From spreadsheets to strategy: FP&A transforms raw numbers into a roadmap for success.

2025 has been full of surprises. Cryptocurrency crashes? Check. Widespread layoffs? Check. Businesses everywhere are facing unexpected challenges.

Entrepreneurs now need smart financial decisions to protect and grow their companies. That’s where Expertise Accelerated comes in, they connect businesses with remote FP&A professionals who help plan, analyze, and guide smarter financial choices.

Even big corporations are making tough calls based on money management. To make these decisions easier, EA offers a foundational guide on financial planning.

Financial Planning & Analysis (FP&A) is the business’s crystal ball. It helps companies:

- Verbalize the future and make it measurable

- Find opportunities and risks

- Make better choices using data and trends.

Businesses that check their financial statements have a 95% chance of doing well.

This blog is a quick guide that explains how financial planning and analysis helps companies make confident decisions and drive their vision forward.

Key Takeaways:

- FP&A helps check, plan, and improve financial decisions.

- For effective Financial Planning & Analysis (FP&A), the accounting team’s records must be accurate, and consistent.

- Expert guidance can save money and improve strategy.

- Small businesses can benefit from FP&A too.

Financial Planning and Analysis

Financial Planning and Analysis aids firms to make wise cash choices. The team studies financial data, predicts what’s coming, and shows leaders what to do. FP&A turns numbers into simple insights that guide business decisions and keep the company healthy.

Modern tools bring all financial and market data together. It enables teams to plan, see trends, and make smarter choices. It focuses on the future, helping businesses grow, save cash, and invest well.

Great Financial Planning Starts with Good Accounting

Accounting explains what happened. FP&A predicts what could happen next.

For financial planning and analysis (FP&A) to work well, the accounting team has to record everything accurately and on time.

Here’s how it connects:

The accounting team handles all the day-to-day numbers — tracking sales, expenses, assets, and liabilities. At the end of each month, they “close the books” and prepare the Profit & Loss statement, Balance Sheet, and Cash Flow report. Their job is to make sure everything is correct and complete.

The FP&A team then takes that clean data and digs into it — looking at trends, comparing performance, finding risks or opportunities, and using it to create budgets and forecasts. Their job is to turn the numbers into insights that help guide business decisions.

If the accounting data isn’t accurate, the FP&A team’s analysis won’t be reliable. It’s like trying to build a house on a weak foundation.

So in simple terms: Good accounting leads to good data. Good data leads to better decisions.

Accurate accounting → Reliable data → Meaningful analysis → Better business decisions

Why FP&A Matters

FP&A is like a money GPS for businesses. It turns numbers into simple insights to help them stay on track. FP&A helps leaders forecast future results. It helps them:

- plan and manage budgets,

- tracks performance using key metrics,

- create simple financial models,

- test different “what-if” scenarios,

- make rapid and wise decisions and

- share reports with their teams to incorporate well and address issues early.

FP&A Functions

FP&A helps businesses run daily operations and plan for the future.

Key functions include:

- Planning – Collect data and make short- and long-term plans. Test “what-if” scenarios.

- Budgeting – Create and track budgets for cash flow, expenses, and revenue.

- Reporting – Make regular reports to show how the business is performing.

- Forecasting – Use past data and trends to forecast the future. Update forecasts often.

- Special Reports – Make on-demand reports for specific questions.

FP&A Tasks

- P&L Reports: Show costs, revenue, and profits.

- Profit Analysis: Identify the most profitable products or services.

- Budgeting & Forecasting: Plan budgets and predict results.

- Scenario Planning: Prepare best, worst, and likely case scenarios.

- Ad-hoc Reports: Offer quick insights for urgent questions.

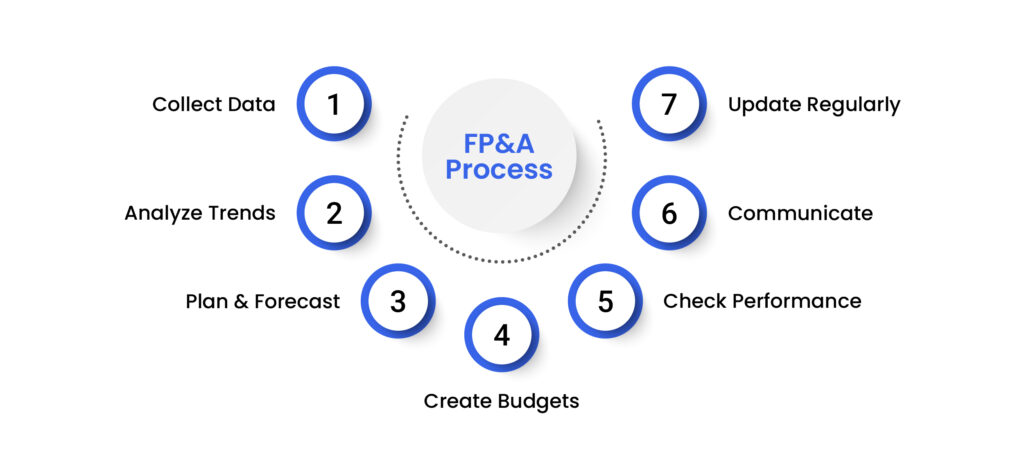

FP&A Process

- Collect Data: Gather information from all departments and track it for accuracy. AI tools can help.

