Finance work is getting faster and smarter with automation and AI. AP automation helps by capturing invoices, checking details, and getting payments approved quickly. AI gives real-time updates so businesses can make better money decisions.

Outsourcing AP can cut costs by up to 70% and speed up invoice processing to 3–5 days. It also reduces mistakes and supports business growth. The AP automation market is growing fast. It may reach $1.5 billion by 2025 and $7 billion by 2032. That’s why more companies are switching to automation.

Many businesses now choose Expertise Accelerated for outsourcing. EA uses smart tools and experts to save time, cut costs, and boost accuracy. CFOs who work with EA build safer, stronger, and more modern finance systems.

An Introduction To Accounts Payable Outsourcing

AP outsourcing lets experts manage invoices and payments, saving time and boosting accuracy. The AP outsourcing market is growing fast and is set to reach $5.4 billion by 2027. More businesses see the value in letting experts handle routine tasks. AP outsourcing captures, matches, approves, and schedules invoices saving time and reducing errors. Records stay safe, and reports support audits and budgeting.

According to Forbes, by 2025, Outsourcing and nearshoring offer big advantages, not savings. The BPO market may hit $525.23B by 2030, with Latin America leading for its talent and time zones. AI is making offshoring faster and easier, with automation and chatbots. Firms also concentrate on sustainability and long-lasting partnerships.

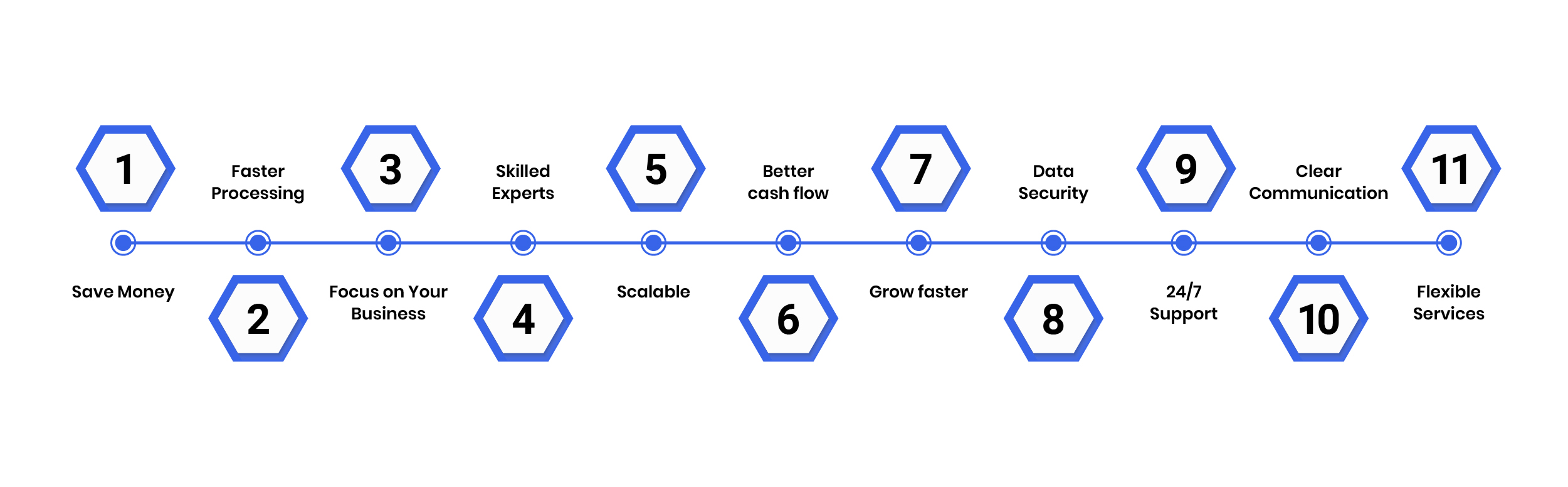

Benefits of Accounts Payable Outsourcing

1. Save Money – No need to hire or train staff or buy expensive software.

2. Faster Processing – Automation speeds up tasks and reduces errors.

3. Focus on Your Business – Let experts handle AP while you focus on growth.

4. Skilled Experts – Outsourcing teams follow the latest rules and best practices.

5. Scalable– Adjust services as your business grows.

6. Better cash flow– Pay on time, avoid fees, and get discounts.

7. Grow faster– Focus on strategy, not paperwork.

8. Data Security – Top providers use strong encryption and secure systems.

9. 24/7 Support – Most companies offer round-the-clock help.

