FREQUENTLY ASKED QUESTIONS

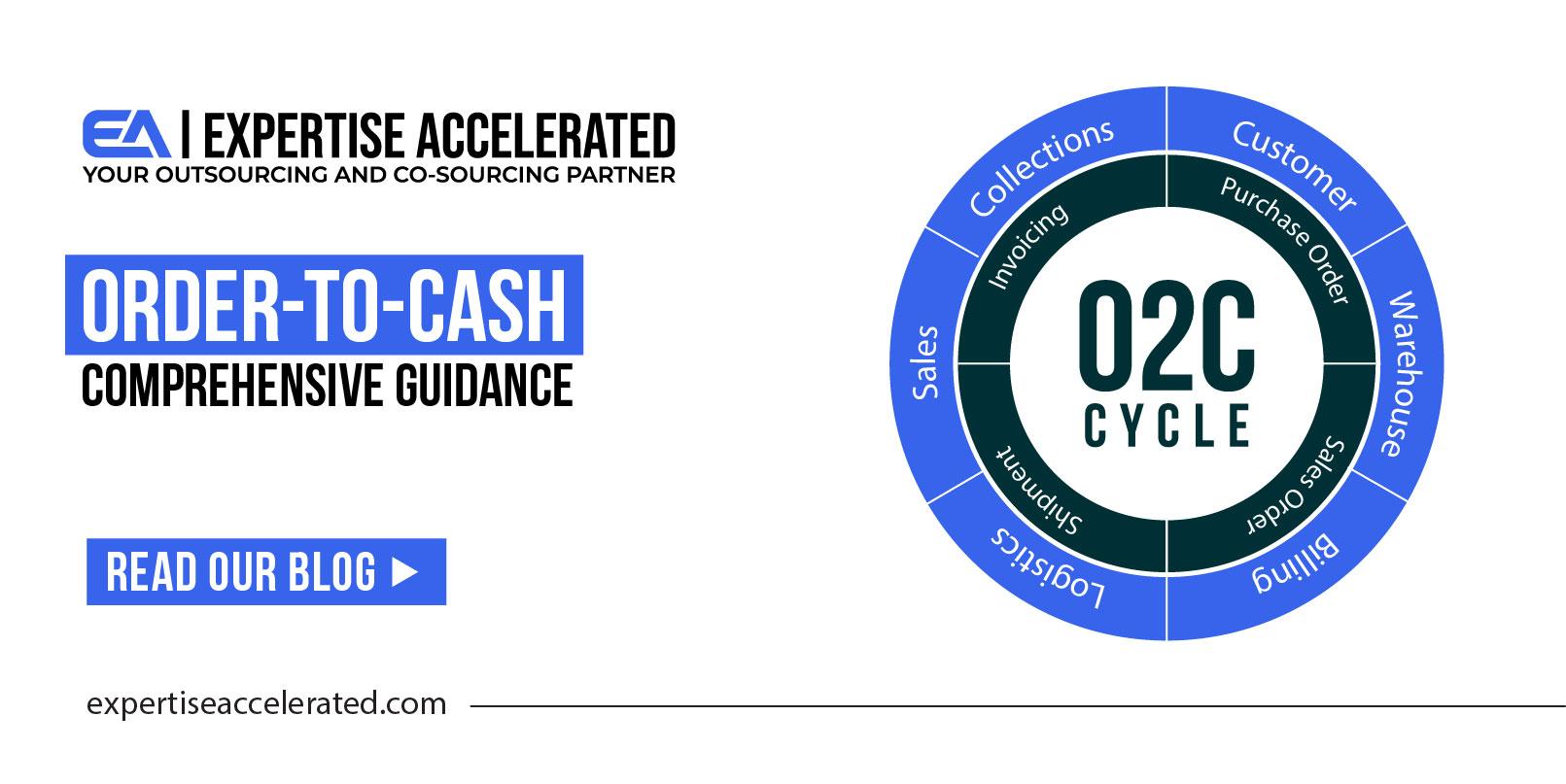

Accounts receivable services ensure that the company gets paid on time with the least possible risk. This will involve implementing a set of standard procedures, such as the dunning process, and sending regular reminders.

Outsourced AR services give you a team of trained workers who take care of collecting payments, sending bills, recording payments, handling problems, and making reports. They are usually a much cheaper expense than an in-house accounting team.

Yes, accounts receivable services are suitable for small businesses, especially as they grow.

Companies in the food sector often struggle with:

- delayed or incomplete invoice entry,

- stranded deduction balances,

- delayed follow-ups and recoveries,

- delayed cash application,

- weak reporting,

- inaccurate customer statements,

- limited access to customer portals,

- outstanding issue tracking, and duplicate invoices.

We create backward- and forward-looking visibility reports, showing balances due within two weeks and beyond, issued weekly, to provide clear insights.