In manufacturing, every dollar saved in costs can mean thousands earned in profit.

Running a manufacturing business isn’t about production, managing accounting is as important.

Big U.S. companies show why manufacturing accounting is so important. Good accounting helps track inventory, control costs, and plan growth. Poor accounting wastes money, gives wrong reports, and lowers profits. Checking accounting helps avoid mistakes, find opportunities, and make smarter decisions. About 62% of U.S. manufacturers have inventory accuracy below 80%.

GM tracks costs for electric cars. Johnson & Johnson ensures accuracy in medicines and devices. Small cost or compliance mistakes can cause big problems. Nike has to manage material costs, labor, and supply chains around the world while still keeping good profit margins. Kellogg’s needs to watch ingredient and packaging costs as it makes more healthy snack options. Pfizer controls vaccine production costs to save money and help public health.

This blog shares practical tips and strategies for manufacturing accounting.

William Wilberforce: Life ends one day, and we will answer to God for how we lived.

Key Takeaways

- Manufacturing accounting checks materials, labor, and overhead to show the total product cost.

- Errors in stock, cost allocation, and income recognition can harm profits.

- Tools like ERP systems, automation, and strong controls assist to prevent errors.

- Proper accounting sustains better decisions, compliance, and business growth.

Things to Consider

- Choose ERP that fits your company size

- Check if software integrates with supply chain tools

- Ensure strong security & compliance features

Note

Not all methods work for every manufacturer. Small businesses may use simple systems, while big companies often need advanced ERP software.

Bonus Point

In manufacturing, every dollar saved in costs can mean thousands earned in profit.

Disclaimer

This blog provides general information, not legal or financial advice. For specific guidance, consult a professional manufacturing accountant.

Understanding Manufacturing Accounting

Manufacturing accounting tracks costs and profits and requires specialized software to track production expenses. Accountants use double-entry methods to record materials, labor, and overhead. They set prices, track expenses, and create reports showing savings, real costs, and compliance. Good accounting allows manufacturers to work better, earn more, and keep clear records.

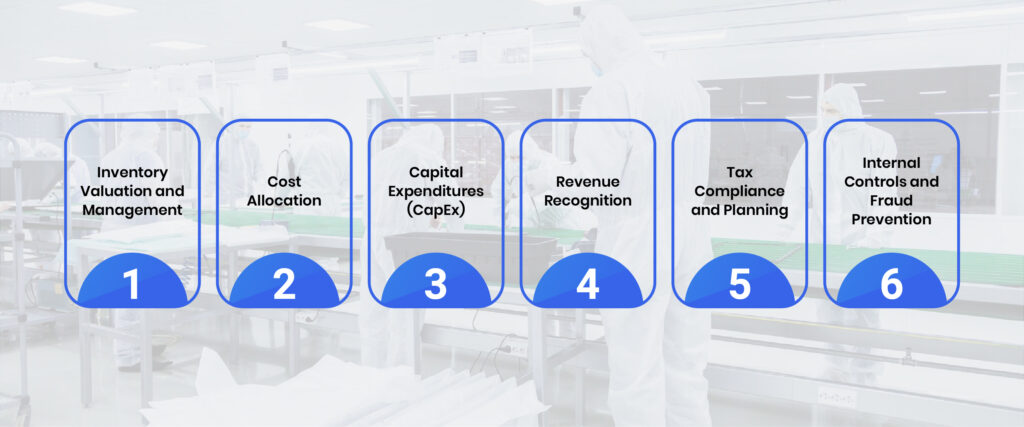

Common Manufacturing Accounting Mistakes

1. Inventory Valuation and Management

Mistakes like late entries, counting errors, or missing records can mess up your costs and profits. This makes it hard to plan production, forecast sales, and use resources well.

Ford handles thousands of vehicle parts across global plants. Even a small mistake in tracking materials like steel or chips can slow production and increase costs.

Use a perpetual inventory system linked to your ERP software. It updates inventory in real time, tracks movement, and cuts mistakes. This keeps your numbers accurate and ready for decisions.

2. Cost Allocation

Overhead costs often get spread across products incorrectly. Traditional methods may treat all products the same, even if they use different resources. This results in misleading cost data and wrong pricing or profitability analysis.

Tesla’s cars have expensive batteries, and misallocating costs can distort prices and profits.

