Being a small business nowadays does not seem to be a slow, gradual uphill ride, but rather a survival-of-the-fittest game. The international market has eliminated borders, e-commerce has diminished the entry barrier, and suddenly, even the smallest startups are not competing with a few local competitors-thousands of businesses are competing to win the attention of the same customers.

The thing is, in such a landscape, it becomes clear that small businesses cannot afford the use of guesswork very easily. They require accuracy, planning, and economic clarity to remain in the game. That is why a Certified Public Accountant (CPA) has ceased to be a luxury; it is a competitive edge.

When even international megachurches such as Amazon and Netflix are starting to feel the intensity of competition, the ordinary entrepreneur attempting to grow, expand, or even survive can barely imagine it. As never before, keeping a CPA on your side is not just a nice thing to do, but the most intelligent thing a small business can do.With professional accounting services, businesses can navigate financial complexities, stay ahead of the competition, and ensure their growth is sustainable in an increasingly competitive market.

CPAs do not just have an impact on accounting functions. They have a ripple effect that can uplift all of the business functions. Also, since it may come up as a point of interest, check out our publication “Bookkeeper Vs. CPA, What’s the Difference”. It provides a detailed breakdown of a CPA and how they differ from the bookkeepers they often get confused with.

The Benefits of Hiring a CPA for Small Businesses

Resource Management and Cost Control

The biggest benefit of hiring a CPA is the resource management and cost control skills they bring to the table. Small businesses often spend too much or too little as entrepreneurs learn their way through the market.

They cannot expect much more, as these things are only learned through experience. The problem is that the business world is far less indulgent these days. One small spending blunder today can catalyze the business’s failure. Poor cash flow is among the top reported reasons for small business and start-up failure.

In this hyper-competitive, cutthroat marketplace, entrepreneurs need to tread very carefully. Every word must be measured, and every step must be taken after hours of pondering. Expecting a new player to know all the tricks is absurd.

This is precisely why a CPA for small businesses is the perfect play for small businesses this year. A CPA may dent your wallet, but what they bring to the company is well worth it. A year after hiring a CPA, that cost will seem like a drop in the ocean that the CPA has brought to your business’s shores.

Waxing poetic aside, let’s get down to brass tacks. Business works the same way as it always has: spend less than you make, and you’re the king. However, this ratio of spending vs earning needs to be min-maxed to the umpteenth degree.

Otherwise, it is folly to think about running for king. Every penny saved is a victory. The one who can help you minimize your resource expenditure is a CPA.

A quality CPA will have no problems developing a proper budget for the business. They can also craft a complementary financial plan that aligns with the entrepreneur’s business and financial goals.

They can allocate the proper funds for a project and ensure they are spent properly. Not to mention negotiating with suppliers and collaborators to score the best arrangement. The money saved will then contribute towards developing the business further, and so on.

Business-wide Positive Impact

Another major reason onboarding a CPA for small businesses is a terrific idea is their company-wide positive impact. The sales department will operate better when aided by a CPA. They can help with pricing and provide financial projections and cash flow forecasts that help decision-making.

The supply chain will function better with a professional assisting in demand and supply planning. The entire business team will work all the more efficiently with a CPA as the financial backbone. Payroll will be processed faster, which will improve morale. The money saved from the CPA’s activities will help hire more professionals to assist as the business grows.

A CPA’s overall positive impact just by existing and acting as the financial control tower is invaluable. Not to mention that a CPA can also serve as the business’s CFO and have a portion of administrative responsibilities. This relieves the core C-suite and gives everyone breathing room.

Tax and Audit Support

Another major benefit of a CPA to small businesses is optimizing tax handling and auditing. Taxes are generally not that difficult to file. The hard part is finding and leveraging all the incentives and deductions available to you from the government. There is also the fear of legal repercussions if taxes are mismanaged. That’s a risk that is too severe to put up to chance.

Similarly, audits are a necessary part of business and must be managed efficiently. Both internal and external audits are massive time sinks. Having a CPA on call to prepare and oversee the audit can make it easier for everyone else.

How Much Does a CPA Cost for Small Businesses?

The next logical question we are sure you have is how much a CPA costs for small businesses. After all, we are convincing you to spend your hard-earned cash. It also falls to us to help you budget and search for one. So, let’s get into it, shall we?

CPA costs are typically determined based on employment terms and the extent of the workload. For small businesses, it is ill-advised to splurge too much on a full-time CPA. Most accounting work today is all addressable on the cloud. This means remote CPAs are just as viable a choice as a suited pro in the office.

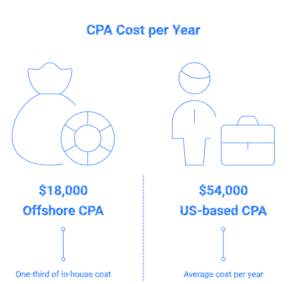

With that said, businesses can expect a US-based CPA to cost an average of $54,000 per year, according to Glassdoor. This is just an estimate we are highlighting here to show you where the costs could go. This is not what they will be. While these numbers might seem well out of reach for many small businesses, trust us. There is a way to bring them much lower.

What we are referring to is hiring an offshore remote accounting professional. A US-based remote CPA will still end up costing quite a hefty sum. This amount can be reduced to a fraction of the original if you go to the global talent pool. The cost can go as low as a third of the in-house equivalent. This is not only feasible for small businesses but also a great future investment.

