Financial management is vital for business success. Firms employ outsourced CFOs to control costs and drive growth, mainly with more regulations. Knowing when to hire a CFO is key to success as your business grows.

A study by Expertise Accelerated found that 40% of U.S. businesses outsource accounting offshore due to inflation. Outsourcing your CFO and other business tasks could be a smart choice for your business as well!

This blog covers the services offered, debunks myths, and looks at the future of the field. It highlights Expertise Accelerated, providing fractional CFO and accounting services.

Understanding Outsourced CFO Services

Outsourced CFO services offer affordable financial guidance for small businesses, covering forecasting, reporting, and strategic planning. They allow leaders to concentrate on their strengths. Meanwhile, professionals handle the financial side.

Proper financial records guide your business, showing its health and promoting informed decisions. For small businesses, offshoring saves time and money by having professionals handle bookkeeping, payroll, and taxes.

An outsourced CFO is an agreement professional providing strategic financial advice. This lets small businesses access CFO expertise without the high cost. Outsourced CFOs manage accounting, financial reporting, forecasting, and more. At Expertise Accelerated, we go beyond handling finances. We also assist with strategies, evidence-based decisions, and growth planning. Outsourcing offers professional financial services at a lower cost than a permanent team, making it ideal for businesses with limited resources. Outsourcing offers flexibility, providing help when your financial workload fluctuates. Outsourcing gives you access to specialized expertise, like tax planning, that’s hard to manage alone.

If your business is growing or facing complex financial decisions, consider hiring a full-time or fractional CFO. A CFO helps manage the complexity of growth, especially when entering new markets. They offer insights for strategic decisions, like mergers or investments. They also assist with financial issues, such as cash flow problems or declining profits. A fractional CFO is an affordable solution for small businesses. This option allows you to tap into the expertise of a permanent CFO without the added expense. It’s flexible and low-risk, with options for specific or ongoing support.

According to Forbes, In businesses, behind-the-scenes roles are as vital as leadership and service teams. An organization is like a body, leadership is the head. Service teams are the torso and finance is the heart that keeps everything running. Finance ensures payments, collections, and business health. Every role matters, from cleaning staff to IT. Today’s CFO manages not only money, but also HR, IT, marketing, and strategy. CFOs are increasingly focused on managing CSR, environmental, and health equity issues. Networking helps CFOs stay ahead, share knowledge, and build their reputation. Every team member helps the business stay strong and competitive.

According to Bloomberg, Businesses see accounting as necessary, not strategic. But, CFOs are now predicted to offer fast, precise data to aid with key decisions. Many finance teams still depend on manual processes and old tools, wasting time on data collection rather than analysis. Automation can decrease mistakes and let workers concentrate on more essential tasks. Finance teams must be flexible, faster, and better at forecasting due to new regulations and market changes. Automation helps meet demands and stay compliant. Partnering with experts eases finance and boosts efficiency.

