Messy books can cost you more than money, they can cost you peace of mind.

Imagine opening your email inbox and seeing thousands of unread messages. It would be hard to find what’s important, right? Bookkeeping works the same way if your books are messy, you can’t see your business finances.

That’s where bookkeeping cleanup services come in. It organizes records, fixes errors, and adds missing info. Clean books help with taxes, decisions, and loans. You can do it yourself (catch-up bookkeeping) or hire a professional.For example, a New York eCommerce startup increased sales by 50% in six months after using cleanup services because they could spot new opportunities and run operations better.

With the global ledger software market expected to reach USD 8.67 billion by 2026, it’s clear that accurate bookkeeping is more important than ever (Verified Market Reports).

Some Signs You Need Bookkeeping Cleanup

- Missing or unorganized receipts

- Bank and credit card statements not matched

- Mixing personal and business expenses

- Incomplete or wrong records

- Trouble making reports on time

- Tax planning problems

- Audit preparation issues

- Cash flow confusion

Let’s discuss what cleanup involves, its benefits, real examples, and how to prepare for a smooth process.

Key Takeaways:

- Ledger cleanup fixes errors, removes duplicates, and ensures compliance.

- Clean records support better decisions and investor trust.

- Preparing documents early makes cleanup faster and smoother.

- Bookkeeping Cleanup = fixes past mistakes & organizes messy records.

- Catch-up Bookkeeping = records missing or delayed transactions.

- Both are important for accurate financial reports.

- Consistency prevents errors and saves time.

Bookkeeping Cleanup vs. Catch-up Bookkeeping

So, what is Catch-up bookkeeping? It is the process of updating business records after falling behind. It helps bring books back on track, correct mistakes, and prepare for tax season. While catching up, businesses can see their real financial health, notice problems that need fixing, and find what’s slowing them down. Catch-up bookkeeping is helpful, especially for small businesses and start-ups.

| Bookkeeping Cleanup | Catch-up Bookkeeping | |

| Purpose | Fix errors, removes duplicates | Record missing transactions. |

| When | When records have mistakes | When books are incomplete |

| Goal | Accuracy and compliance | Complete records |

| Example | Fixing misclassified expenses | Entering 6 months of invoices. |

Things to Consider

- Keep receipts and invoices organized.

- Reconcile bank statements monthly.

- Use accounting software to reduce errors.

- Work with a professional if records are messy.

- Collect 12–24 months of financial documents before cleanup.

- Give your accountant access to your software.

- Note key events (launches, migrations, funding) to explain unusual transactions.

Note

Even small bookkeeping errors can grow into big financial problems. 82% of small businesses fail due to poor cash flow, often caused by messy records (U.S. Bank).

Bonus Point

Use automation for reconciliations and repeating entries to save time and avoid mistakes.

Disclaimer

This is general educational content. For business-specific advice, talk to a qualified accountant or financial advisor.

Understanding Ledger Cleanup Services

Ledger cleanup services fix and organize your messy financial records. This helps your books become accurate and reliable for tax season, audits, or planning. The process involves correcting errors, matching bank statements, and removing duplicate entries. A proper cleanup gives you a clear financial picture and a fresh start.

Key trends are shaping the future of GL systems. These are cloud-based access and immediate monitoring for quicker decisions. They also offer smooth integration with ERP and other systems, along with built-in security and compliance tools. Blockchain secures records, and ESG tracks impact with finances.

- 25% of businesses report falling behind on bookkeeping by six months or more (Score.org).

Why Financial Cleanup Services Is Important

Financial Cleanup services have many advantages. It enables you to make wiser decisions, ease taxes, and manage your finances. A clean ledger lets you trust reports and plans. Clean your books if records don’t match, receipts are missing, transactions are wrong, accounts aren’t balanced, or cash flow is off.

Companies fall behind on their money records for simple reasons. They might grow too fast, have new people in charge of the books, or switch to new computer programs. Many small businesses struggle with paperwork or tax time. A U.S. Bank study shows 82% fail from poor cash flow, often due to messy records. Cleanup services restore clarity and reduce risk.

Get ready for ledger cleanup by collecting 12–24 months of bank statements, invoices, payroll, and loan records. Give accountants access to your software and note product launches, system changes, or funding. This aids in spotting issues, saves time, and provides a smooth cleanup procedure.

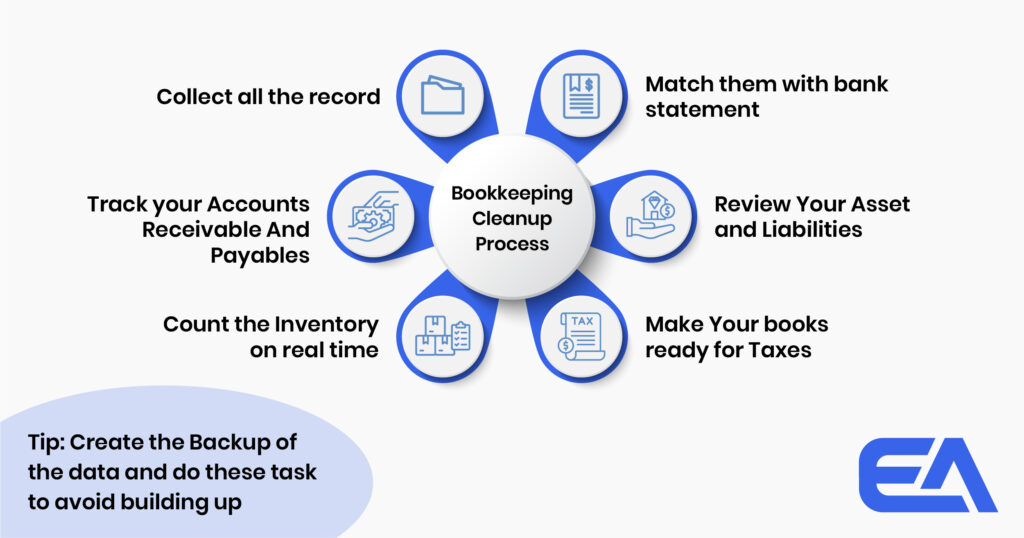

Bookkeeping Cleanup Process

- Start by collecting and checking records, bank statements, receipts, and invoices for errors.