Define what counts as direct and indirect costs. Review and update these categories in your accounting system. Modern ERP tools help assign costs so your pricing and financial reports show the true picture.

3. Capital Expenditures (CapEx)

Manufacturers sometimes mix up regular expenses with long-term investments. For example, repairs or minor equipment may get recorded as CapEx. This mistake changes depreciation, messes up reports, and shows a wrong picture of investments.

Boeing invests a lot in new equipment for plane production. Recording repairs or upgrades as CapEx makes assets overpriced and long-term results wrong.

Do a full analysis before classifying expenses. Check whether the item is a real long-term investment and what ROI it brings. Create clear rules for what counts as CapEx and make sure teams follow them. This keeps financial reports reliable and aligned with business growth goals.

4. Revenue Recognition

In industries with complex contracts, companies can’t always record revenue when they ship products. Recording it at the wrong time can cause wrong income reports, cash flow issues, and legal problems.

Caterpillar works on large equipment contracts that include delivery, service, and warranties.

Recording all revenue at once instead of over the contract can give a wrong view of earnings. Follow ASC 606 laws. Break contracts into tasks, set a price for each, and record income after completing every task. Revenue software can make this easier and keep you compliant.

5. Tax Compliance and Planning

Many manufacturers lose tax credits like R&D or energy incentives because they don’t track activities or apply on time. This leads to paying more tax than necessary.

3M spends billions on new products. If they don’t keep proper records, they could miss R&D tax credits that support U.S. manufacturing innovation.

Work with tax experts for manufacturing. They help find credits, handle paperwork, and suggest software. Planning ahead makes sure you don’t miss savings.

6. Internal Controls and Fraud Prevention

Automation can make companies overconfident. Without proper checks, they risk fraud, theft, or mistakes. Poor task separation or weak vendor oversight can cause losses and compliance problems.

A company like General Motors handles millions of vendor transactions every year. Without strong controls, fake vendors or duplicate payments can happen.

Use strong controls like automated monitoring, access limits, and audits. Combine technology with human checks to spot problems early. This keeps finances safe and builds trust.

Tilman J. Fertitta Don’t let your business get ahead of its money. Always know your numbers and keep track of them.

How Manufacturing Accounting is Different

Manufacturing accounting has some unique features compared to regular accounting:

- Cost classification – Breaking costs into direct materials, direct labor, and overhead.

- Inventory valuation – Track materials, WIP, and finished goods with FIFO or average cost.

- Overhead allocation – Spreading indirect costs (rent, utilities, depreciation) fairly across products.

- WIP accounting – Recording costs for products still in progress.

- Variance analysis – Comparing actual vs. planned costs to find problem areas.

- Industry compliance – Following specific standards like GAAP or IFRS.

James Belushi: Long ago, one lawyer could handle everything. Now, you need a different lawyer for each area of law.

Manufacturing CPA Services

- CPA services bring expertise and tools to streamline accounting.

- They set up ERP systems for real-time financial data.

- They design cost allocation systems and guide CapEx classification.

- They assist with ASC 606 compliance and tax credit planning.

- They support audits and strengthen internal controls.

Cost Accounting and Inventory Errors

Accounting errors are unintentional mistakes in records, like wrong or missing entries. They can be found with trial balances, audits, and bank checks. Using updated software and strong controls helps prevent and fix them quickly. Some Common Errors are,

- Original Entry: Wrong amount posted to accounts.

- Duplication: Entry recorded twice.

- Omission: Transaction not recorded.

- Entry Reversal: Debit and credit switched.

- Principle: Accounting rule applied incorrectly.

- Commission: Posted to the wrong account.

- Compensating: One error offsets another.

Preventing Errors

- Record transactions immediately.

- Reconcile bank accounts.

- Use strong internal controls.

- Keep accounting software updated.

Inventory Errors

Inventory mistakes affect profits and cost calculations.

- Wrong unit count or measure.

- Wrong cost assigned to items.

- Mistakes in inventory layers (FIFO/LIFO).

- Wrong part numbers or missing items.

- Errors during transfers or adjustments.

- Customer or consignment inventory miscounted.

Cost of Goods Manufactured (COGM) is the entire cost to make products, including materials, labor, and overhead. Errors happen when costs are recorded wrong. For instance, if a factory buys $5k of materials but records only $4,500, the COGM is too low. This can affect profits and inventory. Keeping good records and checking.

