Every finance leader knows the stress of the month end closing checklist. The pressure to close the books accurately and on time can overwhelm even seasoned teams. From missed invoices to reconciliation errors, a single oversight can detail compliance and distort decision making. That is why having a structured checklist can be useful.

A month end close checklist ensures that the financial close is organized, numbers can be trusted, and the process works the same way every month.

This blog gives you a month-end closing checklist you can rely on, insights into the challenges most teams face, and shows how accounting services helps you finish faster, without sacrificing accuracy.

What the Month-End Close Involves

Proper month-end closing ensures that the financial closing is organized and accurate.

Accounting teams handle month-end closing tasks in most companies. Larger corporations often have standard procedures (SOPs) in place to make this process smoother. For smaller companies, a monthly closing checklist can help avoid bottlenecks and keep things on track.

During the month-end, the accounting teams compile all the month’s transactions. They ensure that all the transactions that pertain to that particular month are accounted for. Every income earned and incurred should be recorded in that month.

Monthly end closing involves recording adjusting and recurring entries, reconciling bank and loan accounts, confirming balances such as mortgages or other debt, and ensuring all expenses are properly recorded for the period.

Next, financial statements are prepared using the available information. Accountants usually follow a specific checklist for month end closing. The closed books are reviewed by the higher management for any adjustments to be made so this can be a back-and-forth process. Ideally, teams are required to close within the first week of the next month.

*A financial close is the finalization of the company’s financial statements for a period. After this, no more changes are made, and the numbers can be trusted as the official record.

Why is Month End Closing Important?

Many personnel in the accounting teams will understand their individual tasks but don’t really consider the overall effect of their work in the financial statements. The overall purpose of a month end close is to ensure that all revenue, expenses and transactions for the given month have been recorded. For instance, bank reconciliation ensures there are valid reasons for the difference between your amount in the bank statement and the GL account in your ledger.

Why is this important?

Month end close helps management have clear visibility of the company’s financial statements of that month. Running a P&L and a Balance Sheet and analyzing the company’s performance month to month can deliver insights such as:

- how much more/less was the revenue this month compared to last month (or the same month from last year?)

- comparing key financial ratios (margins, liquidity) to track performance

- Ensuring DSO, DPO and inventory turnover is within acceptable standards.

These insights are only as good as the data behind them. That’s why an accurate, reliable month-end close is essential. Without it, management risks making decisions on faulty information.

Why the Month End Close is So Challenging

Warren Buffett once said, “You only find out who is swimming naked when the tide goes out.”

In accounting, that tide is the month end close where weak processes are quickly exposed.

Month end close is not just about compliance, it is about trust. Executives rely on timely, accurate financial statements to guide business decisions. Yet many companies struggle to close on time, facing challenges like:

- Meeting deadlines → “It’s the 28th, and we’re already behind… how will we get everything reconciled by the 5th?”

- Doubts about data accuracy. These are due to data fragmentation with multiple systems and manual entries → “Wait, why don’t the bank recs tie to the GL? Did we miss something again?”

- Audit season panic → “The auditors are asking for supporting schedules… where are those files?”

- Team capacity issues → “Two staff accountants are out this week… how will we close on time?”

- Leadership pressure → “The CEO is asking for financials for the board meeting, but we’re still cleaning entries.”

- Growing pains → We’ve just added three new entities… how are we going to consolidate them every month?

- System or process bottlenecks → QuickBooks reports aren’t matching Excel consolidation again. This is eating hours!!

A survey by CFO.com found that the median company takes six days to close its books, while top performers do it in four days or less.

The Month End Closing Checklist

A month-end closing checklist should capture everything the accounting team needs to do to tie out the books and prepare accurate financial statements. It helps ensure no steps are missed, everything is consistent, and the close is audit ready.

Many accounting teams overlook the importance of cross-department collaboration during the month-end close. Working closely with analysts, managers, and other departments can make the difference between a smooth process and a stressful one. For example, a timely close depends on receiving key information, such as inventory counts or payroll data, on schedule. Just as important, that information must be accurate to ensure the financials are reliable.

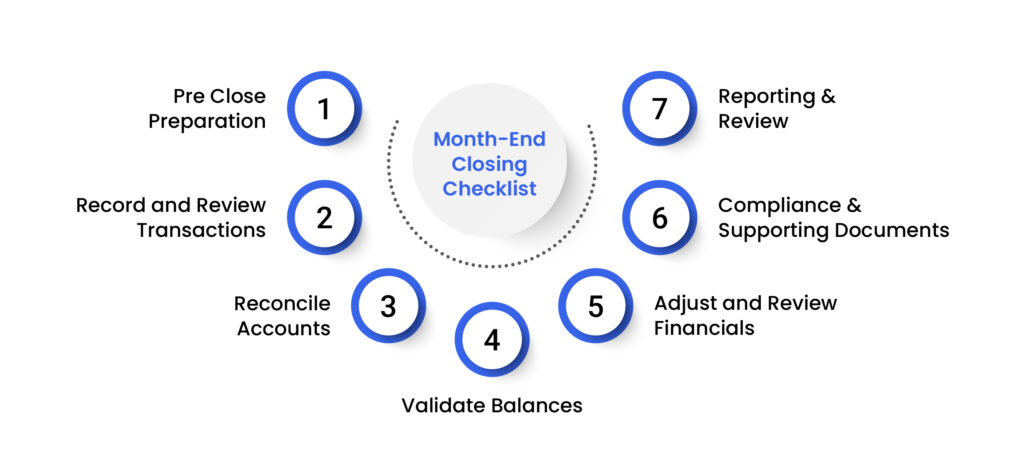

Month-End Closing Checklist

1.Pre Close Preparation

Before closing, ensure all transactions are captured

- Collect vendor bills and employee expense reports

- Review accounts receivable for outstanding invoices

- Verify payroll and benefits entries.

