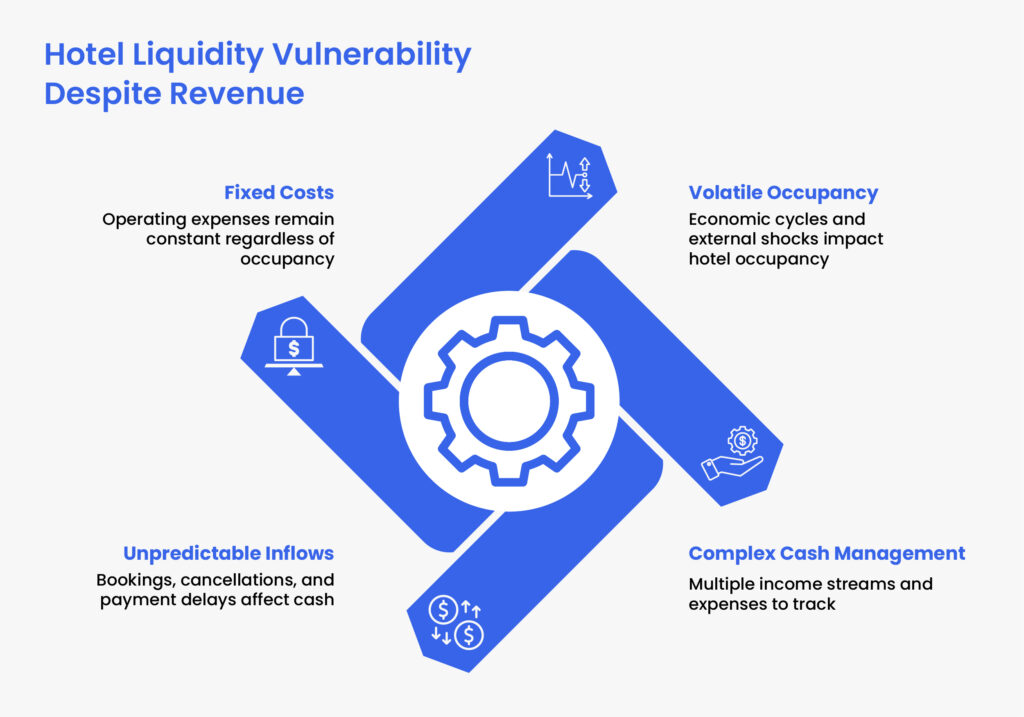

Revenue in hospitality is not liquidity, and that is what makes the difference between survival and failure. Hotel statistics always indicate that the hotels may reach cash flow gaps of 20% – 30% during low seasons, although annual revenue goals may be technically met (STR, Statista).

The fixed operating expenses do not reduce with occupancy, and this has left most of the properties vulnerable to liquidity pressures despite the high booking tools.

Hotels are one of the businesses with the highest amount of cash requirements to run. STR and SiteMinder estimate that labor, utilities, maintenance, and vendor commitment costs frequently represent 60% or higher of monthly cash outlays (CoStar). However, with bookings, cancellations, a delay of OTA settlement, and corporate credit terms, inflows are impossible to predict.

This dislocation in timing between the time revenue is earned and when cash is received poses structural risk. It is particularly the case when markets are disrupted, or seasonal downturns have already been identified, and revenue is therefore incalculable.

The data is unambiguous. According to Statista, the hotel occupancy in the world is very volatile, depending on the economic cycle, the feeling of enjoying traveling, and external shocks (NetSuite).

Weak cash flow control properties are compelled to take reactive measures: reducing staff, delaying maintenance, or losing pricing power, whereas successfully managed cash flow hotels can remain operationally stable and still be able to take strategic decisions.

In the case of the hotel executives of today, cash flow management is no longer a back-office operation. It is a fundamental leadership duty that has direct effects on resilience, valuation, and growth readiness. Hotels that perform better are the ones that have the best ability to control their liquidity, timing, and financial visibility, rather than having the highest headline revenue.

This article considers the practicality of hotel cash flow management and presents executive-level tactics and strategies that have been shown to work by the hotel in stabilizing liquidity, cushioning margins, and positioning the hotel to sustain growth in whatever the market operates.