Unfortunately, we cannot pinpoint the exact amount it will cost. There are too many variables that affect the cost of a remote CPA. However, what we can assure small business owners is that the price will be much more reasonable. Definitely worth serious consideration.

Finding the Right Remote CPA for Small Businesses

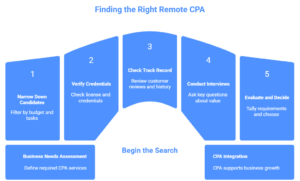

With all that said, let’s find the most affordable yet quality CPA for small businesses. We are assuming a tight budget and focus on growth. So, we will focus on hunting for the best offshore remote CPA for the job. However, the same basic steps are involved when tracking for an in-house CPA for small businesses.

Assess Your Business Needs

Before you can go out and ask for CPAs to join your business, you need to prepare. Draw up a clear list of services you require from them. Ironically, an accounting professional is the best person to ask about this. However, consulting with fellow small business owners is the next best option.

You can easily pin down your business’s operations and list what you can delegate to a remote CPA. After that, consult with fellow business owners in the market and see how they leverage their accounting team.

While competition may be cutthroat, the business landscape has never been more open to helping newcomers. You will quickly find a vast collection of fellow business owners open to sharing advice. Of course, always remember to get multiple perspectives and not follow the first person you ask.

On top of this, the internet is a fantastic resource. You can post a question on forums like Reddit, LinkedIn, and Quora, listing your business model, and have actual CPAs and CFOs share some wisdom. Such forums are very trustworthy and are a great community to be a part of to get an unbiased perspective.

Begin the Search

You should have a budget set at this point. Calculate how much it should cost based on market rates for your chosen tasks. With everything planned, it’s time to search.

Based on that budget, start narrowing down what outsourced remote CPA firms are viable candidates. There are tons of different CPA firms in the US today. A quick Google search can yield all the results relevant to your locale. Another good idea is to get a list of names from your fellow business owners. Such names are guaranteed to be legitimate and will not require scrutiny.

Which leads us to the other part of the search. While you can easily cobble together a long list of CPA firms that fit the bill, there is a high chance that some may become scams. As with any other service industry, some malicious actors falsely promise you services and disappear after being paid. Especially in the remote offshore context, there will likely be next to no recourse if you fall prey to scammers.

Luckily, it is very easy to weed out such problematic entities. All you need to do is call their business and ask them for their license and credentials. Such documents are necessary to operate in the US and are publicly verifiable by consumers. If a firm refuses to provide such proof, it can get crossed off the list.

Still, the list will prove pretty hefty even after culling any scammers. Offshore remote CPAs hail from all corners of the world, so naturally, there will be tons to choose from. This is where you need to start picking out the ones with the best visible track record.

Choosing The Best CPA for Your Firm

Customer reviews are a great indicator. You can even call a firm’s previous clients and inquire about their experience. Asking around on the internet is also a great idea. You will inevitably find somebody who has dealt with the firm. It’s a lot of work, and most of it is just a matter of intuition in the end. You will ultimately have to follow your gut. Settle on around 5-6 CPA firms that you think will be the best fit for your business.

Interviews and Making a Decision

The next, and hopefully last, stage is the interview phase. Once you have your shortlisted CPA firm candidates, it’s time to start scheduling meetings with them. One meeting is frankly needed, and we advise preparing some questions before hopping on a call with someone. Some good interview questions are:

- What value can your CPA support add to my business?

- How does your firm operate, and what is your role in the arrangement?

- What returns can I expect if I retain your services?

- What technology does your firm use, and how is your data security and infrastructure?

- What recourse do you offer your clients in case of accidents or mishaps?

These are some good questions that are not so obvious to ask in a meeting with a CPA firm executive. As a client, you are entitled to have this information before you decide.

While interviewing the firm, remember to keep calm and have water nearby and a notepad to take notes for reference later. Also, ask for a service rates card and the firm’s terms and conditions for collaboration. After meeting and getting answers from your chosen candidates, it’s time to choose.

Now, none of your shortlisted candidates may meet your expectations. In this case, you start working on your original list’s next 5-6.

Anyway, after all that interviewing and vigorous research, you are finally at the finish line. Start tallying up which of the firms check the most items on your initial list of requirements, and make a decision. You can also see if the firm you choose offers a trial period. You can leverage their services and gauge if they are a good match, which can save you money.

Hiring a CPA for a Small Business with Staff Augmentation Services

Many small business owners hire a CPA for small business accounting tasks to ensure financial compliance and maximize tax deductions. A skilled CPA for small businesses can offer valuable insights and strategic financial advice to help drive growth and profitability.

An alternative to the grueling work of finding the right outsourced CPA firm is to opt for CPA staff augmentation services instead.

The bottom line is that your business needs a CPA professional, right? Well, instead of going through and verifying the merits of hundreds of outsourcing firms, why not go to a single staff augmentation firm and have them hunt for you? You just need to hire one person, and you can do just that by providing a CPA staff augmentation firm with all of your required parameters.

What accounting staff augmentation firms like Expertise Accelerated do, in a nutshell, is connect US businesses with offshore professionals. Think of us as a more focused and involved form of websites like Upwork. Firms like EA take in your list of requirements and start shortlisting candidates in their extensive databases to find the best fit for your business. They can then show you a list of candidates that meet your needs, and you can directly interview them and finalize a contract.

The firm, meanwhile, will only be involved with facilitating communications and supporting your hired CPA with their infrastructure. The firm will also handle any problems or complaints with the CPA, but in regular affairs, entrepreneurs will have direct communication and control of their CPA’s activities.