The age of automation is not about to arrive; it is already here, and the finance field is being hit more than any other business activity. Over the past ten years, AI and automation have changed not only customer services to supply chains, but the biggest change is occurring behind the scenes in the back office.

Accounts Payable – traditionally regarded as one of the most paper-intensive, manual, and prone to error sectors of the accounting field – is currently emerging as one of the quickest-paced workflows in contemporary finance to automate.

The numbers tell the story. Ardent Partners indicates that 74% of AP teams continue to waste too much time on manual invoice management (High Radius), but 41% of the businesses are already considering automation of invoice payments, and 71% of AP professionals are already thinking about automation as the future of AP.

This is no speculation; this is a reaction to increasing operational strains. Considering that processing a single invoice manually costs between 12 and 30 dollars, and using automation, companies can process a single invoice for as low as 2.36, companies are in a rush to remove the inefficiencies before their competitors (APQC).

And this change did not come as an overnight event. Even in 2018, well before the pandemic further propelled the concept of digitization forward and even before generative AI came to dominate, a Sage report found that 83% of businesses were expecting their accountant to do more than basic bookkeeping.

The proverb was already on the wall: the accounting services positions ceased to be the data entry positions and started to be the advisory, analysis, and strategic financial leadership positions.

The trend cannot be reversed anymore. The trend of paperless accounting is becoming a reality. AP systems on the cloud are substituting filing cabinets. AI is predicting dangers before human eyes.

And the workflows are being automated and are being accomplished in a few minutes, which used to take a team hours or days (APQC). As the world turns into a tight competition, and companies struggle with economic uncertainty, forcing them to do more with less, it is no longer a mere inefficiency to fail to automate AP; now it is a liability.

The successful businesses in 10 years will be those that do not view AP automation as a luxury, but as a foundation of a 21st-century finance department. This blog will bring you through the step-by-step process of what AP automation is, why it is important today more than ever, and how AP automation is transforming the future of accounting.

Let’s dive in.

What is Accounts Payable Automation (AP Automation)?

AP automation is the process of systematically delegating routine AP operations to algorithm-driven automation software. AP can be automated partially or completely, with multiple configurations available to fit requirements. Some of the major operations software that can be addressed in AP include:

- Invoice Reception

- Coding

- Payment Approval

- Payment

- Reconciliation

For businesses skeptical of complete automation, they can simply limit automation to payment approvals and handle the remaining tasks manually. There is a certain level of risk involved in automating payments, which is understandable and addressable with a semi-automated AP process.

Typically referred to as touchless processing in financial circles, AP automation makes it so you do not even have to lift a finger to make payments. AP automation is typically built into a business’s ERP system or accounting software (Medius). Most notable accounting software comes with all kinds of automation tools and algorithmic processing functions useful for AP. These software are also highly agile and easy to use, allowing for quick configuration and straightforward recourse in case of a problem.

There are even search features included to help make auditors’ lives easier and retrace the money trail when it’s time for taxes.

What Exactly Can be Automated with AP Automation?

We realize that it may be a bit too vague to simply say everything is automatable and move on. Before we head over to look at the benefits and challenges that come with AP automation, let’s list some of the big AP responsibilities you can leave to the robot’s hands!

Record Keeping

The most mundane and time-consuming part of AP is the record-keeping that comes with it. Whether it be filing digital invoices or matching them with supporting documents, we all know that accountants have better things to do. Automation solves this problem, recording all outgoing transactions automatically and saving the invoice for reference. Automated data records are also far more accurate and resistant to human error.

Automated Approvals and Coding

Invoice coding and approvals are easy to automate. Accountants can simply configure the system to assign the correct general ledger codes to invoices and route payment approvals directly to their desktop or phone. One click and the payment is on its merry way.

Scheduled Payments: Automation allows for payment scheduling, which allows businesses to plan out their payments in accordance with incoming earnings for better cash flow management. For example, if office bills are due by the middle of the month, they can be scheduled for payment a day earlier, and payment collection can be planned to ensure timely debt fulfillment.

Fraud detection

Fraud is running rampant these days, with things only getting worse with time. Automation technology removes the human element from the payment process, which means less chance of an accountant paying fraudulent invoices and harming the businesses. These software are also equipped with fraud detection and prevention measures to monitor and halt fraudulent transactions.

AP Process Optimization

AP automation software is a great tool for process optimization. The program can highlight potential bottlenecks in the AP workflow, as well as generate reports on the business’s spending trends for improvement.

