Managing vendor payments is vital but can cause cash flow and supplier issues. That’s where effective accounts payable (AP) management makes a difference. AP management means building a reliable system to pay bills accurately and follow rules.

Studies show 88% of manual AP documents have errors like wrong numbers or dates.

AP plays a vital role in maintaining a company’s finances. Good AP helps cash flow, vendor trust, and follows rules. Without it, businesses lose money and trust. Using technology is key as businesses grow.

This blog will explain the benefits of good AP management, how to install it and accounts payable solutions and problems..

What Is Accounts Payable Management?

Accounts payable management is how a business manages money owed to suppliers. It includes everything from tracking invoices to making payments on time. This process ensures accurate, on-time payments and helps with organization and planning.

Automating accounts payable helps businesses in three main ways. It improves money management by controlling payments and helping plan finances. Second, it reduces risks by catching mistakes, preventing fraud, and making audits easier. Smart systems can find problems early and alert the team. Automation supports growth by saving time and handling more work as the company expands.

According to Forbes, New AP software can boost your business but may be hard to link with existing systems. With careful planning and good training, you can make the change smoothly. For example, moving data needs care to avoid errors, and new software must fit with your current tools. Employees may struggle at first, which is normal, but training tailored to their roles helps. Open communication and involving the team early make the process easier and faster. After switching, check the software and collect feedback to improve it. Focus on planning, technology, and people to smoothly add new AP software and improve efficiency.

Key Parts of AP Management

Processing invoices means checking vendor bills. Tools like OCR scan them fast and cut errors. Keep vendor info updated to avoid problems and maintain good relationships.

After approval, pay on time by check, bank transfer, or ACH. Save all payment info in the accounting system for easy tracking and audits. Regular talks with vendors build trust and prevent problems. Tracking bills and using controls stops fraud and improves cash flow.

Payments should match your budget to avoid overspending. When your business grows, automation makes handling more payments easier and less stressful. New AP tools also connect with ERP systems, linking payments with buying and finance. These tools give useful reports to help you make better decisions.

How to Manage Accounts Payable

Managing AP well keeps your money in order, helps build good supplier relationships, and makes work easier. Here are eight simple tips for better AP management:

Use automation to speed up work, cut errors, and stay secure. Set clear rules for invoices and stay in touch with suppliers to avoid delays and get better deals. Check invoices, orders, and payments often to catch errors and keep records right. Plan payments to get discounts and avoid late fees. Keep good records using digital tools to make audits easier and know where your money goes. Track invoice speed and payment times to improve your system. Finally, give your team the right training and tools so they can do their jobs well and keep up with best practices.

