CPG companies often miss deduction errors in trade promotion management. These are small mistakes that quietly drain millions from their bottom line. Retailer chargebacks can build up unnoticed, until they surface at the worst possible moment. Imagine facing an audit or a board meeting, suddenly having to justify millions in unexplained write-offs.

“From what I’ve seen, it’s just like a health issue. At first, people ignore it, pushing it under the rug. The deductions pile up, they start aging, and no one reacts. Then, one day, like any other health problem, it hits hard.

Suddenly, management starts asking tough questions, and the scramble begins. Unfortunately, by that time, it’s already too late. The deductions have piled up, and clearing them in a meaningful way becomes incredibly difficult.“

— Haroon Jafree, CEO of EA

Learn how trade promotion deductions can drain millions from your profits. This guide will help you:

- Protect your bottom line

- Safeguard your role as a CFO

- Save your company millions

Let’s get started.

How Unchecked Deductions Drain Your Profits

Trade promotions expenses are the second biggest line item in the company’s P&L statement. Each year, companies receive thousands of deductions. These deductions are written off without the validity of each chargeback being checked. As a result, companies can lose millions of dollars to possible abuse.

For instance, a CPG (Consumer Packaged Goods) company that sells snacks generates $500 million revenue.

Here’s a simplified version of its Profit & Loss (P&L) Statement:

| Category | Amount ($ in millions) |

| Revenue (Sales) | $500 |

| Cost of Goods Sold (COGS) | $250 |

| Gross Profit | $250 |

| Trade Promotions Expense | $75 |

| Marketing & Advertising | $40 |

| Logistics & Distribution | $30 |

| Administrative Expenses | $20 |

| Net Profit | $85 |

Since these trade promotion expenses are often 15%-30% of revenue, they become the second-largest cost after COGS.

The trade promotions expenses are spread across various deductions from retailers, promotional spend adjustments, and backend charges that lack clear documentation.

Retailer chargebacks, in particular, can often be a challenge. Retailers deduct amounts from invoices under various claims, pricing discrepancies, unauthorized promotions, and post-event adjustments. Many of these deductions come with vague justifications, and disputing them is time-consuming.

Hence, deductions from invoices may not always align with agreed-upon promotions leading to the complex and frustrating reconciliation process.

Here’s why this is a serious problem:

- Retailer deductions can quickly spiral into a profit-draining black hole if not closely tracked.

- Without granular visibility into trade promotion spend, companies risk significant revenue leakage.

- While the board may accept some uncertainty in the short term, repeated unexplained costs can erode trust and put the CFO’s job at risk.

Once the deductions pile up, it can be challenging to clear those deductions in a meaningful way.

Why?

👉Because many companies simply lack the resources or trained personnel to investigate them thoroughly. Even if you do have unlimited resources and an unlimited amount of money, identifying unauthorized deductions isn’t enough. Industry standards dictate that if a deduction isn’t disputed within 90 to 120 days, it becomes permanent.

As a result, by the time the problem surfaces, many organizations are left with no choice but to write off millions in lost revenue.

Shortage of Manpower

Another major challenge is the shortage of manpower in most organizations. With thousands of deductions to review and hundreds more coming in daily, finance teams are already stretched thin.

If CFOs decide to prioritize historical deductions while keeping up with new claims, they are forced to divert limited, high-value resources to an overwhelming task. This creates a constant trade-off—focus on recovering past losses or preventing new ones from slipping through the cracks.

Either way, without the right systems in place, companies risk losing millions in unverified deductions simply due to a lack of bandwidth to address them.

And even when discrepancies are identified—say, a retailer made unauthorized deductions a year ago—recovering that money is often impossible. Retailers typically respond with, “It’s too late. You should have disputed this within 90 days!” This means that by the time finance teams catch these issues, the window for recovering lost funds has already closed, turning potential recoveries into permanent financial losses.

Misaligned Teams

Misaligned teams lead to costly trade promotion failures.

Haroon Jafree, CEO of EA, states, “One of the common themes I’ve seen, even with some big companies, is that nobody understands the whole picture. So they try to attack bits and pieces of it. But unless it is solved from start to finish, addressing all the different areas of this process and its cross-functional aspects together, you can never bring this process together in a meaningful way.”