Also Read: The Impact of Technology on Accounts Payable and Accounts Receivable Processes

The Benefits of AP Automation

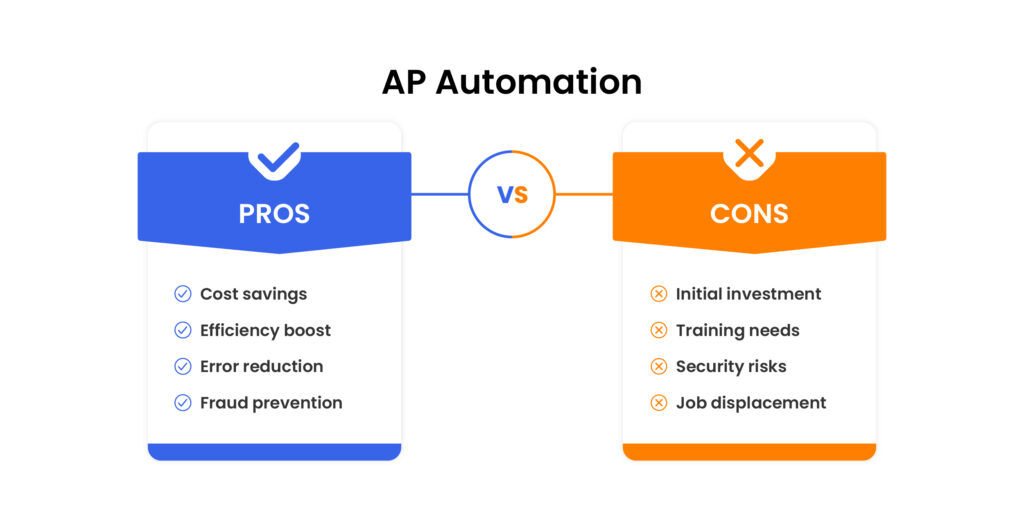

With a clear grasp on exactly what kind of tasks are addressable with automation, it’s time to talk about why all of this matters. What is AP automation’s purpose, and why is it such a big deal right now?

Cost Savings

Among the major benefits of AP automation, the most noticeable one is the cost savings that accompany it. Businesses will start to notice that after implementing AP automation, there is a drastic shift in the accounting function. Not only are they saving money usually lost to late payments, but the number of AP-related problems has also gone down.

The cost of processing an invoice is a good measure of the AP function’s efficiency. The Institute of Finance & Management reports that on average, businesses using AP automation spent $1.77 per invoice, while those not using automation spent $8.78. This dramatic difference cannot be ignored. AP automation offers around 70-80% cost savings, which can be used to fuel more important things. The costs can contribute to hiring a fractional CFO, for example, to further prop up accounting and finance.

Efficiency and Productivity Boost

AP automation speeds up the whole AP process. Everything from invoice processing to payment reconciliations is drastically sped up, optimizing the workflow. This leaves accountants the room to focus on more analytical activities. They can devote more time to Budgeting and FP&A, for instance, which is a much better proposition for business growth. An efficient AP system then ripples out and positively affects other parts of the business.

Timely salary and wage payments boost team morale and foster a positive work culture, which improves productivity. Everything needs money to happen in business, and all ongoing projects can proceed smoothly thanks to AP automation. Timely payments to vendors and other business expenses mean everything stays on track and does not exceed the budget due to tardiness.

Error Mitigation and Fraud Prevention

Human error is the culprit behind the vast majority of AP problems and cyber-attacks. AP automation acts as a solid shield against such issues by minimizing human intervention. The computer is smart enough not to open malicious links, for example. It will also not mess up data entry and make erroneous payments. It can also distinguish fraudulent invoices and prevent any malfeasance from within.

On both fronts, whether the threat is external account theft scams or internal embezzlement operations, AP automation can protect the business. By maintaining high security and reducing the chances of erroneous payments, AP automation is a proactive defense against all manners of AP problems.

Want to keep your business safe from fraud and other threats? Read our in-depth guide to accounting cybersecurity in current times.

Automation-assisted Decision-Making

AP automation is an accountant’s best ally in the consultancy department. An automated AP workflow not only streamlines the process but also makes it more transparent and open to action. Accountants can glean key insights from the business’s payment trends, for example, which can factor into crucial decisions. Strategies and projects can be planned around the business’s payment patterns to ensure there is sufficient cash flow at crucial junctures.

These are just some examples of the benefits of AP automation in the decision-making room.