Benefits of Accounts Payable Management

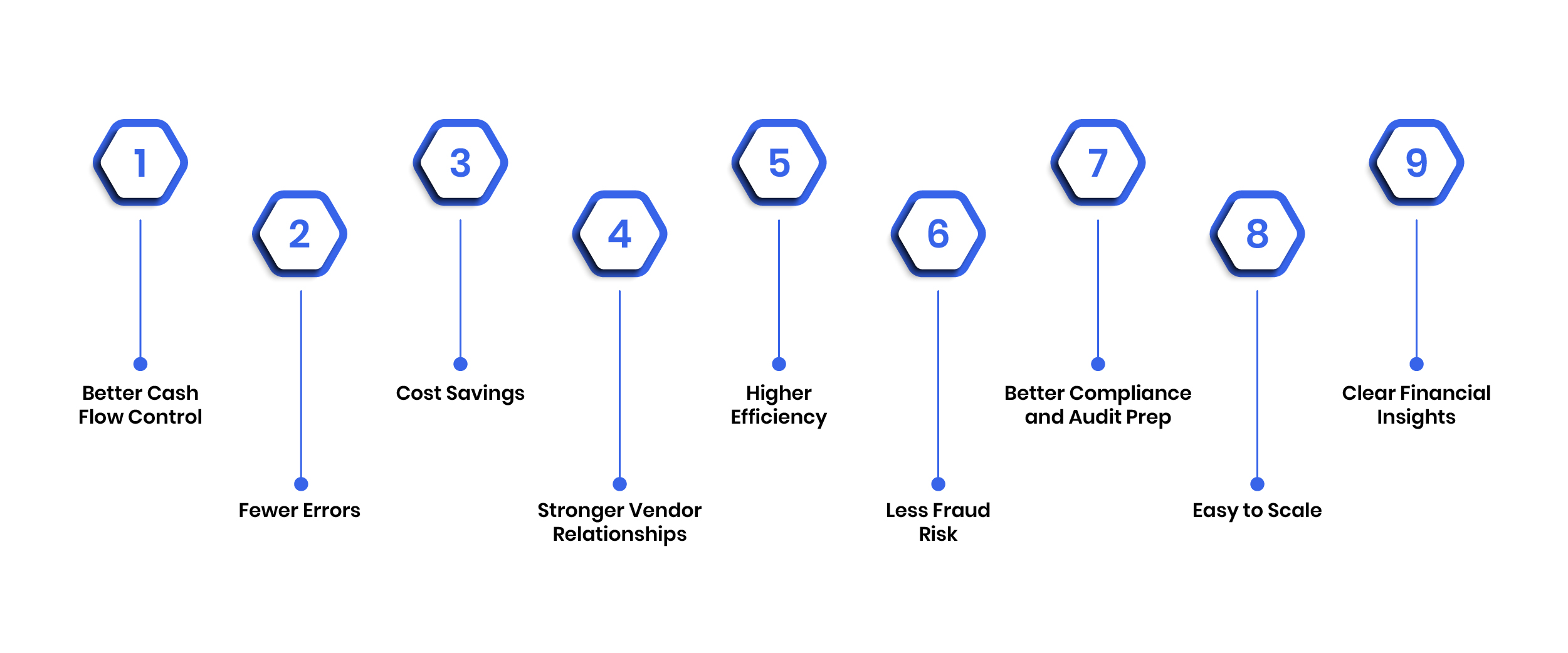

Good AP management brings many benefits:

- Better Cash Flow Control. It helps you manage when and how money goes out, so you avoid surprises and plan.

- Fewer Errors Automated systems reduce mistakes like double payments or wrong amounts.

- Cost Savings: You can save by getting early payment discounts and avoiding late fees. Automation also reduces labor costs.

- Stronger Vendor Relationships Pay vendors on time to build trust and get better terms.

- Higher Efficiency Automation frees staff to focus on key tasks, not paperwork.

- Less Fraud Risk Smart systems help catch suspicious activity before it becomes a problem.

- Better Compliance and Audit Prep Automation helps follow rules and makes audits easier.

- Easy to Scale Efficient AP systems can handle growth without needing to add lots of new staff.

- Clear Financial Insights: Real-time data helps you decide and plan better.

