Bookkeeping is vital for businesses of all sizes. A skilled bookkeeper assists in keeping your finances managed by operating transactions and monitoring expenditures. They also confirm that your records are valid. Many businesses prefer to outsource bookkeeping to save resources and time.

A bookkeeper helps you concentrate on handling your business. But employing one brings a common query: How much does a bookkeeper cost? The cost of offshoring bookkeeping can be unclear for many business proprietors .

Knowing the factors and costs will let you choose the suitable bookkeeping option for your business. How much does it cost you to maintain your financial records up-to-date, and how much does it cost you in terms of business losses when you fail to do so?

Bookkeeping is a background activity for many business owners until something goes wrong: the cash in the pocket is insufficient, the tax returns are a nightmare, or an incomplete set of numbers is used to make business decisions.

Actually, research studies always indicate that inadequate financial record-keeping is among the primary contributors to the failure of small businesses in almost 30 percent, not because they are not profitable, but because the companies simply lack financial visibility.

Keeping books is no longer a matter of data entry. With current changes in the tightening of margins, increasing compliance pressure, and working with real-time decisions, a good bookkeeper becomes a cash flow control point, a discipline in spending, and financial confidence.

This is why over half of the small and medium-sized businesses outsource bookkeeping today not only to save time, but to obtain regularities and minimize the expensive mistakes (Wishup).

Nevertheless, there is one question that prevents action of most owners, and it is how much a bookkeeper really costs, and what you are actually paying? Per hour, retainer, off-shoring groups, in-house recruits- the pricing environment may be baffling and obscure.

This guide breaks it all down. We will discuss the structure of fees of bookkeeping, the costs, and should or not affect the cost, and how to select the bookkeeping model that fits your business, so that you are not only paying to have your money counted, but you are also investing in your finances and control.

What Does a Bookkeeper Do?

But what exactly happens when a business knows its numbers? It is not magic, it is bookkeeping. Bookkeepers are involved with the daily financial business that silently makes or breaks a business go out of control or plunge into a mess.

Fundamentally, bookkeepers make sure that all dollars in and out are properly logged, and the logging should remain consistent (Bookkeepers). They establish the financial transparency business owners need to make informed decisions as opposed to gambling. It is with this basis that even the most lucrative businesses may be confused about how their money is dissipating, or why they may have a limited cash flow even after posting good numbers.

Bookkeeper’s Responsibilities:

Typically, a professional bookkeeper deals with:

- Note the monetary transactions such as income, expenditure, and transfer every day.

- Balancing bank and credit card accounts to verify that records are in balance with the actual balances.

- Payroll, vendor invoices, and customer receipt management to ensure the running of operations.

- Arranging financial statements, including profit and loss statements and cash flow statements.

- Facilitating the preparation of tax returns through maintaining neat records and categorizing them, and making them audit-friendly.

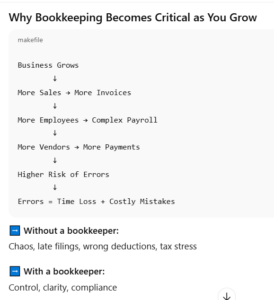

Financial activity increases as a business increases (Bookkeepers). Increased invoices come with increased sales. Increased employees imply a more complex payroll. Increased vendors would imply increased payments to monitor. In the absence of a bookkeeper, it is time-consuming to keep things in order – and any error is costlier.

The reasons why a lot of businesses use bookkeepers:

Bookkeeping begins as a DIY project for a lot of business owners, done after work or as extra work if it fits the schedule of the main activities. In the long run, this practice can result in late filings, deductions, incorrect report preparation, and pre-tax season stress.

It is where a bookkeeper comes in (Fyle). They can relieve you of some of your regular financial burdens by transferring them to specialists who can help you concentrate on doing the best in your own business sales, strategy, customers, and operations rather than on spreadsheets and receipts.

Bookkeepers in small businesses are frequently multicapped. They can also help with light accounting work, system installation, and work process enhancement, and are not merely a data entry position, but a financial support agent.

So, How Much Does a Bookkeeper Cost?

This is the point at which the majority of business owners hesitate. The cost of bookkeeping may vary greatly based on some factors (QuickBooks):

- The experience and qualifications of the bookkeeper.

- The required services scope.

- The bookkeeper can be freelance, outsourced, or in-house.

- The size and the level of your financial activities.

It does not have a one-size-fits-all price. It is only a matter of knowing what kind of support your business actually requires and making that work with a budget that makes sense.

In the next parts, we are going to demystify the bookkeeping expenses, pricing strategies, and what you are likely to pay, so that you make an educated choice not to pay too much, as well as not to invest too little in the foundation of your company.

How Much Does a Bookkeeper Cost Per Month?

So the query emerges, how much does a bookkeeper cost? The price of employing a bookkeeper differs depending on factors such as their knowledge, business measures, and the intricacy of the task (Zeni AI). Here’s an outline:

Common Fee Structures

Hourly Rates:

Contract-based bookkeepers usually charge hourly, between twenty-five dollars and a hundred dollars per hour. The actual amount relies on their qualifications, experience, and the duties they execute.

Monthly Retainers:

Several companies prefer a fixed amount as a monthly payment ranging between two hundred dollars and two thousand five hundred dollars. This includes accurate services, including negotiating accounts and preparing monthly reports.

Flat Fees for Projects:

Other bookkeepers use a fixed fee when performing their duties, such as preparing taxes or preparing financial statements.

Percentage of Revenue:

Bookkeepers seldom can and do charge one percent to three percent of the revenues of your business, which is in line with your success.

Small Business Monthly Costs:

Depending upon the type of employment, small businesses can use three hundred to a thousand dollars per month on bookkeeping services (Zeni AI). In the case of an on-site bookkeeper, the costs may be significantly increased, with three to five thousand dollars per month, including the benefits and the salary.