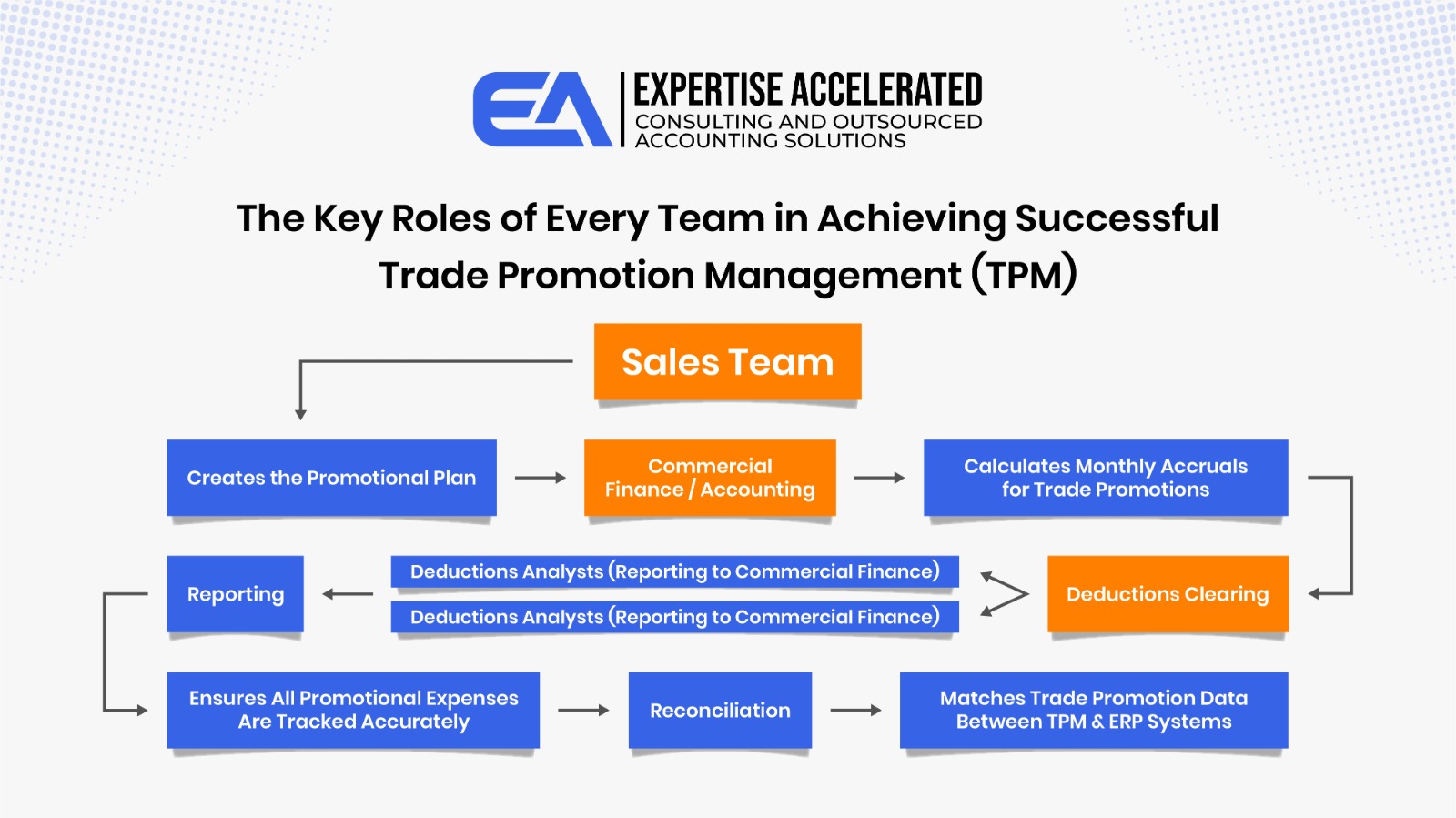

For trade promotions management to be a success, there has to be a strong collaboration between the cross-functional teams (i.e. sales, accounting, and deduction analysts teams). (This is shown in the image below). Many companies struggle to align these teams, leading to inefficiencies and revenue leakage.

