Success measurement and management are one of the most important issues that every business faces, be it is small or big. In some cases, it is aimed at making correct reports that will satisfy investors and auditors. To others, it is about making significant insights that will inform internal decisions and future development. It is here that the debate on financial accounting and managerial accounting becomes critical.

Both are related to numbers, reports, and performance evaluation. However, the distinction between financial and managerial accounting is in their aim, time, and organization. Financial accounting reports the past performance to external entities whereas managerial accounting is concerned with the improvement of operations within the organization and the future.

This blog discusses the working nature of the two kinds of accounting, their different functions, and the importance of the connection between them to every business leader who wishes to make sound and strategic decisions.

Key Takeaways

- Financial accounting vs managerial accounting differs mainly in purpose. Financial accounting focuses on the past, while managerial accounting looks toward the future

- Financial and managerial accounting in business work together to ensure compliance, efficiency, and growth

- Managerial accounting is internal and flexible, while financial accounting is external and standardized.

- Understanding the purpose of financial and managerial accounting helps businesses strengthen both decision-making and transparency.

What is Financial Accounting?

Financial accounting refers to the process of coming up with standardized and correct reports that reflect the financial status of a company. These reports contain the balance sheet, income statement, and cash flow statement which in turn assist in showing how the company has performed within a given period.

Financial accounting has the main purpose of availing reliable information to external users that include investors, regulators, and lenders. It should adhere to standard structures such as GAAP or IFRS to be consistent and credible between organizations and industries.

Purpose of financial accounting:

- Report the company’s financial results over a specific period

- Ensure compliance with legal and regulatory standards

- Establish transparency and build trust with stakeholders

Example:

A business that documents its annual report to either investors or government agencies is also indulging in financial accounting. Such reports are a historical document that is evidence of accountability and integrity.

Financial accounting plays a very important role in ensuring that a business remains in its proper perspective and financial stability. It makes sure that the numbers are put in a fair manner, where the outside audience can make informed decisions about the health of the company.

What is Managerial Accounting

Management accounting or managerial accounting has a much different audience. It is specifically made to be used in internal decision making, and it aims to aid managers and executives to plan, control, and evaluate business operations.

Managerial accounting is not required to follow the GAAP and IFRS unlike financial accounting. It is flexible in reporting and can be tailored to the individual needs and objectives of a company. The reports may be issued on a day-to-day, weekly, or monthly basis depending on the needs of the management.

Purpose of managerial accounting:

- Provide insights for operational planning and control

- Evaluate costs, budgets, and forecasts

- Support strategy by identifying profitability trends and performance gaps

Example:

When a manufacturing company is examining the costs associated with the process of production so that they know what products they are making that are the most profitable, it is applying managerial accounting. The acquired information assists the decision-makers to change processes, prices, and allocation of resources to achieve improved outcomes.

Managerial accounting focuses on actionable insights. It converts data into decisions and makes sure that the leaders are equipped with the right information at the right time to enhance productivity, cut costs, and improve profitability.

| Aspect | Financial Accounting | Managerial Accounting |

| Purpose | Focuses on presenting an accurate record of past financial performance and position. | Focuses on analyzing data to guide internal planning, control, and strategic decisions. |

| Users | Prepared for external stakeholders such as investors, regulators, and creditors. | Designed for internal stakeholders such as managers and executives. |

| Focus | Emphasizes historical results and compliance with accounting standards. | Emphasize future projections, budgeting, and performance optimization. |

| Regulation | Must follow GAAP or IFRS for uniformity and transparency. | No mandatory standards; reports are tailored to internal needs. |

| Reporting Frequency | Issued periodically; usually quarterly or annually. | Prepared as often as needed, from daily dashboards to monthly reviews. |

| Level of Detail | Provides summarized information for overall business performance. | Provides detailed data by department, product, or project level. |

| Time Orientation | Looks backward to evaluating what has already happened. | Looks forward to forecasting outcomes and guiding future actions. |

| Examples | Income statements, balance sheets, and cash flow statements. | Cost analyses, variance reports, and performance dashboards. |