- Analyze Trends: Look for growth opportunities, patterns, and seasonal changes.

- Plan & Forecast: Predict future sales, expenses, and profits. Use:

- Predictive Planning: Based on past data.

- Driver-Based Planning: Focus on core factors that drive success.

- Scenario Planning: Prepare for different outcomes.

- Create Budgets: Set and update department budgets.

- Check Performance: Track profit, expenses, and cash flow.

- Communicate: Share reports with leaders to guide decisions.

- Update Regularly: Compare actual results with forecasts and adjust plans.

What FP&A Tools Can Do

Modern FP&A tools don’t just crunch numbers, they tell the story behind them. Turning data into clarity gives leaders fast and accurate insights when it matters most. They reveal how a company is really performing, where it’s investing, and where it’s winning or losing.

Teams use FP&A tools to plan, collaborate and bring every department into the same conversation. Most importantly, businesses use the expertise of analysts and tools to see what’s coming, the opportunities to seize and the risks to prepare for. Because the smartest decisions aren’t made from instinct alone. They’re made from insight.

Future of FP&A

Modern FP&A tools aid businesses to plan well and stay adaptable for growth. With cloud access, you can reach your data anytime, anywhere. AI and machine learning offers better forecasts and deeper insights, while automation saves time on repetitive tasks. Together, these tools make handling finances smarter and more effective.

From FP&A to xP&A (Extended Planning & Analysis) connects finance, HR, sales, and operations. This helps planning become faster, simpler, and more precise.

Real-Life Examples

FP&A plays a vital role across different industries. For tech startups, it shows when they will need more money so they can plan and grow wisely. In manufacturing, FP&A checks if investing in new machines or markets is worth it, helping use money wisely. Retail chains use FP&A to analyze sales trends and customer demand. This helps them maintain optimal stock levels. It also reduces costs and prepares them for busy seasons. For healthcare providers, FP&A examines revenue and profit by service. It highlights areas to focus on for increased profitability. It also helps improve patient care.

Tesla: Smart Investments

Tesla grows fast, and big choices cost a lot. Building a Gigafactory takes billions and careful planning. FP&A helps Tesla decide if it’s a smart move. They track if the firm has enough cash, how costs might change, and when the factory will start making money. This helps Tesla make smart choices and grow in the electric vehicle market.

Netflix: Planning Shows

Netflix spends a lot on shows. FP&A helps check if the money is worth it. For shows like Stranger Things, they check new viewers, retention, and profit potential. FP&A uses past data to guide Netflix on which shows to fund or cancel, saving money and supporting growth.

Airlines: Adjusting Ticket Prices

Airlines like Delta and Southwest change ticket prices all the time. FP&A helps by looking at how fast flights sell, fuel costs, and competitors’ prices. If a flight sells fast, ticket prices go up to earn more. This helps airlines act fast and make money. Hotels, Amazon, and other companies also use FP&A to watch demand and stay ahead.

Amazon & Walmart: Inventory and Forecasting

Amazon and Walmart use FP&A to manage stock and predict what customers will buy. They track sales, trends, and which products are famous. This aids them to stock the right items, advertise what sells, and prevent waste. By watching the data, they can act quickly and make more money.

How Expertise Accelerated Can Help

The foundation of every projection is the company’s financial statements (the profit and loss statement, balance sheet, and cash flow statement). Creating projections means building a story on this foundation, which is why accuracy in financial statements is essential.

At Expertise Accelerated (EA), we remind our clients that they are the only ones who can truly tell their story. They are the ones who know the future of their company. Our team helps them verbalize that future and make it measurable. We ensure their financial statements are accurate and, using that foundation, develop projections that empower them to make confident decisions and drive their vision forward.

EA provides highly professional accounting teams with deep US industry experience. Our teams work under the guidance of US-based management’s supervision. Clients experience up to 60% payroll savings, without compromising on quality.

Looking for the guidance you need to make smarter financial decisions and grow with confidence?

Book a free consultation now.

Conclusion

FP&A helps businesses plan ahead and make wiser money decisions. Modern tools use cloud and AI to give quick insights and enrich teamwork. FP&A is more than finance; it guides business strategy. Firms with good FP&A teams are ready for challenges and opportunities.

In 2025, planning your finances is very vital. Expertise Accelerated connects businesses with top FP&A experts to give advice on strategy and decisions, helping companies grow without hiring full-time staff.