Best Practices in Manufacturing Accounting

- Automate processes – Use automation for invoices, payments, and records to cut mistakes.

- Control inventory – Track materials and products to prevent shortages or excess.

- Track production costs – Track labor, material, and overhead costs.

- Use data analytics – Study data to find insights and make better financial decisions.

Choosing the Right Manufacturing Accounting Software

Manufacturers use ERP software to connect production, planning, and inventory. When choosing accounting software, look for these features:

- Production cost tracking – Track direct and indirect costs for each product or batch.

- Financial reporting – Create reports on performance and profits.

- Data analytics – Analyze costs and profitability to guide decisions.

- Inventory management – Control stock levels, bills of materials, and costs.

- System integration – Ensure smooth connection with other business tools.

Manufacturing Accounting Services

EA’s manufacturing accounting services help you understand your business’s financial health and make smarter decisions. We guide you on where to focus, track working capital, and identify opportunities to improve efficiency. Our team supports manufacturers at every step, giving you confidence to plan and grow.

Manufacturing accounting is more complex than retail or services because you have to track materials, production costs, inventory, and true product costs. EA specializes in outsourced accounting for CPG and inventory-based companies, serving clients like 37th Street Bakery, Lipton, and KinderFarms. We hire experienced accountants globally and train them under our U.S.-based leadership team with over 25 years in the industry. From inventory valuation and return management to automating manual processes and controlling trade spend, we provide tailored solutions to keep your finances accurate and efficient.

Conclusion

Strong manufacturing accounting practices aren’t a one-time setup; they need constant improvement. As the manufacturing industry evolves, so should your processes. By fixing these mistakes and checking your systems, you can reduce risks, save money, and grow your business.

With Expertise Accelerated, you get all these features in one solution. It helps you manage production costs, track inventory, and generate useful reports. Book a demo with Expertise Accelerated today to see how you can simplify manufacturing accounting and boost growth.

Faqs

Q1: Why does manufacturing accounting need special attention?

A: Manufacturing is more difficult than retail or services. It involves checking raw materials, labor, overhead, and work-in-progress. Each of these impacts product costing, pricing, and stock value. That’s why proper accounting is so vital.

Q2: What are the most common accounting mistakes in manufacturing?

A: Manufacturers often face problems with inventory, cost tracking, and mixing up CapEx and OpEx. They also make mistakes in recording revenue. Many miss tax credits. Weak internal controls can even expose the business to fraud.

Q3: How do CPA services help fix these issues?

A: CPA services bring both expertise and tools to streamline accounting. They set up ERP systems for real-time data, design cost allocation systems, and guide CapEx classification. They also help with ASC 606 compliance, tax credit planning, and audits to strengthen internal controls.

Q4: What risks come from poor accounting practices?

A: Poor practices can inflate or understate the cost of goods sold (COGS). This distorts profitability and misleads decision-making. They can also cause missed tax benefits and compliance violations. Such mistakes waste resources and may hurt the company’s market competitiveness.

Q5: Are there benchmarks manufacturers should follow?

A: Yes. Industry best practices suggest inventory accuracy should be above 80%, yet many firms fall below this benchmark. Around 70% of manufacturers still use manual data entry. Automation can cut errors. It can also boost efficiency in a big way.

Q6: What are the most common manufacturing accounting mistakes?

A: A: The most common mistakes include poor inventory tracking and weak cost allocation. Many companies also struggle with AP/AR mismanagement and manual bookkeeping errors. Incomplete financial reporting adds to the challenges and hurts growth.

Q7: How can a manufacturing CPA accounting firm help prevent mistakes?

A: A manufacturing CPA accounting firm brings CPA-level oversight to cost accounting, reporting, and compliance, ensuring accurate records. This reduces risks and gives manufacturers more financial control.

Q8: What is the difference between a manufacturing accountant and a CPA?

A: A manufacturing accountant handles daily tasks like bookkeeping and reports. A CPA is licensed to provide advanced services such as audits, and compliance checks. They also deliver financial plans to guide business decisions.

Q9: Do CPAs handle accounts payable and receivable for manufacturers?

A: Yes, manufacturing CPA services often include AP/AR oversight, vendor reconciliations, and receivables tracking to reduce leakage and improve cash flow.

Q10: Why should manufacturing companies choose CPA-led accounting services?

A: CPA-led accounting ensures higher accuracy, compliance, and strategic insight compared to general accountants or bookkeepers.