Trade promotion management (TPM) is supposed to be a simple, number-based process. It’s all about using discounts, rebates, and deals to boost sales without eroding margins. But in reality, it can feel like a big mess, especially when the numbers are not aligned and the different teams aren’t working together.

If your sales team plans a promotion, your accounting team calculates accruals, and your deductions team clears payments, why do so many companies still lose money on trade promotions?

Because these teams aren’t working together the way they should.

Sales launches a promotion, but does accounting have the right numbers to track it? Deductions start rolling in, but does anyone actually check if they match the plan? And when discrepancies pop up, who’s responsible for fixing them?

The reason most businesses struggle with Trade Promotion Management (TPM) is because they don’t have a tight, cross-functional process in place. And that means lost revenue, inaccurate accruals, and a whole lot of confusion.

But here’s the good news: You don’t need a bigger budget or a brand-new system to fix this. The gaps in your TPM process can be identified and resolved using the resources and processes you already have.

In this post, you will learn:

✅ Why cross-functional TPM (trade promotion management) fails, (and how to fix it)

✅ How to spot weaknesses in your current system before they cost you money

✅ Simple, practical ways to improve your processes without extra overhead

If you’re tired of watching money slip through the cracks, keep reading. The solution is already within your reach.

Let’s dive in.

How Do Cross-Functional Teams Fail?

Cross-functional teams often fail when each department operates in isolation, focusing only on their own functional area/responsibilities. They miss out seeing the whole picture and how their work fits into the overall process. For example, the sales team may be busy developing promotion plans, using tools like Blacksmith or Microsoft Excel. However, they might not fully understand how accounting will use this information. Meanwhile, the accounting team, focused on preparing accruals, may overlook the need to allocate sufficient funds for the deduction team to clear deductions.

When teams fail to connect the dots, inefficiencies arise, leading to misalignment and potential financial issues.

Lack of communication between the departments results in an unclear process.

Additionally, the department where the issue originates may not even be aware of its impact. From their perspective, they’re simply doing their jobs as instructed, and everything seems fine within their functional area. However, as their information flows to the next department, it may be incomplete or missing critical details. Thus leading to the issues that prevent trade promotion management generating a positive ROI.

How to Foster Cross-Team Collaboration for TPM Success

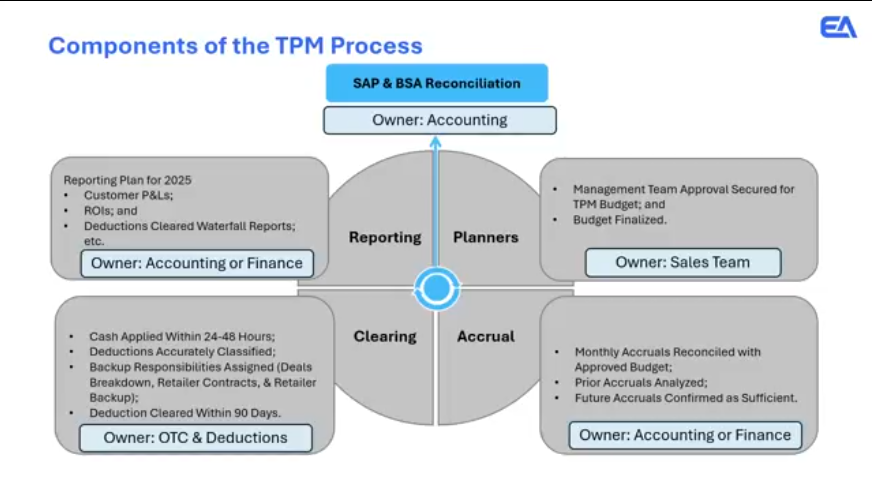

The below infographic showcases:

-the responsibilities of the different departments and

-how they can work together, understanding each of the roles, and

-the implications of their work:

Components of the TPM Process

Haroon Jafree, CEO of Expertise Accelerated states, that this slide basically forces a conversation between the different groups of people or different functional areas. We have found that as the team sits down together and they decide to own the process together and the conversation starts to happen back and forth between the different departments, that’s when the solution of the problems starts to happen.

Effective Trade Promotion Management (TPM) requires seamless cross-team collaboration. So there has to be coordination between multiple teams, sales, accounting, order-to-cash (OTC), and deductions. Each team plays a distinct role, but their success depends on their ability to share information and collaborate efficiently.

Here’s how it works:

- Sales Team:

The sales team is responsible for devising the trade promotion plan. Once the CFO and the board approves, it becomes the foundation for financial calculations. - Accounting Team:

Using data from the approved plan—such as costs, budgets, and expected promotion expenses—the accounting team calculates promotion accruals. These accruals are estimates of the deductions the company expects to receive. The accuracy of these estimates is critical because incorrect accruals can lead to financial discrepancies down the line. - OTC (Order-to-Cash) & Deductions Team:

When actual deductions come in, the OTC team records them in the correct deduction size bucket and ensures they are properly classified. But recording isn’t enough—these deductions must be matched with the planned promotions from the sales team.

🔹 Why is collaboration crucial here? If the deductions team doesn’t have access to the sales team’s planner, they might misclassify deductions, leading to financial misstatements and reconciliation challenges.