10. Clear Communication – Dedicated managers and multi-language support.

11. Flexible Services – Can fit into your current workflows and systems.

Top AP Outsourcing Providers

- Infosys BPM – Uses AI and cloud systems to improve AP tasks and vendor relationships.

- WNS Global Services – Offers tools for invoice tracking and compliance.

- Capgemini – Focuses on automating AP and using data to prevent fraud.

- IBM Finance Services – Helps with invoicing, payments, and financial insights.

- Conduent – Handles large amounts of invoices and works well with existing systems.

Understanding Accounts Payable Automation

AP automation speeds up invoices, approvals, and payments with less mistakes. In 2023, 54% of firms began AP automation, only 9% completed it, and 66% plan to automate by 2025. Automation speeds up invoices, matches orders, and eases expenses. Remote work and contractors boost automation needs. AI handles invoices, fraud checks, and touchless payments. Linking AP with ERP makes the process smoother and more accurate. Automation improves insights, stops fraud, and strengthens vendor ties. Timely payments can earn discounts. Since 2020, inflation and supply issues have made automation vital. By 2025, most finance teams will use it to save time and cut costs.

Benefits:

- Saves time and money

- Fewer errors

- Improves compliance

- Gives real-time updates

- Helps your business grow

Outsourcing vs. Automation

| What it means | Hire a provider | Use software |

| Who handles it | Third party staff | Your system |

| Main benefit | Expert help | Speed and accuracy |

| Cost | On-going fees | One time setup |

| Best for | Small teams | Scaling quickly |

| Control | Less | Full |

| Flexibility | Depends on vendor | High |

| Human Input | Medium to high | Low |

| Scalability | Varies | Easy |

| Security | Some Risk | More secure |

| Customization | Limited | High |

Tip: Many companies use both outsourcing and automation together for best results.

Why Finance Outsourcing Is Changing

Finance outsourcing now focuses on speed, accuracy, and smart insights not saving money. Today’s CFOs want real-time updates, less mistakes, and easy compliance. Providers use automation, AI, RPA, and secure cloud systems to cater to these requirements.

Old AP was slow and defective; automation speeds it up and enriches accuracy. OCR, AI, and RPA manage invoices, approvals, and payments. AP automation reduces invoice costs by 81% and speeds up processing by 73%.

AI also enables predicting cash flow, detect fraud, and enrich financial planning. AI and automation bring efficiency, real-time reports, cost savings, scalability, and compliance. Partnering with EA lets businesses concentrate on growth, not manual tasks.

The future is smart and automated, with AI-driven tools enabling finance teams in real-time.

AP Trends to Watch in 2025

- AI and Machine Learning – Speeds up AP tasks and reduces errors (up to 70% faster).

- Blockchain – Makes payments safer and more transparent.

- ERP Integration – Connects AP systems to ERP for better cost control.

- Mobile Apps – Approve invoices and track payments from anywhere.

- Cybersecurity – Protect data with encryption, secure logins, and regular checks.

- Global Payments – Wise and Payoneer make international payments affordable and easier.

- Predictive Tools – Anaplan helps forecast cash flow and schedule budgets.

How Expertise Accelerated Helps Transform Finance Operations

Expertise Accelerated automates accounts payable with smart tools and cloud approvals. Their system also works with top ERPs, giving 99.99% accuracy and speeding up approvals by 60–70%. With an AI-focused strategy, they help spot fake earlier, find savings, and enrich payment timing. Their cloud platform makes it easy for finance teams to examine invoices, track reports, and stay ready for audits anytime, anywhere.

Case Study

A property management firm struggled with delays, errors, and poor visibility in their AP process. They implemented a cloud-based system for complete invoice tracking. Using AI and RPA, they automated data extraction and processing. Invoices, orders, and receipts were auto-matched, and the full AP process was automated. This led to 60% faster approvals, 40% fewer late payments, 100% accuracy, and better audit readiness.

Conclusion

If paperwork and AP errors cost time and money, outsourcing can aid especially for growing businesses. Outsourcing enhances accuracy, saves time, and allows your team to focus on what matters. AP automation software can also save money by handling up to 80% of tasks and speeding up financial closing.

Consider control, cost, and security when picking solutions. Combining automation and outsourcing often works best.

Finance is transforming fast, and smart automation is essential. Expertise Accelerated eases finance, cuts costs, and boosts accuracy, so your team can concentrate on growth.

Want to improve your finances? Contact Expertise Accelerated to learn how AP automation, AI, and outsourcing can help.