Handling business money can be a tricky ordeal. Many business owners ask, “Do I need a bookkeeper or a CPA?” Making the wrong choice can lead to errors, lost tax savings, or legal issues.

Bookkeepers vs. CPAs, what’s the difference? is quite a common question in the business landscape.

But let us first be clear on who is a bookkeeper and a CPA?

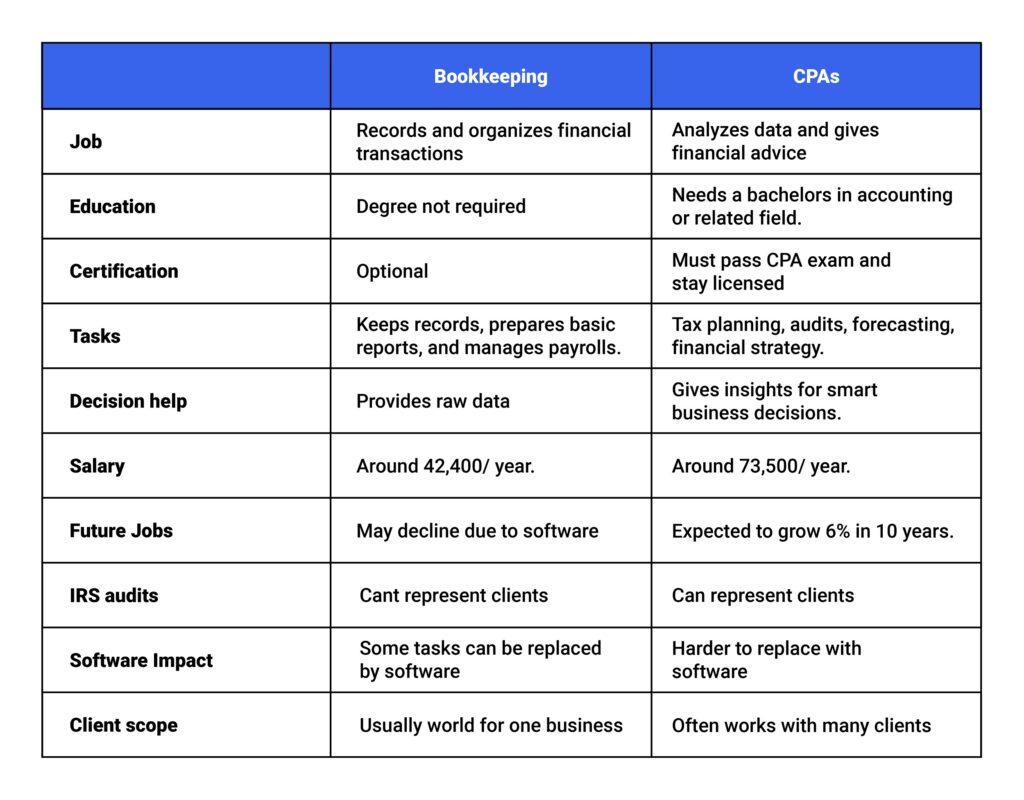

A bookkeeper keeps a check of a business’s cash, like recording expenditures, sales, and payroll. They ensure all the financial records are accurate. While a CPA (Certified Public Accountant) does more than that. They review the records, do taxes, give advice, and aid in planning for the business’s future.

Bookkeepers and Certified Public Accountants (CPAs) are essential professionals in the business landscape. Any experienced entrepreneur knows a good bookkeeper and CPA can boost a business’s finances. Their skills, training, and roles are very different.

But, one must remember that a bookkeeper is not a CPA and vice versa. While both work with financial records, there are myriad differences between the two. There are differences in levels of education, professional qualifications, expertise, and responsibilities.

EMSI says bookkeepers earn about $42,400 a year, and accountants earn about $73,500 around 73% more. Accountants earn more because they have more training and bigger roles.

In the next 10 years, accountant jobs may grow by 6%, but bookkeeping jobs may drop by 2% as software takes over many tasks. Still, accountants give advice and insights that software can’t.