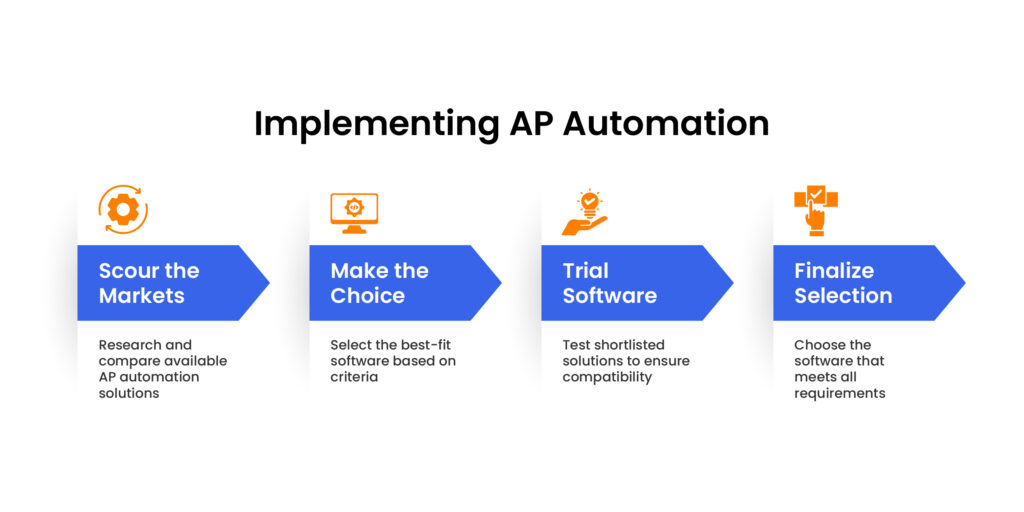

Selecting an AP Automation Software: A Step-by-Step Guide

You cannot just select any AP automation software off the shelf and expect it to work with your business. There needs to be a step-by-step evaluation and selection process so you know exactly what you are paying for and can make the most of it. Let’s go over the steps together and give you an idea of how to go shopping for your first AP automation software:

Evaluating the AP Function

The first step in finding the right AP automation software is to evaluate how your AP is currently functioning. Gather your accounting team and start inquiring about their workday. Ask questions like how much time is spent on AP, and what are good places to introduce automation into the workflow.

Your accountants can give you insight relevant to your unique business circumstances. Things like payment agreements and vendor negotiations can play a part in software selection, for example. Knowing how things are working and how they can be improved lets you know what to search for in software. Better to go shopping with a list rather than guess what you might need.

Scouring the Markets

After figuring out what you’re looking to get from AP automation software, it’s time to go shopping. There are a number of ways to go about this. You could send notable AP automation software vendors a proposal laying out your requirements and putting down your preferred price. You could also start hunting online for software that meets your requirements. Online forums like Reddit are chock full of resources to help you find the best option for you.

You can also take suggestions from industry acquaintances, or at the very least learn about their experiences so you can avoid their past mistakes.

Making the Choice

After thoroughly exploring the markets and receiving offers from vendors, it’s time to decide. Get your accounting team together and start comparing all of the different options. The goal is to find AP automation software that checks all of the requirement boxes at the best price. Bear in mind that user reviews are also a critical element, as the cheapest option may come with problems that explain the low cost.

Once you have shortlisted the best candidates, it’s time to experiment. Get free trials for the ones that offer them, and give them all a trial for a month. After around 3-4 months of trialing different AP automation solutions, you should be able to finalize which one you want to buy a subscription for moving forward.

Key Questions to Ask When Choosing Your AP Automation Solution

Capacity: Can the software handle your business’s regular AP workload, and how much room is there to accommodate growth?

Integrations: How well can the automation software integrate with the business’s existing infrastructure, and will there be a need for better hardware?

Features: Does the AP automation software come with all the required features, such as OCR for invoicing or payment scheduling?

Security and Regulatory Compliance: Does the software meet your security expectations and conform to local regulatory requirements for data privacy?

Reputation: Is the software vendor reputable in the industry, and are the user reviews satisfactory?

Training and Support: How good is the customer support, and how long does it take to train accountants in using the software?

Budget: Does the software fall within budget, and is it the best in the price range?

Outsourced Accounts Payable as an Alternative to AP Automation

While this whole blog has centered around convincing entrepreneurs to adopt AP automation, we recognize that for many, it is not a matter of choice. Small businesses and start-ups run on incredibly thin budgets, and many do not even have an accountant, much less a proper AP function. It is preposterous to expect such businesses to start spending on AP automation when there are more pressing concerns.

Outsourced Accounts Payable services are a viable alternative to AP automation. While it may not be worthwhile to spend on a dedicated automation software, there is far more value to be gained from hiring an outsourced AP professional. An accountant is an invaluable asset to a business; far more important than automation can ever be. By enlisting the aid of an actual remote professional, businesses can get access to an affordable accountant and start building their accounting function.

Sooner or later, there will be a need for a dedicated accountant. Why postpone the inevitable when you can proactively onboard a pro and accelerate business growth? Later down the line, this same outsourced accountant can help you integrate AP automation into your accounting. Instead of disregarding automation, entrepreneurs need to start building the path toward the automated accounting department.

Give it a few years, and you will see how leveraging outsourced accounts payable services can be the start of something spectacular for your business. It’s never too late to start automating. You just need to invest in talent first, and the automation will follow.