Common Mistakes in Accounts Payable

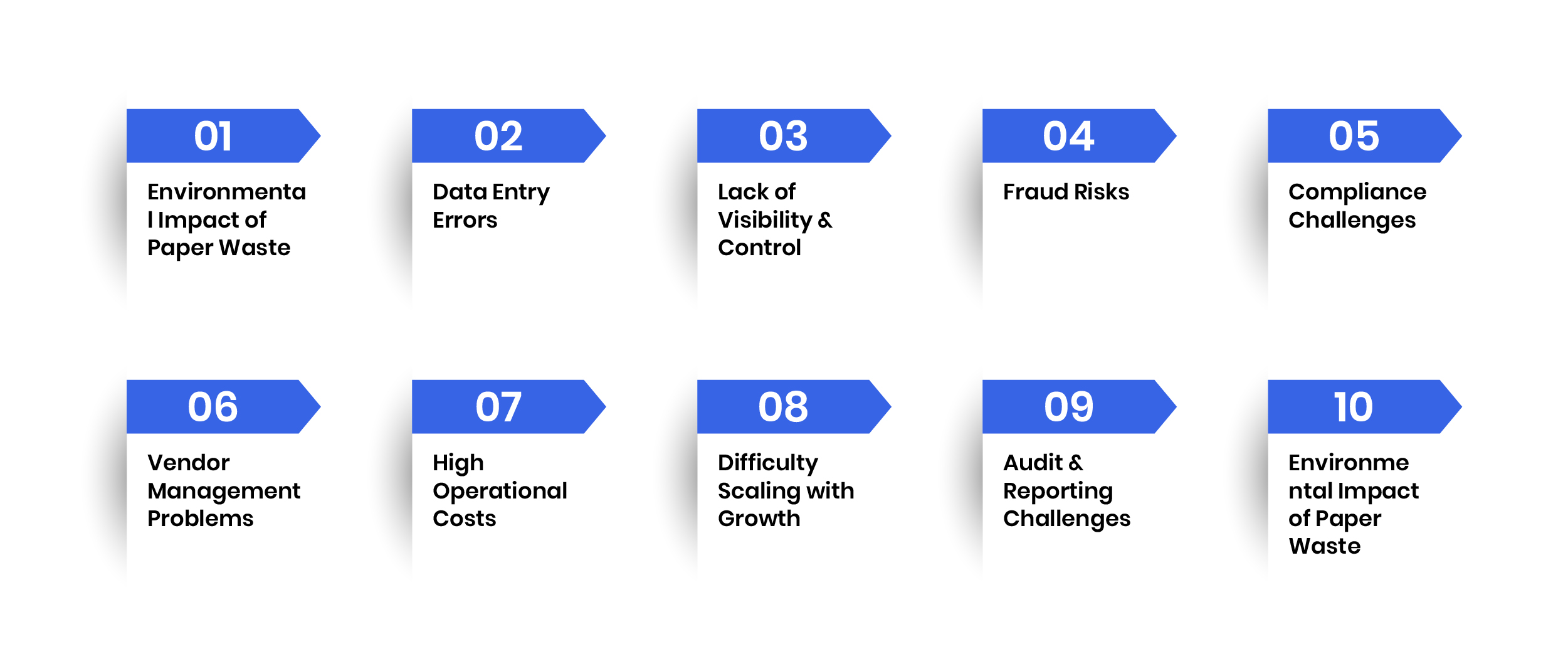

1. Invoice Processing Delays

Problem: Manual invoice handling is slow and error-prone. It can cause lost invoices, late payments, missed discounts, and unhappy vendors.

Solution: Automation uses AI and OCR to fast process invoices and track approvals. This speeds up processing and reduces mistakes.

2. Data Entry Errors

Problem: Manual entry leads to typos and mistakes, causing wrong payments or disputes. Solution: Automated systems check invoice data against orders for accuracy and smarter decisions.

3. Lack of Visibility & Control

Problem: Without clear tracking, it’s hard to know what’s paid or owed, making budget planning difficult.

Solution: Digital platforms give real-time updates to track invoices and payments for better control.

4. Fraud Risks

Problem: Fake invoices or unauthorized payments can slip through unnoticed in manual systems.

Solution: Automation boosts security with access controls, AI fraud checks, and instant alerts.

5. Compliance Challenges

Problem: Keeping up with tax laws and regulations is hard; mistakes can lead to fines. Solution: Automation adds rules, updates taxes, and blocks non-compliant steps.

6. Vendor Management Problems

Problem: Managing many vendors is hard; missing info or old contracts can cause issues.

Solution: Automation manages vendor info, alerts contract deadlines,and lets vendors send invoices online, and cuts admin work.

7. High Operational Costs

Problem: Manual AP processes need large teams and lots of time, increasing costs. Solution: Automation handles repetitive tasks, reducing staff workload and improving productivity.

8. Difficulty Scaling with Growth

Problem: Growing businesses struggle with outdated AP systems and costly staff increases. Solution: Cloud-based automation scales easily and saves costs as your business grows.

9. Audit & Reporting Challenges

Problem: Preparing audits and reports with manual methods is slow and error-prone. Solution: Automated platforms store data in one place with reports and audit trails for fast, accurate processing.

10. Environmental Impact of Paper Waste

Problem: Paper-based AP processes waste resources and harm the environment.

Solution: Digital AP systems cut paper use by managing everything online, helping the environment.

Example of Better AP Management

A property management company started growing fast and doubled the number of rental homes it managed. The CFO was retiring, so the company needed a smooth update to its processes. The new CFO worked with the CIO to bring in modern tools that could replace slow, manual tasks. They added automation to handle invoices, speed up approvals, and keep track of everything. After one year, the company had automated vendor tasks, payments, and other finance jobs. This saved a lot of money, made work easier, and helped employees, vendors, and customers feel happier and more supported.

How Expertise Accelerated Can Help

Expertise Accelerated helps make managing your accounts payable easier and faster. If you have problems like slow invoice approvals, manual data entry, or late payments, their tools can help. They use technology to process invoices and match them with sales orders, cutting down on paperwork and mistakes. Their services help you plan payments better to avoid late fees and get early payment discounts. Paying vendors on time builds trust and better deals. They also protect your business from fraud with automated checks and audits. You can easily see your payments and expenses with simple reports and dashboards. With Expertise Accelerated, your accounts payable will be quicker, more accurate, and ready to grow with your business.

Conclusion

Today’s accounts payable processes are often slow, risky, and outdated. Manual systems struggle to meet modern business needs. Automated AP boosts compliance, cuts fraud, improves vendor ties, frees cash, and supports growth.

Effective accounts payable is more than paying bills; it’s about building strong partnerships with vendors. Treating suppliers well leads to better deals and smoother operations. Simple is that

Expertise Accelerated provides the guidance and tools to help businesses make this change. Their AP automation eases work and strengthens finances.Outsource your accounts payable services to us for faster, easier, and accurate payments.