- Next, match your records with bank statements and sort expenses into categories.

- Then, track who owes you money and who you owe, and pay bills on time.

- After that, review assets, credit card statements, and payroll.

- If needed, check and update your inventory if you sell products.

- Next, get ready for taxes by organizing all numbers.

- Then, always back up your data.

- Finally, do these tasks to avoid future problems from building up.

To keep your business money records (general ledger) organized, reconcile it every month to fix any errors. Use accounting software to make things easy. Keep your list of accounts simple with exact codes to prevent errors. Use audit trails to track changes, back up data, and follow GAAP or IFRS to keep reports valid and reliable.

- 60% of small business owners feel they don’t have adequate bookkeeping knowledge (Clutch, 2023).

Example of General Ledger Entries

To keep a record of your business money, first, you need a list of accounts (like Cash, Sales, etc.) with their own numbers. This is your “Chart of Accounts.” When you do business, you write it down in a book called a journal. Record each transaction twice: once for where the money comes from and once for where it goes. For example, selling $1,000 adds $1,000 to Accounts Receivable and Sales. Then post these to the General Ledger to track totals. This helps you keep a clear history of every single transaction.

Ledger cleanup services help businesses keep their financial records accurate. For example, a tech startup that switched to a new accounting platform discovered months of missing invoices. Cleanup services fixed accounts and removed duplicate entries to track sales and inventory. Cleanup support removed the duplicates and organized the data, giving them accurate financials. A nonprofit preparing for grants had misclassified donations and expenses, needing accurate records. Cleanup services fixed errors, gave clear financial statements, and boosted credibility with funders.

Bank Reconciliation for a Small Business

Bank reconciliation ensures your ledger matches the bank statement. For example, a store’s ledger shows $15,000, but the bank shows $14,500 due to uncleared checks, unrecorded fees, or pending deposits.

The bookkeeper updates the ledger to include the bank fee and accounts for timing differences in the check and deposit. After these adjustments, the ledger matches the bank’s adjusted balance. This process shows available funds, prevents errors, and ensures accurate records for better decisions.

Benefits of Ledger Cleanup Services

- Create trust in profit and loss statements, balance sheets, and cash flow reports.

- Provide tax compliance and lessen audit hazards.

- Support smarter business decisions with precise insights into income and costs.

- Boost investor and lender trust with transparent financials.

- Save time and reduce stress with year-round ready records.

Flowchart: Step-by-Step Cleanup Process

- Collect Documents → Gather receipts, invoices, bank statements, payroll, and loans.

- Review Transactions → Check entries for accuracy.

- Categorize Data → Sort income and expenses properly.

- Reconcile Accounts → Match books with bank statements.

- Fix Errors → Correct duplicates, missing entries, or misclassified data.

- Update Records → Enter clean data into software or spreadsheets.

- Generate Reports → Create updated balance sheets, P&L, and cash flow.

- Plan Regular Cleanup → Schedule monthly or quarterly cleanups.

Final Thoughts

Ledger cleanup services are more than “fixing the books.” Neat records reduce risk, sustain wise decisions, save time on taxes, and train you for audits or investors. A firm general ledger is important, so use audit trails, backups, and reconciliations to keep it specific. Clean books build a healthy, successful business.

At Expertise Accelerated, we make bookkeeping comfortable and easy. Our professional team ensures your ledger stays clean, precise, and ready for growth so you can concentrate on handling your business.

FAQs

How to prepare a general ledger?

To prepare a general ledger, first make a chart of accounts with sections for assets, liabilities, revenue, and expenses. Record all transactions from journals into their respective accounts. Finally, update balances after each entry to keep your ledger valid and organized.

How to enhance the general ledger process?

To enrich your general ledger, simplify data entry and use accounting software to address repetitive tasks. Negotiate your accounts to make sure all balances match and nothing is missing. Keep clear and organized records of every transaction, including amounts, dates, and details. This lessens mistakes and keeps your financial records proper for better business decisions.

What is a general ledger template?

A general ledger template is a ready-made spreadsheet or format for recording transactions. It mainly includes columns for date, account name, description, debit, credit, and balance. Using templates helps keep records consistent and make bookkeeping simpler and more organized.

How to make ledger accounts from journal entries?

To form ledger accounts from journal entries, specify the accounts involved in each transaction first. After that, publish the debits and credits from the journal into the individual ledger accounts. Eventually, revise the balances after each entry to track the financial position accurately.

When should you perform bookkeeping cleanup?

Perform bookkeeping cleanup to keep your records accurate. Many businesses do a small cleanup every quarter and a full review annually. Firms with high transaction volumes may need monthly reviews. Routine cleanup controls errors from stacking up and keeps the finances systematized.

What sets bookkeeping cleanup apart from catch-up bookkeeping?

Bookkeeping cleanup concentrates on fixing errors, clearing duplicates, and handling unorganized records. Catch-up bookkeeping is about entering missing transactions that were never recorded. Both help make your books valid, but cleanup rectifies mistakes, while catch-up adds lost data.