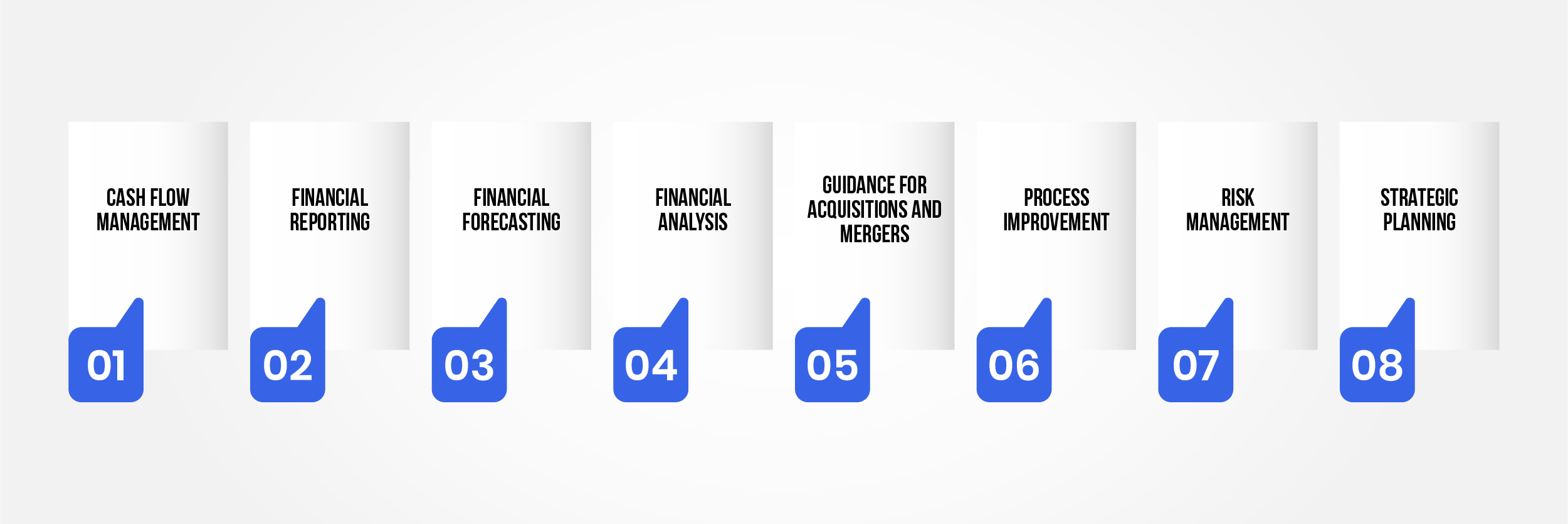

Key Services of Outsourced CFOs

Outsourced CFOs offer ongoing advice, while interim CFOs fill temporary gaps. Knowing the difference helps businesses choose the right fit.

- Cash Flow Management: Outsourced CFOs help stabilize cash flow. For example, they restructure billing cycles to ensure steady cash flow for a construction firm.

- Financial Reporting: They deliver exact reports, aiding businesses to understand their financial position.

- Financial Forecasting: They help businesses forecast performance and identify threats and opportunities.

- Financial Analysis: They identify financial strengths and weaknesses, providing insights for improvement. For example, a retail company saw a 15% profit increase after an outsourced CFO restructured its pricing strategy.

- Guidance for Acquisitions and Mergers: They offer expertise in due diligence and deal structuring. They assist companies in securing financing for growth.

- Process Improvement: They ease financial operations using modern tools. For example, they automate expense and payroll management to enrich efficiency.

- Risk Management: Outsourced CFOs help businesses navigate risks and ensure compliance. For example, they help a healthcare provider avoid penalties with proactive tax compliance.

- Strategic Planning: They help businesses make strategic decisions to boost profitability and growth. They help create long-term financial strategies. For example, they assist a tech startup in securing investor funding, leading to a 300% revenue increase.

Benefits of CFO Services

Offshoring your CFO provides many benefits:

- Cost savings: It’s more affordable than employing a permanent CFO. An outsourced CFO gives you expert support at a lower cost. You only pay for what you need.

- Access to expert knowledge: Access to technical financial expertise not available on-site.

- Flexibility: Outsourced CFOs offer adaptable, scalable services for business growth.

- Plan for the Future: They help you set goals, make innovative plans, and grow your business the right way.

- Manage Money Better: They help you handle cash, control spending, and plan budgets. They can also help you get loans or investors.

- Stay on Track with Rules: They make sure your financial reports are correct and follow tax laws so you avoid problems.

- Connect with Helpful People: They have contacts like banks, investors, and advisors to help you grow.

- Handle Tough Times: They prepare your business for risks and help during hard times.

- Use Them When You Need: You can adjust their help as your business grows—more support when busy, less when things slow down.

- Make Smart Choices: They use facts and numbers to help you make better business decisions.

- Know Your Industry: They often work in specific industries and give advice that fits your business.

When to Consider Outsourcing Your CFO

Outsourcing is an economical solution for small businesses. As your company grows, you may need a long-term CFO. Some think outsourced CFOs only handle basic accounting tasks. In reality, they offer much more, such as strategy and forecasting. They offer financial support but aren’t a replacement for a reliable team. Consider cost, experience, and industry knowledge when choosing an outsourced CFO. A good provider, like Expertise Accelerated, assists control costs while sustaining growth. Outsourced CFO demand is rising, driven by AI and tech that enhance financial management. Companies embracing these services will be better positioned for success.

Case study

A mid-sized manufacturing company faced inconsistent cash flow and poor financial planning. Outsourced CFO services improved budgeting, cut costs by 15%, and secured expansion funding. They shift financial challenges into growth, delivering strategic guidance without the price of a permanent executive.

Conclusion

Outsourced CFO services deliver cost reduction, expertise, and flexibility. An offshored CFO provides financial expertise and strategic advice. An outsourced CFO offers clarity for businesses struggling with growth. Expertise Accelerated helps optimize finances and drive success.

EA offers expert financial support with a team of skilled US-based and global professionals. Struggling with financial planning? Book a Free Consultation with our CEO, Haroon Jafree (CPA), for expert advice.