FREQUENTLY ASKED QUESTIONS

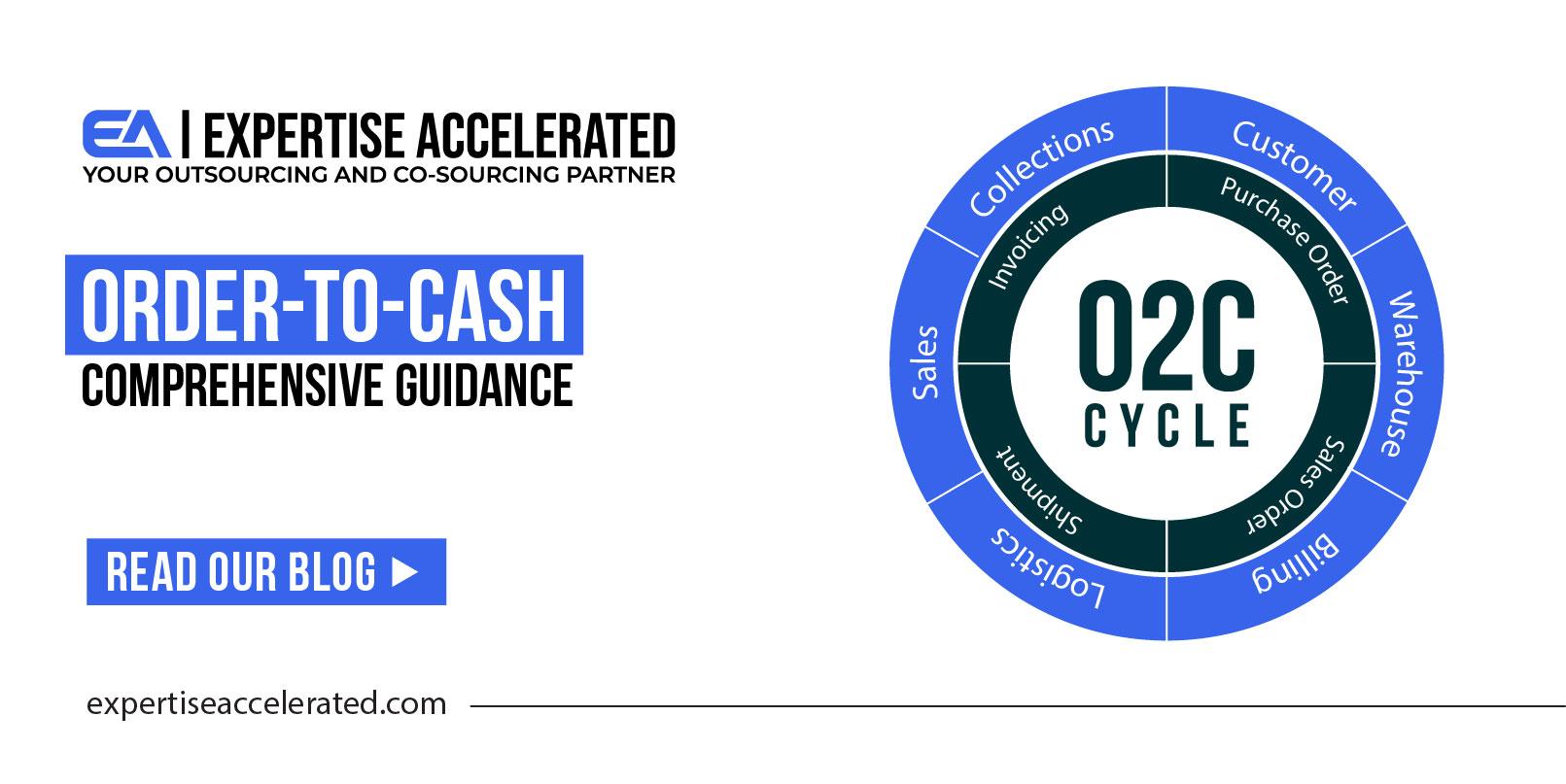

Accounts receivable services ensure that the company gets paid on time with the least possible risk. This will involve implementing a set of standard procedures, such as the dunning process, and sending regular reminders.

AR services help ensure that the company receives timely, predictable cash flows.

Outsourced AR services give you a team of trained workers who take care of collecting payments, sending bills, recording payments, handling problems, and making reports. They are usually a much cheaper expense than an in-house accounting team.

Our team works extensively with QuickBooks Online, QuickBooks Desktop, and Xero.

We also integrate data from EDI systems, distributor portals, POS reports, and manual order processing workflows.

Yes, accounts receivable services are suitable for small businesses, especially as they grow.

When a business is just starting out, it’s common to create invoices in Excel and send them manually. But once revenue grows, often around the $1M annual sales mark, manual processes can slow things down and lead to missed follow-ups or cash delays.

AR services help growing businesses put standard procedures in place, accelerate collections, apply best practices, and maintain healthier cash flow without adding internal overhead.

Companies in the food sector often struggle with:

- delayed or incomplete invoice entry,

- stranded deduction balances,

- delayed follow-ups and recoveries,

- delayed cash application,

- weak reporting,

- inaccurate customer statements,

- limited access to customer portals,

- outstanding issue tracking, and duplicate invoices.

We create backward- and forward-looking visibility reports, showing balances due within two weeks and beyond, issued weekly, to provide clear insights.

Most clients reduce their accounting costs and save up to 60% compared to hiring a U.S.-based accountant, or more, while gaining access to deeper U.S. industry expertise. With EA, you get both affordable accounting and a stronger skill set.