Are you wondering which financial professional is right for your business- a bookkeeper or a CPA? This blog explains the key differences so you can choose the right fit for your business.. Let’s explore the differences and find the perfect fit for your unique needs.

“A good bookkeeper doesn’t write numbers, they tell your business’s money story.”

Jane Smith, Financial Consultant and Business Coach

Key takeaways:

- Bookkeepers manage day-to-day records; CPAs handle strategy, analysis, and compliance.

- CPAs need more education, licensing, and training than bookkeepers.

- Bookkeepers earn about $42,400/year; CPAs earn about $73,500/year roughly 73% more.

- CPA jobs will grow by 6%, while bookkeeping jobs will drop by 2% as software automates routine tasks.

Things To Consider–

Bookkeeper = daily records –

CPA = planning and advice – Only CPAs, lawyers, and enrolled agents can deal with IRS

Note Both work well together.

Bonus Point Software can help bookkeepers, but not replace CPAs.

Disclaimer For general info only. Ask a pro for advice.

Professional Responsibilities of Bookkeepers

Accurate Maintenance of Financial Records

A bookkeeper’s main job is to “keep” the books, maintaining all financial records. Recording financial transactions and reconciling bank statements fall under a bookkeeper’s responsibilities.

Bookkeepers focus on collecting, organizing, and keeping financial data. Every business needs a bookkeeper to keep financial records accurate and organized.

“Bookkeeping records what a business does,” said D’Arcy Becker. “Accounting makes that record useful.”

Preparation of Financial Statements

According to the Expertise Accelerated publication titled “The Guide to the Four Basic Financial Statements,, Financial statements are a record of a business’s finances over a period of time. Financial statements contain essential financial information such as details of assets, liabilities, income, expenses, etc. Financial statements are formal records showing a business’s financial health and performance.

The keyword to note is “record”. A bookkeeper’s main job is to record financial data and prepare financial statements. Bookkeepers can create financial statements but can’t give analysis or opinions on them. A bookkeeper’s job ends after creating and maintaining records. Not all bookkeepers can create financial statements. Creating financial statements is challenging and needs skill and experience.

Payroll Management

Bookkeepers play a crucial role in managing payroll for a business or organization. They pay all employees on time. This includes tasks such as calculating and withholding taxes, deductions, and other deductions from employee paychecks, preparing and issuing paychecks or direct deposits, and maintaining records of all payroll transactions.

Bookkeepers can’t do tasks that need an accountant by law. Only CPAs, lawyers, or enrolled agents can handle IRS audits or paid tax prep in most states.

Real World Scenarios

A small shop might have a bookkeeper tracking sales and costs, while a CPA files taxes and gives money tips. In a startup, the bookkeeper handles bills and invoices, and the CPA helps with budgets and growth plans. For a freelancer, the bookkeeper organizes payments, and the CPA suggests ways to save on taxes.

Professional Responsibilities of CPAs

Tax Planning

One of the main duties of a CPA is preparing for tax season. Taxation is tedious and involves complex laws, which a CPA knows well. They can handle the business’s taxes, make sure it follows tax rules, calculate taxes, and help reduce tax bills. CPAs help entrepreneurs plan ahead and give advice all year to save more on taxes.

Financial Forecasting

CPAs play a vital role in financial forecasting for businesses and organizations. Bookkeepers create financial statements, while CPAs turn the data into useful business insights. Financial forecasting predicts a business’s future finances using past data and trends. CPAs use financial data to forecast a business’s performance. This includes creating budgets, projections, and cash flow forecasts.

Audit Planning

CPAs plan and conduct financial audits for a business. In a nutshell, an audit is an official inspection of a business’s operations, processes, or financial records. There are two types of audits, internal and external. EA publication titled “Internal Audit vs. External Audit: What’s the Difference?” provides an in-depth explanation of auditing for any curious entrepreneur.

CPAs conduct audits and have the license to do so. Bookkeepers can prepare data, but only CPAs handle audits.

Accountants may do some bookkeeping, but bookkeepers don’t usually do accounting work.

Financial Advisory

CPAs identify financial risks and opportunities and advise businesses on managing them. They help businesses create financial strategies that match their goals. CPAs provide insights to help entrepreneurs make smart decisions and plan ahead.