What is Hotel Cash Flow Management and Why Does it Matter?

Hotel cash flow management is simply the art of managing cash flow for a hotel business. What sets hotel cash flow management apart from other businesses’ cash flow management is the sheer amount of cash and avenues of income and expenses that hotels juggle.

For example, a medium-sized hotel typically tends to have several different income streams. The primary income is, of course, from people renting rooms for the night (IBIS World). But if the hotel owner is wise, they will set up multiple income streams within the hotel.

For example, allotting a hotel floor for corporate use would allow brands and franchises to set up shop and operate within the hotel. We see countless examples of fine dining establishments, for example, setting up shop within hotels to capture guests as an audience.

By putting corporate space within the hotel, the hotel owner guarantees monthly rent collections as a secondary income source far more consistent than guests.

It is also a known practice for hotels to allow organizations and people to rent out spaces like auditoriums for meetings, seminars, and weddings. This opens up yet another income stream for hotels, as even if people are not traveling during the off-season, the locals will surely end up renting such spaces for events.

As for expenses, hotels have to cover a wide array of fluctuating expenses. Utility bills, other maintenance costs, and employee payroll are just for starters. Add on the supplier and vendor payments, which can end up in the tens, if not hundreds, given how diverse an inventory a hotel needs to function.

Significance of Hotel Cashflow Management:

The point of this tangent is to demonstrate just how complex hotel cash flow management is. Imagine keeping track of so many different income streams, not to mention all of the hotel’s expenses (Deloitte). Just keeping the numbers straight would be headache-inducing, even with software assistance.

And then you factor in the fact that much of the income may not necessarily even materialize, as people book rooms and spaces on credit. A sizable chunk of books end up canceled, with SHRGroup reporting that 20% of hotel bookings in 2022 wound up canceled.

Tips on Hotel Accounting Outsourcing for Mid-Sized Hotels:

In the case of small hotels and mid-sized ones, revenue increases more slowly than the complexity of accounting does. Small in-house departments, large volume of transactions, and 24/7 business operation all create a challenge to proper and timely financial control without increased overhead. When done strategically, outsourcing hotel accounting enables such properties to obtain enterprise-level expertise but at a non-enterprise level cost.

Outsourcing not just Labor, but also Specialization:

Shun faceless accounting vendors. Hotels need accountants who are knowledgeable about reporting hospitality-specific, departmental P/Ls, night audits, RevPAR, ADR, and revenue models based on occupancy (Light Speed).

A niche outsourcing partner will minimize mistakes, enhance visibility, and accelerate decision-making, particularly so in the case of hotels that lack an internal head of finance.

Begin With High Impact Functions.

Outsourcing the following should become a priority for small and medium hotels:

- Day-to-day reconciliation of revenues and bookkeeping.

- Tracking of payroll and labour costs.

- Vendor and accounts payable reconciliation.

- Cash flow and monthly financial statements.

These functions provide a quick operational relief and a quantifiable clarity of finances without interfering with daily management and enhancing the performance of operations.

Request Timely, Actionable Reporting:

Outsourced accounting should not slow down visibility but enhance it. Demand daily or weekly cash and cash flow snapshots, department-level performance reports, and a transparent variance report. In smaller hotels, a quicker grasp usually proves to be more essential than elaborate reporting hierarchies.

Enforce Internal Financial Control:

The process of outsourcing execution does not imply outsourcing control. Have one internal decision-maker, who is usually the owner, GM, or head of operations, review reports, pay, and performance monitoring. This hybrid type of accountability maintains internal accountability but uses external expertise.

Emphasize Scalability and Flexibility:

The issue of seasonality is inevitable in hospitality. A successful outsourcing partner must be able to expand and contract accounting support up and down in the high and low seasons, respectively, which is not effectively possible under fixed in-house teams. Such flexibility shields cash flow and unnecessary payroll growth.

Make sure of Excellent Data Security and Compliance:

Even small hotels work with financial and guest information. Ensure that your outsourcing company operates on secure systems, controlled access, and adheres to domestic tax and reporting laws. No bargain can be made regarding confidentiality agreements and well-defined ownership terms for the data (Global FPO).