*note: the individual teams are highlighted in the orange boxes.

Here’s how the process typically flows:

- Sales Team – Creates the promotional plan.

- Commercial Finance / Accounting – Calculates monthly accruals for trade promotions.

- Deductions Clearing – Handled by:

- Accounting teams (reporting to the controller), or

- Deductions analysts (reporting to commercial finance).

- Reporting – Ensures all promotional expenses are tracked accurately.

- Reconciliation – Matches trade promotion data between the trade promotion management (TPM) system and the ERP system.

Since trade promotions involve multiple departments, a lack of collaboration can create major inefficiencies such as:

-Sales, finance, and accounting often work in silos, leading to misalignment in promotional spending.

-Deductions may go unverified or disputed too late, resulting in lost revenue.

-Without a clear reconciliation process, tracking trade promotion expenses becomes challenging.

Many companies also lack a culture of cross-functional collaboration, making it difficult to align teams and streamline operations. As a result, instead of driving revenue, trade promotions become disorganized, inefficient, and costly.

Individuals involved in trade promotions management often become frustrated because they attempt to fix issues within their own department. However, since this is a cross-functional process, improving just one part of it won’t resolve the entire problem unless all areas are streamlined and aligned. As a result, inefficiencies persist, and frustration grows.

To address this, management must first understand the entire trade promotions process. They should know how different functions interact and where breakdowns occur. From there, they can deploy the right solutions, such as specialized software, expert consultants, and accounting expertise, to ensure a cohesive, efficient system that works across all departments.

Why a TPM Software Alone Won’t Fix Your Problem

TPM software is a powerful tool, but it’s not a strategy on its own. Success depends on how well a company integrates it into its overall process to drive meaningful results.

Many companies, especially larger ones, rush to implement TPM software, such as Blacksmith, believing it will be the ultimate solution to their operational challenges. And while the right software can be a game-changer, it’s not a magic fix. The real value comes from knowing how to integrate it into your workflows effectively.

It is common for companies to invest hundreds of thousands of dollars in software implementation, only to struggle. The problem? They didn’t fully understand their processes, the software’s purpose, or the ultimate goal. (The goal is robust reporting). As a result, despite the hefty investment in software implementation, they fail to achieve the expected results.

The key to successfully utilizing the software is to implement it early in the process and ensure that management fully understands the entire workflow. This includes knowing how to operate the software, coordinating cross-functional roles, and focusing on the end result, i.e. achieving robust reporting.

How to Prevent TPM Problems

Management Understanding of the Whole Process

One of the key ways to prevent TPM issues is ensuring the right staffing in each functional area. The individuals assigned to the project must not only understand their specific roles but also see the bigger picture and share a common goal: achieving clear TPM reports.

At its core, this is a vision issue. Success requires commitment, especially in larger companies, to not just implementing the software but also aligning people, processes, and training. Everyone involved must be equipped with the knowledge and skills to work toward a shared objective.

Additionally, the system must be structured to generate the critical reporting needed at the end of the process. Management needs reports that provide actionable insights to drive informed decisions. Without this, even the most advanced TPM software will fail to deliver its full value.

Essential Skills and Training for Successful Trade Promotion Management

As stated earlier, when cross functional teams collaborate, the trade promotion management is successful.

Accounting teams must collaborate closely with the sales team and other departments, ensuring the accurate transfer of information and the smooth integration of processes across the organization.

Here are examples of skills required from each team:

Sales teams:

Sales teams should be skilled in robust planning, which is a critical component of the process from the start. They are already familiar with planning but need to adapt to a system-based approach for efficiency.

Accounting teams:

Accrual Calculation: Accounting teams must be able to use the information provided by the sales team to generate accurate monthly accruals. This is essential for booking expenses in the correct period. They need a strong understanding of how to calculate accruals accurately to avoid issues like prior year adjustments.