Issues That Impact A Management’s Cost of Bookkeeping:

The cost you are to spend on bookkeeping services depends on a great number of factors, and those include:

Experience and Expertise

A bookkeeper who possesses years of experience and diplomas will be more expensive, but he or she may work much faster and achieve great outcomes. Certified Public Bookkeepers or Certified Bookkeepers usually charge a high fee due to their technical expertise.

Business Complexity

When your business involves a lot of transactions or complicated financial procedures, you will have to spend more. There are also increased costs in industries that have certain standards of compliance.

Software and Technology

There are also sophisticated programs such as QuickBooks, Xero, or Sage that are used by many bookkeepers to enhance their accuracy and efficiency, but could further increase the expenses.

Frequency of Service

Permanent, continuous services are expensive in comparison to periodic or one-time tasks.

Business Size

Bigger corporations or those with greater transactions require more time and are more expensive.

Services Needed

The simple bookkeeping is less expensive than the specializations, such as financial planning or tax preparation.

Frequency

Services per month are even more expensive compared to quarterly or single work (Zeni AI).

Location

Big cities or other high-cost regions have a higher tendency to pay high costs to bookkeepers.

Experience

Seasoned bookkeepers cost more, but they are likely to be faster and identify problems sooner.

Extra Tasks

Additional charges to the cost may include services like tax filing, payroll, or software setup.

Difference Between Offshore and Onshore Bookkeeping:

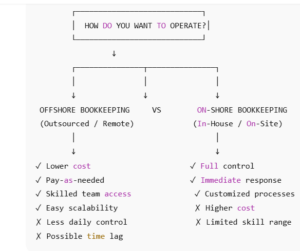

When outsourcing a bookkeeper, you have a choice of offshoring services or employing on-site. Both options have their advantages as well as disadvantages.

Outsourcing Bookkeeping

Offshoring is an activity that entails the outsourcing of a competent company to handle your bookkeeping in a different place (Time Champ).

Advantages:

- Inexpensive: You just pay what you require; other expenses, such as benefits and workspace, are not covered.

- Knowledge: Availability of skilled experts in overseeing complicated work.

- Scalability: Scale services to your business.

Disadvantages:

- Little Control: You might not directly control day-to-day work.

- Lag in Communication: Remote communication may sometimes result in a slow response.

In-House Bookkeeping

A bookkeeper is on site, working directly on behalf of your firm and is a part of your group.

Advantages:

- Direct Control: You are able to have complete control, and you can handle issues immediately.

- Customization: Made to meet your specific business needs.

Disadvantages:

- Increased Expenses: Salaries, benefits, and office costs may increase.

- Lack of Skill: A single bookkeeper does not necessarily possess the multidimensional skills that a team can have.

What to look for in the qualifications of a Bookkeeper:

It is important to choose an appropriate bookkeeper. The following are some of the necessary credentials:

- Education: Seek a degree course in accounting, finance, or a related field.

- Certifications: You are working with a competent professional: a CB or CPB.

- Experience: An experienced person in your industry will know about the financial issues peculiar to it (Franklin University).

- Software Skill: Make sure that they are taught well-known software like Sage, Xero, or QuickBooks.

Why Expertise Accelerated is THE Bookkeeping Company?

At some point, it can no longer beHow much does a bookkeeper cost? But how much is poor bookkeeping costing me?

It is at this point that Expertise Accelerated (EA) will fit in.

The bookkeeping services of EA are outsourced to business entities that seek to have clarity without complexity and control without overheads. You will not be required to depend on a single employee on your books, as you will be able to employ a group of highly qualified individuals motivated by the best practices within the industry in the fields of accounting, reporting, and compliance.

Compared to traditional bookkeeping systems, EA allows companies to gain the scalability of support both up and down as needed without the long-term commitments, payroll, and talent keeping risks of internal hiring.

What Makes EA Different:

- Specialized accounting software depends on the size and industry of your business and the number of transactions.

- Economy of scale by accessing talent all over the world- without impacting on quality or data security.

- Faster, more expeditious end-of-month, quarter, and annual close.

- Retail and e-commerce, manufacturing, CPG, real estate, and restaurants.

- 24/7 support, and as such, you will never have to have the bookkeeping as a bottleneck when you are growing.

- On the one hand, it is not just documenting transactions, but a means to gain financial discipline, provide more visibility to your cash, and ensure your numbers are always at the ready to be used in decision-making.

Outsourcing of bookkeeping using EA can serve as a strategic choice and not just an operations decision to business owners and CFOs who are in a situation where they are under pressure to reduce costs, turnover, and re-focus internal teams in creating a value business.

Conclusion:

The Right Bookkeeper Is an Investment and not an Expense.

The bookkeeping ceases to be an operating activity in the background, but rather the main activity of financial management, confidence resulting in the cash flow, and decision-making.

The cost of a bookkeeper is important to know, but it is the value that the cost will bring that is important. The right bookkeeping model not only saves your time, removes costly errors, improves compliance, and gives you real-time data as to the financial performance of your business.

In most small and medium-sized enterprises, outsourcing offers the smartest approach going as it is flexible, skilled, and can be expanded without straining their financial capabilities in terms of hiring new employees.

Outsourcing your bookkeeping with Expertise Accelerated does not mean that you are outsourcing; it means that you are offloading to a trustworthy financial partner who is geared towards precision, productivity, and expansion.

This is the moment to move on when you are ready, not to worry about your numbers, and instead get them to work to drive your business.

Schedule a free consultation with EA and learn how professional bookkeeping can make your work easier, build a more solid financial basis, and buy yourself some time to work with the aspects of your business you care about the most, namely, expand it with confidence.