Growing companies with multiple stores often spend (waste) hours stuck in spreadsheets. The teams are chasing inventory numbers and sales data instead of making decisions that drive growth. Picture an 11-tab spreadsheet, that’s where most of the time goes. Managing multiple stores with manual processes can be a roadblock for growing companies. Here’s where, NSPB (NetSuite Planning & Budgeting) makes a difference. It helps teams stay on top of inventory and plan for growth.

How NSPB Transforms FP&A

Implementing NetSuite Planning & Budgeting software can massively improve real-time financial analysis and financial forecasting of a firm. Finance leaders, like CFOs, can have confidence in the budgeting data and trust the information they use for forecasts.

Unified Financial Planning

NSPB brings all your budgeting, forecasting, and reporting together in one place. So that there is no more spreadsheet chaos. What this means is that teams, from finance to operations, can actually work together instead of stepping on each other’s toes. Departments no longer work in silos. Budget owners, finance teams, and executives can collaborate in one platform with clear workflows and audit trails.

Efficient Budget Version Control

Teams capture different budget versions or forecast, compare them, and use these versions to monitor performance, make decisions, and ensure alignment among stakeholders.

When using tools like Microsoft Excel, teams often share different versions of a budget, which increases the risk of errors and adds complexity. With NSPB, firms can ensure data integrity and efficient budget version control as all information is stored in a central database.

Finance teams don’t have to spend a lot of time validating data or ensuring that everyone is working from the correct version. Everyone can see the live version. There’s one single source of truth that evolves over time and the added transparency means that every team member is on the same page.

Real-Time Data and Scenario Modeling

Real-time data lets teams see exactly how their plans are unfolding and adjust on the fly

With NSPB static budgets turn into breathing plans. For instance, seasonal transitions result in changes in the product demand. Companies often struggle during these transitions with inventory replenishment. Using NSPB, they can change weeks of supply as a response to changing demand and make continuous changes around seasonal curves across every SKU, channel, and store. Moreover, companies can compare their data against top-line sales data to ensure forecasts and budgets align with what’s really happening in the business.

NSPB’s interactive dashboards and scenario tools show how performance changes when assumptions shift. For example, if demand drops 5%, how does that impact gross margin or inventory levels?

Native NetSuite Integration

Since NSPB connects seamlessly with NetSuite ERP, the planning data always reflects actuals in real time, no manual uploads or reconciliations needed.

Automation and Efficiency

Automation is now a key driver for faster financial insights, no surprises there. With NSPB, manual data entry and reconciliation are replaced by automated data flows and rolling forecasts. For example, imagine a mid-sized e-commerce company. It is expanding internationally and is struggling with complex financial data.

NSPB implementation will automate its financial planning. The Finance teams can use it for its multi-currency support to consolidate data and employ scenario modeling to test growth strategies. The e-commerce company will benefit from more accurate budgets, and reduced consolidation time.

Intelligent Performance Modeling Capability (IPM)

IPM is one of the exciting additions in the NSPB. It uses AI to spot trends, highlight risks, and compare projections with system-generated predictions, helping teams plan confidently

What our team likes about IPM is its ability to compare a team’s projections with system-generated predictions. We can have a clearer picture of what’s really happening, enabling us to plan more confidently. For example, insights AI will anticipate $2.5 million sales for a period in contrast to the forecast of $3million sales for that period.

NetSuite Planning & Budgeting Implementation

NetSuite Planning & Budgeting is a powerful tool, hands down. However, there are certain aspects companies must consider before implementing it such as:

Is NSPB the right tool for your business?

NSPB may not be the ideal solution for every organization. For example, if you run a small business with only one person managing the budget, implementing NSPB might not provide much value. However, it is not a bad idea to start small. Since NSPB has a learning curve, its best to begin with a simple setup and gradually expand its use as your needs grow.

NSPB is more suitable for mid-large size growing businesses that use NetSuite ERP and wants to improve their financial planning accuracy and efficiency. It is a great tool for collaborative planning. Built for teams ready to move beyond the hassle of spreadsheet-based planning, this solution delivers greater visibility and control across the business. Companies with multiple budget owners, stores, and SKUs can take advantage of the advanced capabilities like scenario modeling, rolling forecasts, and reporting as described above.

What are some of the important things to consider before implementing NSPB?

The following are some of the things to consider before implementing NSPB:

Complexity:

NetSuite Planning and Budgeting is a powerful and integrated tool that can benefit organizations that use NetSuite ERP. However, potential users should be prepared that the implementation will be a complex process. Teams, especially the ones without prior experience, may find the configuration and customization of the tool complicated.

Bonus tip: Make sure your NetSuite setup is right before trying to get it to sync smoothly with NSPB.

Implementation dependency:

The success of the software depends heavily on having an experienced implementation partner and an accounting team. The accounting team that collaborates closely with the consultant ensures that the right data is pulled into NSPB. This is important because your planning tool Is only as good as the data behind it.