Deduction Analysis: Accounting teams require strong skills in deduction analysis, including understanding retailer portals, different sales channels, and the process of obtaining and matching the necessary backup documentation to the promotions offered. This skill ensures accurate matching and deduction clearance.

Process Understanding: A clear understanding of the entire accrual and deduction process is crucial. Accounting teams must be able to navigate each step smoothly and efficiently, ensuring that all elements are aligned.

Reporting to Management: Accounting teams need to be skilled in generating reports that allow management to evaluate the effectiveness of trade promotions. These reports should be clear, insightful, and help management make informed decisions.

The Power of Rigorous Chargeback Verification in Reducing Losses

Retailer chargebacks can quietly drain a company’s revenue, often going unnoticed until they accumulate into significant losses. Many businesses only audit a fraction of these deductions, leaving substantial amounts unclaimed.

But what if you could verify 100% of retailer chargebacks without overburdening your internal team?

By utilizing EA’s cost-effective resources trained by a US-based management team, companies can conduct thorough chargeback verification, uncovering potential claims worth hundreds of thousands of dollars. A review process not only ensures rightful recovery but also signals to retailers that every chargeback will be scrutinized. Thus reducing the likelihood of unjustified deductions in the future.

The key is consistency. When businesses establish a rigorous system for validating every chargeback, they don’t just recover lost revenue, they also strengthen their position against recurring disputes. Over time, this approach leads to fewer frivolous claims, improved cash flow, and better collaboration with retail partners.

Investing in an efficient chargeback verification strategy isn’t just about recovering lost dollars, it’s about reinforcing financial control and preventing revenue leakage before it happens.

In a recent podcast, Harry Ferrante, a Trade Promotions Software Expert with +40 years of experience shared some of the critical aspects and insider details of Trade Promotions Management that he has learned in his journey with Haroon Jafree. Click here to learn expert tips and strategies to refine your trade promotion approach and drive success in the coming year.

Conclusion

In trade promotions management, problems often go unnoticed until they surface—by then, it’s too late to recover lost revenue. A lack of cross-functional collaboration further compounds the issue, leading to millions of dollars being written off as retailer chargebacks each year. While software can be a valuable tool, its effectiveness depends on having the right people with the necessary skills and a strong culture of collaboration across teams.

With the right approach, companies can take control of chargeback verification and minimize financial losses. EA’s cost effective resources, trained by a US-based management team, will enable you to verify 100% of retailer chargeback, which will almost certainly result in filing of hundreds of thousands of dollars of claims. A rigorous chargeback verification process sends a signal, reducing frivolous claims in the future.

By strengthening internal processes and ensuring accountability, businesses can turn chargeback verification into a strategic advantage, protecting margins and improving overall financial health.

FAQs

What is Trade Promotion Management (TPM) in the CPG industry?

Trade Promotion Management (TPM) in the CPG industry refers to the process of planning, executing, tracking, and settling promotional activities with retailers, all while maintaining financial accuracy and operational efficiency.

From a finance and operations perspective, TPM plays a critical role in:

- Sales Planners’ Role: Sales teams are responsible for building promotional calendars, aligning with customer timelines, and inputting deal mechanics (discounts, display fees, etc.) into TPM systems. Their forecasts directly impact accruals and planning accuracy.

- Accrual Calculation: As sales planners forecast and approve promotions, finance teams set aside trade accruals, (estimated funds earmarked to cover future promotional expenses). These accruals must be timely and accurate to ensure the company’s financials reflect liabilities and don’t overstate margins.

- Deduction Clearing: Once promotions run, retailers often take deductions on invoices instead of waiting for reimbursement. Clearing these deductions involves matching them back to planned promotions, validating accuracy, and flagging discrepancies, a critical task for minimizing revenue leakage.

- Order-to-Cash Cycle: TPM intersects heavily with the order-to-cash (O2C) cycle. Promotions impact order volumes, pricing, and invoice terms. A well-integrated TPM system ensures that trade deals flow through to order processing and billing accurately, minimizing errors, disputes, and delays in cash collection.