Things to Consider

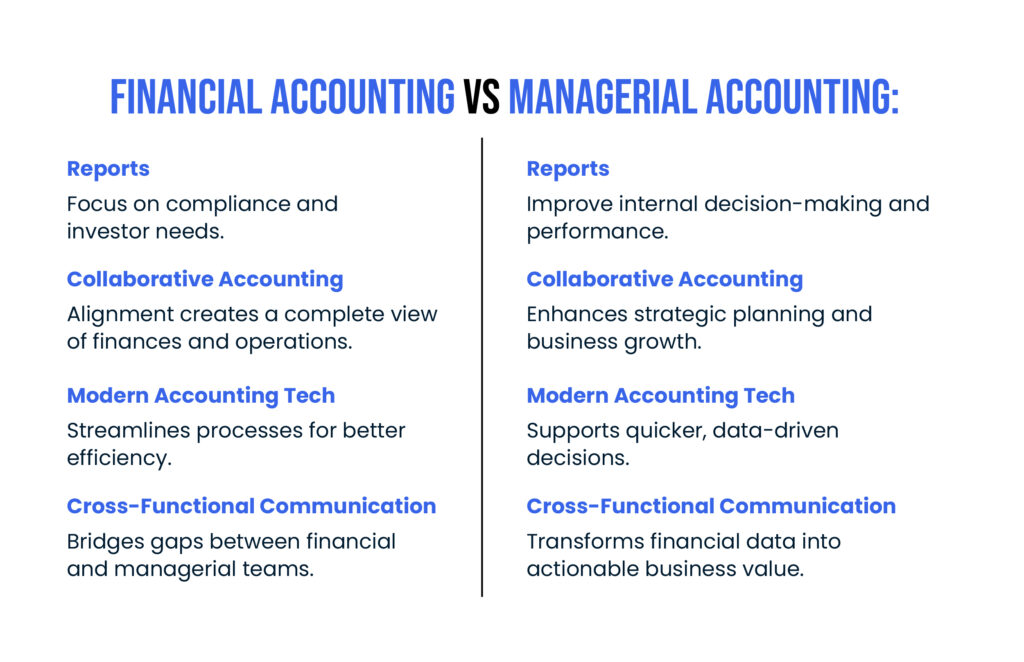

- Financial vs managerial accounting reports are necessary for effective governance. Financial reports satisfy regulatory and investor needs, while managerial reports help leadership improve performance

- The financial vs management accounting relationship should be collaborative. When both teams align, businesses gain a full picture of their financial reality and operational potential

- Investing in modern accounting technology allows companies to integrate both accounting functions, improving accuracy and efficiency. Tools that combine financial data with real-time operational insights empower managers to make quicker, data-driven decisions.

- Encourage cross-functional communication between financial accountants and managerial teams. This ensures the numbers not only meet compliance requirements but also drive real business value

As management experts often say, “What gets measured, gets managed.”

This statement captures the essence of managerial accounting. Measuring performance in a meaningful way allows businesses to control outcomes and achieve strategic goals.

How can Expertise Accelerated Help?

At Expertise Accelerated, we help businesses bridge the gap between financial accounting and managerial accounting. Our outsourced accounting and FP&A services combine compliance expertise with strategic insight to support growth and efficiency.

Our experienced professionals help business owners move beyond traditional reporting by turning financial data into actionable intelligence. From streamlining accounting systems to developing advanced budgeting and forecasting processes, Expertise Accelerated empowers leaders to make informed, confident, and forward-looking decisions.

With our support, companies can ensure that both their financial and managerial accounting work together to strengthen performance and profitability.

Conclusion

The importance of financial vs managerial accounting does not lie in the selection of one over the other but the combination of both accounting methods.

Financial accounting is used to uphold transparency and compliance, demonstrating the performance of a business. Managerial accounting helps to have an insight, and a vision of how the business can be better and developed. Once these two systems move in the right direction, they become the basis of effective decision-making and success in the long run.

Contemporary businesses require specificity and flexibility. Financial accounting develops credibility whereas managerial accounting develops strategy. They combined can help business leaders to sail through difficulties with a sense of confidence and clarity.

Finally, there is no rift between financial and managerial accounting, and their collaboration is a partnership. Those companies who see this balance have a competitive advantage and transform numbers into stories that propel performance and what success is.

Frequently Asked Questions:

What is the difference between financial accounting and managerial accounting?

Financial accounting reports on historic performance to external users whereas managerial accounting is instead geared towards making internal decisions and the future.

What is the significance of managerial accounting?

It assists the managers in managing the costs, budgeting, and making effective decisions that enhance efficiency and profitability.

Is financial accounting all that a business can depend on?

No. Financial accounting is required to make sure the requirements are met; however, managerial accounting is required to give a strategy, forecast, and growth.

What can Expertise Accelerated do tofacilitate both functions?

Yes, EA’s CPA-led accounting teams can facilitate both functions. Our accountants have deep US industry experience and help companies in financial and managerial accounting.