- Automate reminders for departments to submit expenses. This reduces last-minute delays.

2.Record and Review Transactions

- Post all invoices, bills, and journal entries.

- Record recurring entries (e.g., rent, depreciation, amortization).

- Capture accruals and deferrals for the period.

3. Reconcile Accounts

- Bank reconciliations.

- Credit card reconciliations.

- Loan and mortgage reconciliations.

- Intercompany reconciliations (if multiple entities).

- Inventory counts and reconciliations.

4. Validate Balances

- Confirm accounts receivable aging.

- Review accounts payable aging.

- Match prepaid and accrued expenses to schedules.

- Verify fixed asset balances.

- Reconcile payroll accounts.

5. Adjust and Review Financials

- Post adjusting entries as needed such as depreciation of assets, prepaid expenses allocation, accruals for unpaid invoices and payroll, deferred revenue recognition

- Review trial balance for anomalies.

- Compare actuals vs. budget/forecast.

- Ensure revenue recognition is correct.

6. Compliance & Supporting Documents

- Ensure supporting schedules are complete (AP, AR, fixed assets, prepaid, accruals).

- Prepare tax-related accruals (sales tax, payroll taxes, etc.).

- Confirm documentation for audit readiness.

7. Reporting & Review

- Generate preliminary financial statements (P&L, Balance Sheet, Cash Flow).

- Controller/CFO reviews for accuracy.

- Finalize and distribute reports to management.

For added efficiency and consistency, it helps to build structure into the month-end close. Each step in the checklist should have a clear owner and deadline to ensure accountability.

Using standard templates for reconciliations, schedules, and recurring entries keeps the process uniform and easier to review.

Wherever possible, automation such as bank feeds, consolidation software, or closing tools can further streamline the workflow and reduce manual errors.

According to Ledge, 61% of accountants still use Excel for reconciliations, costing finance teams 10 or more hours per week. Outsourcing this task to specialists can free up valuable staff time. Many teams use Excel for month end closing while others are switching to specialized month end tools such as Numeric or Floqast.

In addition, outsourcing parts of the close to a specialized team can relieve bandwidth constraints, speed up the process, and ensure greater accuracy.

Month End Closing Checklist at a Glance

| Step | Task | Owner | Outsourcing Benefit |

| Pre Close | Collect transactions, vendor bills, AR review | Accounting Staff | Offshore teams can gather and verify data faster |

| Reconciliation | Bank, credit cards, intercompany, inventory | Controllers or Staff Accountants | Specialists handle reconciliations, saving 10 or more hours weekly |

| Adjustments | Depreciation, accruals, deferrals | Senior Accountant | Experienced offshore CPAs ensure accuracy |

| Reporting | Trial balance, FS prep, approvals, close | Finance Manager or CFO | Outsourcing reduces workload and speeds approvals |

Example: The Month-End Bottleneck

Imagine a growing mid-sized company where the finance team is juggling invoices, payroll, and reconciliations all at once. As the month end approaches, the pressure mounts. Bank statements arrive late, vendor bills are still pending, and the team spends hours tracking down missing receipts.

What should be a smooth five-day close often drags into nine or ten days, delaying reporting for management and frustrating other departments that rely on timely financial data.

Now consider what happens when this company leverages outsourcing support. Routine but time-consuming tasks like bank reconciliations, intercompany matching, and journal entry postings are handled by an external team trained specifically in month-end closing best practices. This not only reduces the cycle time but also helps the internal finance staff shift focus to higher-value tasks such as analyzing variances and advising leadership on business decisions.

The result is not just a faster close, but a more accurate one, with fewer errors slipping through, better audit readiness, and greater confidence in the numbers presented to management.

How Expertise Accelerated Can Help

Managing the month end closing checklist internally can overwhelm lean teams. That is where Expertise Accelerated (EA) comes in. We provide cost effective offshore accounting professionals trained by U.S. based CPAs. Our CPA-led accounting teams specialize in month end closing, and financial closing procedures.

As an outsourcing partner, we support our clients by handling the month-end close for the functions we manage. For example, when we provide Accounts Payable services, we take ownership of the AP month-end close and deliver detailed reports for management review. In cases where we are engaged only for the AP function, our focus is on ensuring those AP reports are accurate, timely, and audit-ready.

For more complex areas, such as Trade Promotion close, we bring structure and expertise to navigate the multiple reconciliations and reports required. No matter the function, our process ensures management receives clear, reliable reports that simplify decision-making and reduce closing stress.

With EA, you can

- Cut costs by up to 60% while maintaining quality

- Reduce the month end close period.

- Ensure timely and accurate closing every month

- Strengthening compliance and audit readiness

- Scale finance support as your business grows

Conclusion

The books should not become a nightmare to close on a monthly basis. Through a proper end of the month closing checklist, attention to detail and proper support model, the businesses can make a stressful process into a strategic advantage.

Through taking over regular tasks to trusted partners, such as Expertise Accelerated, finance teams will be able to concentrate on what is important, which is turning things around and making decisions based on data with confidence.