2. Why is TPM important for CPG companies?

Effective TPM allows CPG companies to optimize their promotional investments, accurately plan and categorize liabilities, strengthen retailer relationships, and enhance brand visibility in the marketplace. Without a robust TPM strategy, businesses risk failing to deliver profitable results or meet key performance indicators (KPIs).

Many CPG companies lack processes for best practices. This can lead to issues such as not clearing deduction claims on a timely basis.

3. What are common challenges faced in TPM?

Some prevalent challenges include relying on manual calculations, which can lead to inaccuracies; lack of integration both internally and with external partners; and the inability to plan promotions based on analytics.

Here are the key challenges faced by CPG companies in managing Trade Promotion Management (TPM):

Lack of Standardized Processes and Best Practices

- Companies often do not have clear or effective TPM processes in place.

- There’s no structured system to manage promotions or clear deduction claims, which leads to inefficiencies and missed recovery opportunities.

Delays in Deduction Claim Clearing

- Deduction claims from retailers are not cleared on a timely basis.

- This results in accumulating deductions that go unresolved, negatively affecting cash flow and financial accuracy.

Inefficient Handling of Supporting Documentation

- Companies struggle to maintain or secure valid contracts and promotional documentation.

- Without proper backup, they can’t validate or dispute deductions effectively, making it harder to recover money from invalid claims.

Poor Visibility and Audit of Incoming Claims

- Multiple deductions from multiple retailers come in with limited oversight.

- There’s often no systematic audit process to verify whether the deductions are valid or aligned with approved promotional plans.

Inability to Dispute Invalid Deductions

- Without a proper review and dispute mechanism, invalid deductions are often accepted by default.

- This leads to revenue leakage and unnecessary expenses.

4. How can technology improve TPM outcomes?

Technology can improve Trade Promotion Management (TPM), but only if it’s used the right way.

Many CPG companies think that just installing TPM software will fix their problems. But software alone isn’t enough. If the management team doesn’t understand the full promotion process, from planning to deductions, the software won’t help much.

To get real value from technology, companies need to:

- Get everyone on the same page: TPM involves sales, accounting, and finance teams. If only one team uses the software, and others don’t, it creates confusion and messy data.

- Train the team properly: The software only works if people know how to use it. Without training, half the data ends up in the system and the rest stays in spreadsheets or emails — making it hard to run accurate reports.

- Bring in the right experts: Software consultants, along with sales and accounting professionals, should work together to set up the system in a way that fits the company’s actual processes.

- Make sure leadership is involved: When management supports the project and understands how TPM works, the whole company is more likely to follow through and see good results.

In short, technology helps. But only when there’s strong teamwork, clear processes, and support from the top. Otherwise, it’s like buying a plane without learning how to fly it.

5. What are best practices for effective TPM?

To achieve effective Trade Promotion Management (TPM), there are several best practices that CPG companies should follow.

First, strong management sponsorship and understanding is essential. Leadership needs to fully understand the entire TPM process, from start to finish. Without this top-down support and vision, it’s difficult for the company to align all departments and drive successful outcomes.

Next, cross-functional team alignment is key. TPM is a cross-functional process, so it’s crucial that all teams, including sales, finance, and accounting, are on the same page. The individuals involved in TPM should understand the entire process, not just their specific tasks, and work together toward a common goal.

Additionally, companies need to ensure proper staffing across different functional areas. These individuals should have the expertise needed for their specific roles but also a holistic understanding of how their work fits into the larger process. This ensures that everyone is contributing effectively to the TPM effort.

Training and commitment are also critical. A successful TPM strategy requires commitment from everyone involved. This includes investing in training to ensure that all team members know how to use the TPM tools effectively and understand the importance of their roles within the broader vision.

Finally, companies must make effective use of technology. Implementing and properly utilizing TPM software tools helps streamline the process. The software should be designed to generate the necessary critical reports that provide the management team with accurate, actionable data to drive decisions.

Effective TPM requires clear vision, cross-functional collaboration, proper staffing, continuous training, and the strategic use of technology. These practices ensure everyone is working toward a common goal and that the process runs smoothly from beginning to end.