In business circles, it is common to hear jargon like “debit” and “credit” frequently used in conversations. Entrepreneurs setting out for the first time into the business landscape may find this jargon difficult to understand. There is always the chance of mistaking it for the more colloquial use of the words, such as in “debit cards”. This article provides entrepreneurs with a short and insightful look at the double-entry accounting system. And also a breakdown of the jargon involved.

Table of Contents

Bookkeeping for beginners

Basic bookkeeping is an important tool in an entrepreneur’s toolbelt. While bookkeeping is tedious and mundane work, the actual process is not as difficult as the jargon makes it out to be. Here is a brief introduction to the bookkeeping jargon and the process.

The General Ledger

In layman’s terms, a General Ledger is like a master bookkeeping ledger that accumulates the totals of the sub-ledgers such as cash, receivables, payables, fixed assets, etc.

The Chart of Accounts

The Chart of Accounts represents a summary of all the transaction accounts present in a company’s General Ledger distributed among the following primary categories.

- Assets

- Liabilities

- Equity

- Revenue

- Expenses

Debit

In accounting, debit refers to the left side of a ledger account, also colloquially referred to as a T account. Assets and expenses accounts have a natural debit balance i.e., a debit in the account increases the account’s balance, while a credit decreases it.

Credit

Conversely, credit refers to the right side of a ledger account. Liability, equity, and revenue have a natural credit balance i.e., a credit in the account increases the account’s balance, while a debit decreases the balance.

Trial balance

As defined by the Corporate Finance Institute, “A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time.” The trial balance is where adjustments are made, and the debit and credit are balanced to give a final view of the business’ finances at a point in time. The final balance which shows the balance left at the end of a time period is then generated which goes on to be used to generate the business’ financial statements.

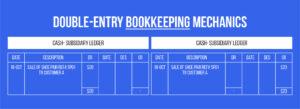

Double-entry bookkeeping mechanics

The double-entry bookkeeping system is a standardized bookkeeping methodology used by businesses. As the name suggests, in this bookkeeping system every business transaction is recorded in at least two different accounts as credits and debits. The goal of the double-entry accounting system is to balance and maintain debits and credits such that the accounting equation holds true for the business book of accounts.

In other words, double-entry bookkeeping is an accounting system in which each transaction is recorded with a dual effect – reflecting its legal form as well as the economic substance – as a debit or a credit.

For example, cash sales proceed worth $20 for selling a pair of shoe ref# SP01 to Customer A on 10/18 will be recorded in a double entry system using the following ledgers.

The double entry would be as follows.

The Accounting Equation

The debit and the credit of a transaction must be equal and balanced, if it is not balanced then there is an error in the books. In simple terms, double-entry accounting illustrates where and why money moved through the business.

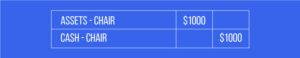

Similar to the example given earlier, the example below explains this further. If the business bought chairs worth $1000, then the transaction would be recorded as:

This shows that the business debited or increased $1,000 in the Assets ledger through a debit entry, and credited or decreased $1,000 in the Cash ledger through a credit entry.

This method allows entrepreneurs to trace where and why money moved between the business’ accounts so that it can be accurately accounted for in the books of account.

The importance of double-entry accounting

The double-entry accounting system is the most robust bookkeeping system available for business accounting today. Due to its endorsement in the Generally Accepted Accounting Principles (GAAP) of the US, it has become the standard bookkeeping system for businesses today.

The double-entry bookkeeping system is used in the accruals method of accounting, which is the standard accounting system the US businesses use.

In a prior Expertise Accelerated publication titled “Accruals Versus Cash: Which Accounting Suits You Best?”, we noted that businesses generating over $25 million in gross yearly revenue, as well as public companies were required by the IRS to adopt the accruals accounting system.

The benefits of double-entry bookkeeping

Double-entry bookkeeping is the most reliable method of bookkeeping for businesses. There are a multitude of reasons for this.

Error mitigation

Erroneous bookkeeping is very common in the US, with 27.5% of accounting errors being attributed to fat finger errors in a report by Accounting Web. The double-entry bookkeeping system is the key to mitigating these errors before they spin out of control. Because double-entry bookkeeping requires the debits and credits to be equal in the business’ accounts, if there is an erroneous entry such as a typo or a duplication, it will be detected fairly quickly when the account is closed. This can save businesses a lot of hassle by preemptively detecting the error.

Some errors go undetected even with double-entry accounting, such as the error of omission, the error of commission, etc. Errors Not Revealed By A Trial Balance by INTIME provides detailed insight into such errors.

Generating financial statements

Financial statements are important for businesses because they present the financial performance and position of the company and serve as the primary instrument for the shareholders and stakeholders to make informed business decisions. Expertise Accelerated publication titled “The Guide to The Four Basic Financial Statements” provides a fairly comprehensive insight into financial statements.

Single-entry vs double entry bookkeeping

The single-entry system is primarily used by small, local businesses such as family-owned restaurants. These businesses do not have very complex transactions. That doesn’t meet the threshold of revenue where they must adopt the double-entry system. The single-entry bookkeeping system works under the cash accounting method. Which only records transactions based on cash received or paid or credit given or recovered.

While single-entry bookkeeping works fine for smaller businesses. It lacks the accuracy, comprehensiveness, completeness, robustness, and reliability of the double-entry system.

Why choose double-entry bookkeeping?

While there is no denying the simplicity and lower cost of adopting the single-entry bookkeeping system. Businesses that intend to grow or are in the process of scaling must eventually switch to the double-entry system. Double-entry accounting provides a company with the capability to produce financial statements. It can qualify for merits associated with a scaling company, such as investor confidence, regulatory compliance, fraud deterrence, informed decision-making, etc.

Expertise Accelerated Knowledge-Based Staff Augmentation Services

Staff augmentation refers to hiring manhours and/or expertise from a third-party service provider. To enhance capacity and optimize business costs and organizational processes. Many small businesses today leverage staff augmentation services as an instrument to beef up their competitive strength. When it comes to staff augmentation services, accounting is one of the most popular choices. EA publication “Why Staff Augmentation is Vital for US Companies today?”. It elaborates on the significance of staff augmentation for US companies in the prevailing business context.

EA’s staff augmentation services are knowledge-driven in which high-quality remote professionals are trained intensively. To fit client needs and co-manage during the transition period. The service doctrine has been designed and has proven to deliver superior professional resources at a fraction of the US cost.