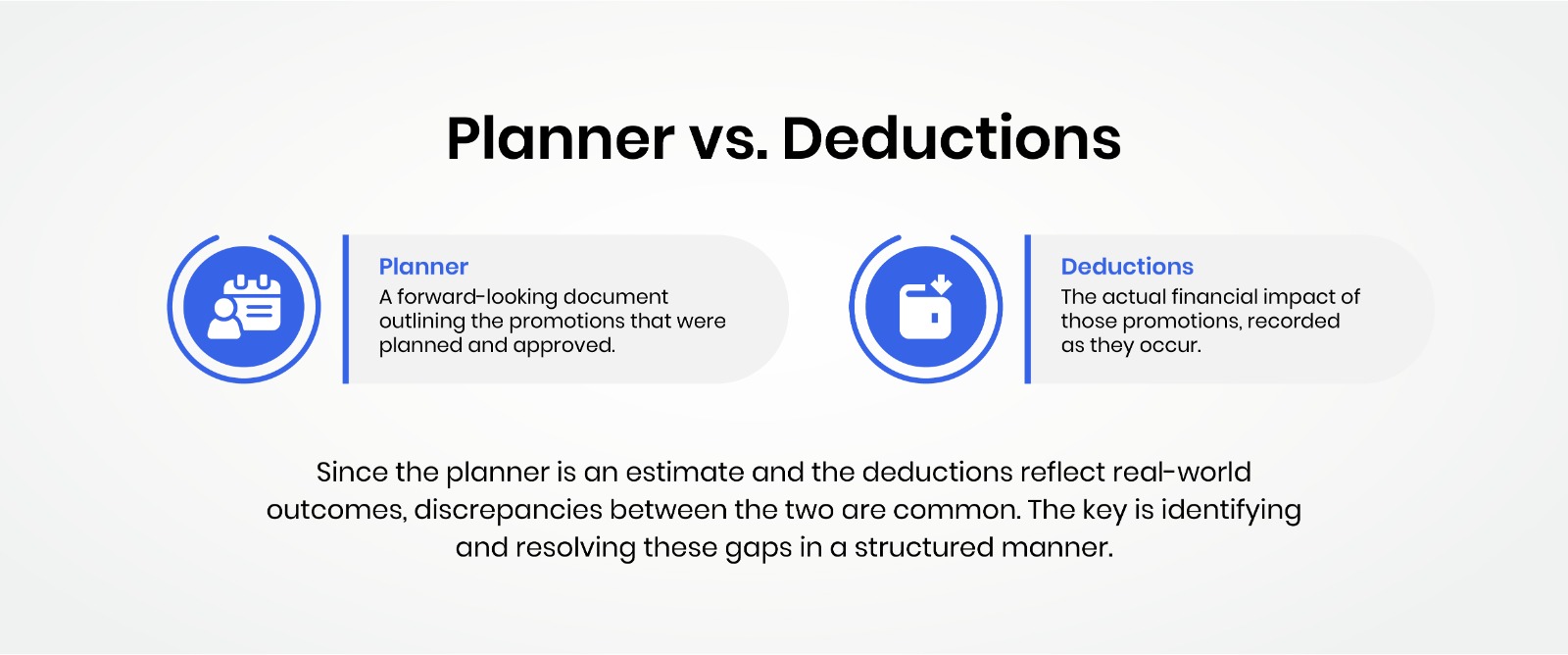

Handling Discrepancies Between the Planner and Deductions

What to do if there are any discrepancies between the planner and the deductions received?

When there’s a mismatch between the planned promotions and actual deductions received, the Deductions Team must:

✅ Coordinate with the Sales Team to understand the reason behind the discrepancy.

✅ Request supporting contracts for deductions. (The sales team, with help from brokers, should maintain a repository of customer contracts.)

✅ Monitor aging deductions—long-standing, unresolved deductions should be escalated to both the accounting and sales teams to ensure timely resolution.

The Accounting Team’s Role in Accrual Adjustments

Once the actual deductions are recorded, the Accounting Team compares:

📌 Planned vs. Actual Deductions – Were the recorded deductions in line with expectations?

📌 Previous vs. Current Accruals – How does this season’s accrual compare to past ones?

📌 Month-to-Month Accuracy – Were deductions recorded in the correct period?

Based on this analysis, they determine whether the current accrual is sufficient. If adjustments are needed, they report their findings to management and the CFO to ensure financial accuracy.

Why Effective Cross-Functional Collaboration Matters

When sales, accounting, and deductions teams work in silos, errors creep in, leading to financial misstatements, misclassified deductions, and disputes with customers. But when these teams share information, align on expectations, and communicate effectively, Trade Promotion Management becomes smoother, more predictable, and ultimately more profitable.

Take Control of Your Trade Promotion Deductions with Expert Support

Struggling with accrual calculations, deduction clearing, or cash application? We’ve got you covered.

At Expertise Accelerated, we act as an extension of your accounting and finance team, handling the end-to-end deduction management process. From accurate accrual calculations to seamless deduction clearing and reporting, we ensure your Trade Promotion Management (TPM) process is optimized for efficiency, thus reducing trade promotion cost.

✅ Streamline your deduction management for clean, actionable data

✅ Generate meaningful reports to drive informed decision-making

✅ Recover lost revenue by identifying unauthorized deductions

Let’s turn your deduction data into valuable insights and real savings. Ready to optimize your process? Let’s talk.

Related Links:

–How Trade Promotion Management Could Be Quietly Costing You Millions