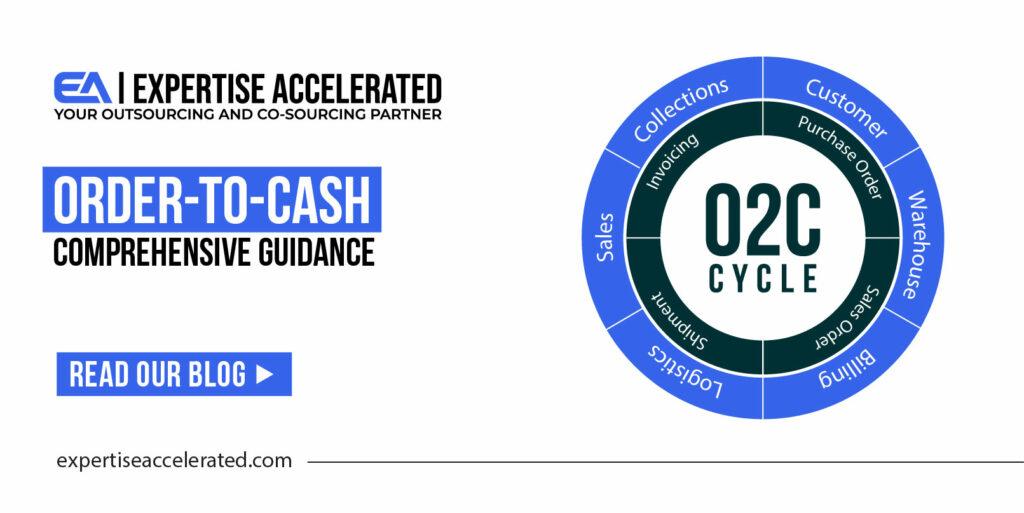

The order-to-cash (O2C) process is principally a business’ entire order processing system. In essence, it is the process by which businesses facilitate sales and invoicing. As soon as a customer places an order, the business’ O2C cycle begins. Due to the highly contextual nature of the O2C process, many businesses develop and adjust their own O2C process as time goes by to further the business interests while maximizing customer satisfaction.

In its simplest form, the O2C process looks like this.

Why is the order-to-cash process important?

Entrepreneurs often put all their focus into generating leads and converting them into customers. While this is fundamentally important for the business if the O2C process that follows it is not strong enough, it can sour relations with customers and damage the business’ reputation. A 2021 survey by Business Wire reports that 41% of customers cited delayed and unresponsive service as a bad customer experience. Think about it, whenever we order a product online that turns out to be delayed or faulty, how much trust is lost in the business that sold it. This is precisely the reason that the O2C process is important.

A robust O2C cycle can greatly enhance customer satisfaction, while also enhancing productivity and lowering production costs. The O2C cycle is deeply connected to many different functions of the business, such as accounting, supply chain management, inventory management, and others. If any of these functions suffer from an irregularity, the adverse effect spill over to other functions.

The business’ cash flow projections can also suffer due to a subpar O2C cycle. A failure to invoice accurately and follow them up on time can lead to poor cash inflows.

The 8 stages of the order-to-cash process

While businesses tend to develop unique O2C cycles tailored to their custom needs, they still tend to follow a general framework. Here is a breakdown of the 8 stages of the general O2C framework.

Order management

The O2C cycle begins with the placement of an order by a customer. An order can come from many different avenues, such as over the phone, the internet, EDI, or in person. The sooner an order is received and forwarded to the concerned department in the business, the better. Most businesses today opt to automate order placement so that whenever an order is received, it is routed to the concerned department(s) for further processing.

Credit management

After placing an order, the next step is to verify the customer’s credit history. An order from a customer with poor credit history is reviewed before being sent into processing. This step is very contextual to the business, and some businesses tend to operate on cash rather than credit and process an order only when it has been paid.

Automation of this step is also quite popular among businesses, with new customers evaluated and verified using software, and difficult-to-evaluate cases routed to the finance department for review.

Order fulfilment

Fulfilling the order comes next, and this is where the inventory management function comes into play. A poorly managed inventory system can erect a bottleneck at this stage, and hold up the O2C cycle. A robust O2C process is one that conducts regular inventory checks, ensuring that the business is not short on inventory to fulfil an order. Automation plays a key role here as well, and a combination of a strong inventory manager with powerful inventory management software can save the business time and money.

Expertise Accelerated publication titled “Inventory management strategy” offers an in-depth look into inventory management strategy.

Order Shipment

Perhaps the most crucial step in the O2C process is shipment. Shipments are generally either handled by the business’ internal logistics department or using third-party service providers. Either way, there is no room for error here.

Short, wrong and delayed shipments are some of the major issues that can arise at this stage. Thorough and regular audits must be performed when it comes to the shipment to ensure that products reach the customers safely and timely and in accordance with the purchase and the sales order. Errors in shipments can lead to bad reviews and dissatisfied customers, which can plummet the business’ reputation.

Invoicing

The invoicing or billing stage deals with settling accounts once the order is fulfilled. Businesses invoice customers for the goods or services provided to them. Invoices provide details such as the products/services provided, their cost, cost of shipment, taxes, etc.

Invoicing has to be accurate and timely. Erroneous or delayed invoicing can upset customers and adversely affect a business repute. Therefore, invoices should be verified for accuracy before being sent out. Again, automation can greatly boost accuracy and timeliness in the invoicing process.

Accounts receivable

Businesses that make credit sales need to maintain a record of the outstanding invoices, i.e., the amounts recoverable from each of their customers.

Receivables management is critical to a company’s cash flow. An efficient receivables management function helps company’s liquidity.

Collection

The collection is also important and must be handled with care. A good payment collection system can really make a difference when it comes to customer retention. Customers need to be provided with a variety or reliable payment options so that they can conveniently pay the company for the goods or services purchased.

Reporting

The final step in the O2C process is creating a report of the entire process itself. By consistently monitoring the business’ O2C cycle, entrepreneurs can spot areas of inconsistency and develop countermeasures. The O2C cycle is not a one-and-done deal.

What comes next?

While this guide can give entrepreneurs a solid foundation to build their own order-to-cash process, but this is not enough. The O2C process is a difficult trial and demands expertise in several business areas, such as billing, logistics, sales, and inventory. Hiring experts in these functions is a way to get around this hurdle, however, it can sometimes prove costly as well. Luckily, Expertise Accelerated’s process optimization services are among the finest in the US and can provide entrepreneurs with all the tools they need at a fraction of the US cost.

Expertise Accelerated’s process optimization services

Expertise Accelerated is led by Haroon Jafree (CPA), who is a turnaround expert specializing in cost optimization, process efficiency, and trade spend management.

EA’s Connecticut-based team leads the engagement to identify areas of potential optimization and advises process reengineering initiatives to bring in payroll savings and process efficiencies for the client company. Meanwhile, EA also recruits high-quality accounting & finance and supply chain professionals from its global talent pool and trains them for client-specific roles to implement these solutions.

In this way, EA clients receive trained remote professionals in areas of accounting & finance and supply chain that are professionally comparable or even superior but cost merely 40 per cent of their US counterparts. Our clients have widely acknowledged the professional excellence and payroll savings that came with EA’s trained remote professionals.