Let Outsourcing Deflate Cost Pressure, Retain Insight.

In the case of small and medium hotels, it is not necessarily the lower cost that is the real value of outsourcing, but rather improved financial decisions. A lot of properties receive senior-level accounting experience at less of the expense of employing it in-house, allowing them to price smarter, maintain a tight rein on their costs, and better plan their cash flows.

In the case of small and medium hotels, outsourced accounting is the most time-saving route towards financial maturity. It substitutes bookkeeping that is reactive with organized control, decreases overhead, and provides leadership with the visibility to function comfortably in a turbulent market. Outsourcing is not a trade-off but a competitive advantage when it is combined with the correct partner.

Strategically Approaching Hotel Cash Flow Management:

With income and expenses all over the place and in apparent chaos, it falls on the business’s CFO or CPA to streamline processes out of the madness and keep things straight. That is precisely why hotel cash flow management deserves a dedicated discussion.

Dynamic Pricing Strategy and Technology Integration:

One of the reasons why hotel cash flow can end up fluctuating is the lack of dynamic pricing. Dynamic pricing is a pricing strategy where, based on certain parameters, the hotel’s pricing shifts to take advantage of the situation (Sage).

For example, if the market trends show that travel demand has decreased, room prices can decrease appropriately to attract travelers who are still coming. And when travel demands rise, the pricing rises to take advantage of the increased demand.

On top of that, dynamic pricing is a great way to figure out ideal pricing. It ensures you are not leaving money on the table. Some hotel owners, for example, offer rooms at a much lower rate as a competitive strategy to capture more guests.

But what happens when there is a lull in hotel demand, and the few guests are not charged enough to sustain operations? With a dynamic pricing tool, this problem is entirely avoided. The tool factors all these external variables into the calculation to find the best pricing. The best pricing is affordable and attractive to guests while generating good revenue.

A dynamic pricing strategy depends on technological assistance to collect and analyze all the available data. It suggests pricing based on the market. However, by integrating dynamic pricing into your hotel management system, you gain far more than the relatively meager cost of implementation.

Most importantly, your hotel’s cash flow will end up far more stable and consistent. Dynamic pricing ensures that your bottom line is not affected, no matter what happens.

Partnerships and Collaborations:

Another important aspect of hotel cash flow management is securing partnerships and collaborations. For example, imagine partnering up with a local restaurant to provide a bundled experience for guests, with lodgings from the hotel and food from the restaurant.

Not just restaurants, but any local business can be a good strategic collaboration partner to host events at the hotel and provide guests with an experience beyond the basic lodgings.

The business’s accountant and management must make these collaborations happen. Improving cash flow necessitates increasing income. Hence, it’s up to the accounting function to determine favorable terms and help management negotiate mutual benefits.

Cash flow management is never about just the numbers. A major part of why we call it an “art” is the need for strong communication skills and critical thinking. These help come up with ways to bring more business to the business and cut down operational costs.

Outsourced Accounting Services:

While not technically a “trick,” EA felt it necessary to mention outsourced accounting services early on. Running a hotel is no small fish to fry. Entrepreneurs will quickly find that the accounting workload for even a small hotel can pile up. Hiring an accounting professional will not only prove the right choice in the long run but also have a noticeable impact on operational efficiency.

The roadblock for many here is the cost of an accountant or CFO. We suggest outsourced bookkeeping and accounting services as a good alternative. With Expertise Accelerated’s outsourced accounting services, for example, hotel owners will find opportunities for payroll savings of up to 60%. They can obtain the services of some of the best remote accounting professionals in the global talent pool.

Conclusion:

The taboo over outsourced accounting has long been dispelled with the advent of the pandemic. We saw almost every administrative desk job being just as, if not more efficient, in a remote setting. So, realistically, there are no real downsides to leveraging outsourced accounting for hotel cash flow management and many upsides. This “trick” to avoid the cost barrier of an accounting professional can do wonders for hotel cash flow management. It gives a much-deserved break to the core team.

Projections by Statista are showing promise for the future, but all that opportunity can be wasted or missed if your hotel’s cash flow management is not optimized. The year has just begun; there is still time to prepare and incorporate some of this advice into your plans.