Before implementing NSPB, companies must ensure their internal finance team understands the basics of how budgeting works in their core system (like NetSuite ERP), not just in the planning tool itself. It is common for a lot of teams to jump straight into configuring NSPB without ever setting up budgets in the system it connects to, which makes the whole process frustrating and confusing.

NSPB isn’t a plug-and-play solution. It relies on clean, structured data and a team that knows how financials flow between systems. Hence, before starting to implement it the accounting teams understand must:

- where the data comes from,

- how budgets are structured, and

- how that ties into the overall planning process.

This groundwork makes a huge difference in building models in NSPB. EA’s offshore accountants have experience collaborating with external consultants and onshore US finance teams to ensure successful NSPB implementations. Our teams have hands-on experience supporting every stage of the process, from data preparation to post-implementation support.

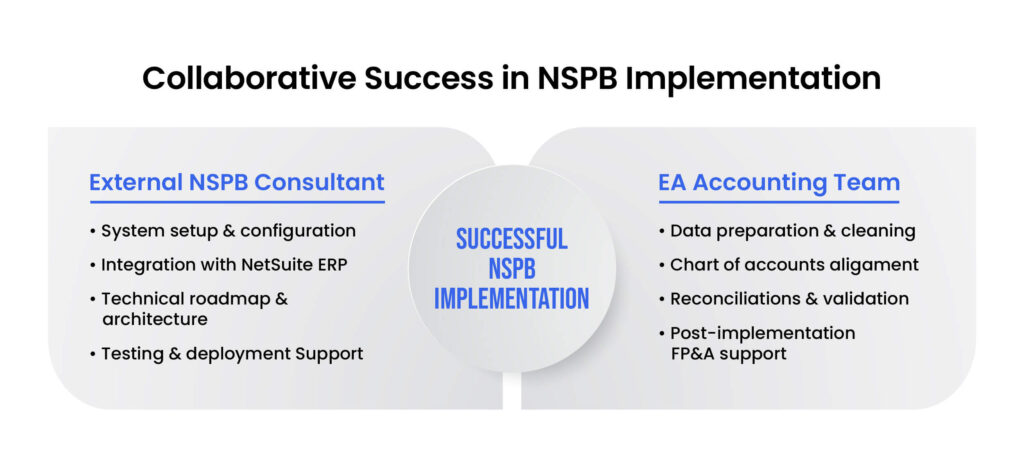

The Role of External Consultants and Accounting Partners

Most US businesses bring in a certified NetSuite implementation consultant to handle the technical side, system setup, configuration, and integration.

Most US businesses bring in a certified NetSuite implementation consultant to handle the technical side, system setup, configuration, and integration.

But that’s only half the equation. Once the consultant outlines the implementation roadmap, there’s a phase where accounting and administrative tasks must be complete to support the project. That’s where your outsourced accounting team steps in.

Your Accounting Partner’s Role:

- Preparing and cleaning financial data for system migration

- Ensuring the chart of accounts aligns with NSPB requirements

- Reconciling balances and reviewing historical financials

- Managing administrative and transactional tasks requested by the consultant

- Supporting ongoing FP&A operations post-implementation

Expertise Accelerated’s team have experience working alongside their client’s NetSuite functional consultants on key areas such as master data, testing, training, and change management. This collaboration ensures that when our client’s NSPB goes live, the financial foundation is accurate, compliant, and ready to perform.

Taking the Next Step: Implementing NSPB Successfully

As discussed above, implementing NetSuite Planning & Budgeting (NSPB) is more than a software rollout. It’s a big change of how finance teams plan, forecast, and collaborate.

To ensure a smooth transition and teams achieve the most value maximize the platform’s value, businesses should focus on four key implementation pillars:

Master Data Alignment

Every successful FP&A system starts with accurate, consistent master data. Before going live, companies should align their chart of accounts, departments, entities, and project codes between NetSuite ERP and NSPB.

Clean data ensures forecasts are reliable and avoids reconciliation headaches down the road.

Comprehensive Testing

Every model, assumption, and integration should be validated through unit testing and user acceptance testing (UAT) to confirm that calculations, dashboards, and workflows perform as expected.

User Training & Adoption

Even the most powerful FP&A tools are only as effective as their users. Investing in training sessions will help finance and business users become confident with dashboards, forecasting templates, and reporting tools.

Change Management

Transitioning from spreadsheets to an automated planning system involves a mindset shift. The change management must communicate the “why” behind NSPB, engaging key stakeholders early, and designating internal champions to lead by example. This ensures the new system is embraced across the organization, not resisted.

Key Takeaways

NSPB is helping US businesses improve their FP&A massively. Real-time access to data helps finance teams to stay aligned and make confident decisions that may even accelerate their growth. However, implementing NSPB is not an easy process. There are some things to consider before companies choose to implement the software. Successful implementation often requires collaboration of the external consultant with the accounting teams.

EA’s offshore accountants have experience supporting clients through the implementation journey. They ensure that accurate financial records are pulled into the system. This foundation of accurate data is important because your forecasts are only as good as the data they are built upon.