Qualifications for Bookkeepers vs CPAs

Bookkeepers don’t need a license or degree, though they may have one in accounting or a related field. But, bookkeepers may choose to pursue certifications such as the National Association of Certified Public Bookkeepers (NACPB) certification or the American Institute of Professional Bookkeepers (AIPB) certification to prove their knowledge and skills.

CPAs get licensed by earning a degree, passing the exam, meeting experience rules, and staying updated.

Both help manage money — always check their skills and certifications before hiring.

Career Paths for Bookkeepers vs CPAs

The career paths for bookkeepers and CPAs also differ. Bookkeepers work for a company, while CPAs often work alone or in accounting firms. Bookkeepers usually handle one client, while CPAs can manage many clients.

Additionally, the opportunities for advancement for bookkeepers and CPAs are different. Bookkeepers can advance to management roles, but companies limit their growth opportunities. CPAs, however, have many opportunities for advancement, such as becoming a partner in an accounting firm or a CFO of a company.

CPAs earn about 73% more than bookkeepers.

CPAs usually earn higher salaries than bookkeepers. According to the Bureau of Labor Statistics, the median annual salary for bookkeepers in 2021 was $45,560 per year, while the median annual salary for CPAs was $77,250.

Differences between Bookkeeping vs CPAs

6. FAQs (Common Misunderstandings)

- Can a bookkeeper do everything a CPA can?

A bookkeeper cannot do everything a CPA can. Bookkeepers check and manage daily financial transactions, keep records correct, and handle invoices and payroll. They make sure the numbers are valid, but don’t give proficient advice. While the CPAs use these records to handle audits, prepare taxes, create financial strategies, and guide businesses for growth.

- Who is best for tax season?

A CPA is the best option for tax season. They understand tax laws very well and can find deductions and ways to save money. They ensure your business obeys all the laws and can control even complex tax forms. With their assistance, you can control costly blunders and save more on your taxes.

- Do bookkeepers need a degree?

No, bookkeepers do not need a degree. Many bookkeepers are trained and experienced without a formal degree because their major function is to keep financial records correct and managed.

CPAs, yet, require a degree in accounting or a corresponding field. They also have to pass the CPA exam and keep their license through ongoing education. This ensures they have the expertise to manage complex financial tasks.

- Why do CPAs earn more?

CPAs earn more as they have extra training and take on major duties. While bookkeepers record and manage financial transactions, CPAs examine the data, give financial advice, plan taxes, and perform audits. They also aid businesses in making significant financial decisions. CPAs earn more because their education, expertise, and licensing let them handle complex tasks.

- Do bookkeepers and CPAs work jointly?

Yes, bookkeepers and CPAs do work together. Bookkeepers keep a check on all the financial details and make sure the records are right. CPAs leverage this data to give advice, prepare taxes, check for mistakes through audits, and aid in planning for the business’s future. Jointly, they ensure the business’s finances are valid and assist owners in making wise financial decisions.

Conclusion

In short, bookkeepers and CPAs both help with finances, but they have different jobs and skills. Bookkeepers are responsible for maintaining records of financial transactions and handling administrative tasks. CPAs analyze and interpret financial information and give advice to their clients.

Expertise Accelerated, The One-Stop-Shop for Your Accounting Needs

Whether it be bookkeepers or CPAs, one universal fact is that such professional services do not come cheap. For many small businesses, the services of such professionals are hardly worth the price tag, and so they must operate without financial experts on the team. This can be a massive hindrance to small businesses, stunting growth and hurting revenue.

Luckily, Expertise Accelerated’s unique outsourced bookkeeping services provide entrepreneurs with some much-needed reprieve. EA prides itself on building bridges between US entrepreneurs and offshore accounting professionals.

EA’s staff augmentation gives entrepreneurs top accountants at a fraction of US costs. Vetted by US accounting veteran Mr. Haroon Jafree (CPA), EA gives small businesses low-cost remote accounting. Whether it be a bookkeeper or accountant, EA is your one-stop shop for cost-efficient accounting solutions.