An accounts payable team has two key duties: handling cash flow and building suppliers’ trust. This is tough, especially with outdated methods like paper records and checks.

Moving to digital processes and using AP automation can make things easier. But even with automation, AP teams are still busy. They manage vendor payments, travel expenses, loan repayments, and other short-term payments. They often work with purchasing and stay in touch with vendors.

When AP isn’t working well, it can cause major problems. Late payments can delay shipments, strain vendor relationships, and disrupt business. That’s why accuracy and speed are so important.

Despite this, many companies still rely on manual processes. This leads to lost time, scattered records, and endless frustration. Hiring more people doesn’t solve the issue, it only adds to the complexity.

The real solution is to streamline the process. AP teams should focus on timely payments and organized records, especially with remote work delays.

The good news? There is a better way to handle this and Expertise Accelerated is here to help.

What is Outsourced Accounts Payable?

Outsourced accounts payable means hiring a third-party company to handle your business’s bills and payments. They handle invoices, payments, and records, so your team can focus on other tasks.

Outsourcing accounts payable services means having another company manage your payments. This includes receiving invoices, checking them, paying vendors, and keeping financial records. It helps save time, reduce errors, and improve efficiency.

Some accounts payable outsourcing pitfalls are poor communication that can cause missed payments. Your data needs to be safe, so security is important. Some providers might have hidden fees, adding extra costs. You may feel less control over the process. Also, if their system doesn’t work with yours, it can cause tech issues.

Why Outdated AP Processes Cost You

Outdated practices cause mistakes and complicate spending and supplier trust.

Despite changes, 42% of B2B payments are still made by check, says JPMorgan. Checks are slow, costly to process, and more prone to fraud. On top of that, Almost half of invoices cause delays and errors.

Paper-based systems also make it hard to track expenses and forecast accurately. Late payments damage vendor ties, causing faster payment demands or lost suppliers.

Mismanaged AP can cause cash flow issues to snowball quickly. Missed invoices and incomplete records cause cash shortages and extra costs.

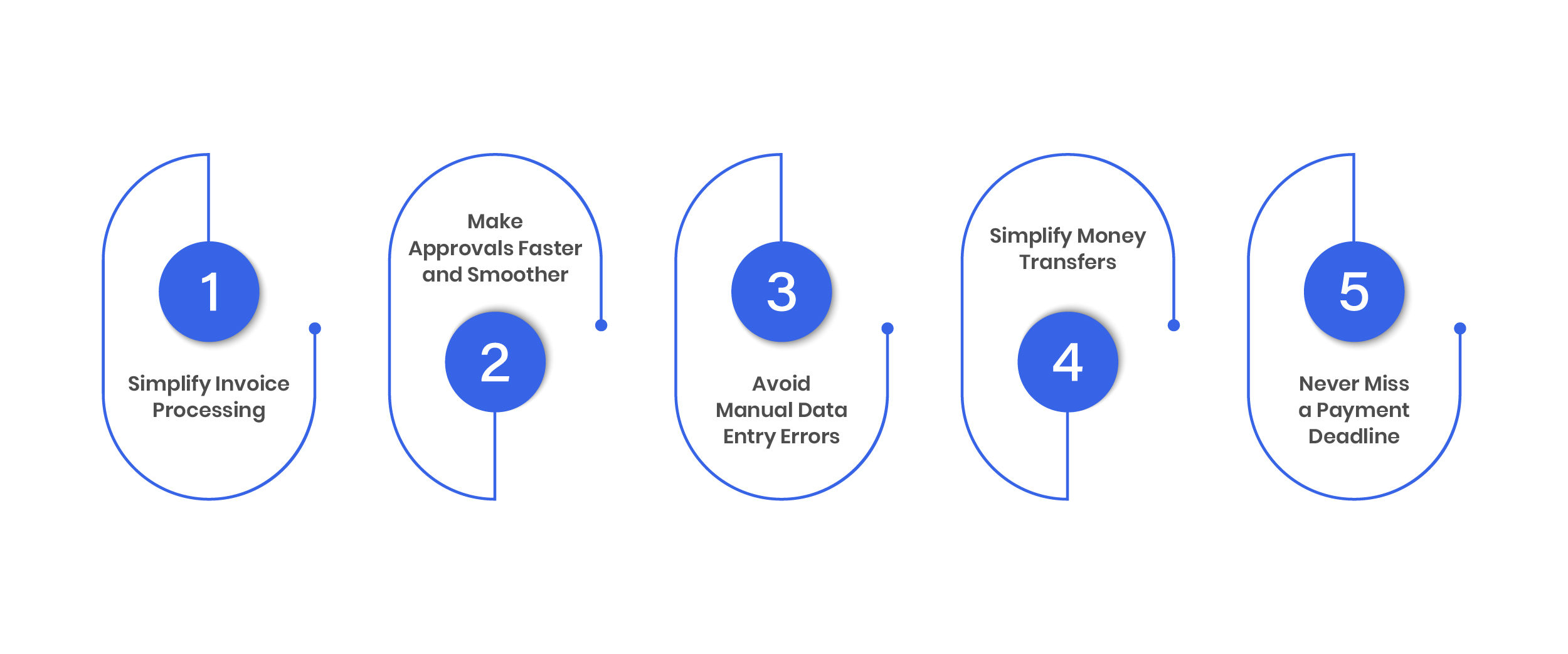

5 Common Accounts Payable Challenges and How to Fix Them

Many companies now recognize how much financial stress poor AP management can cause. Managing AP takes effort, but avoiding late fees, boosting vendor trust, and staying compliant saves costs. Even a 5% reduction in bad debt can save your business hundreds of thousands per year.

According to Forbes, many companies outsource to save money, but it comes with challenges. As the owner of a small outsourcing agency, understanding these problems is key. Four successful outsourcing company founders shared their experiences. Here’s what they faced and how they solved it.

Mark Gross from (DCL) said outsourcing can save money, but often lacks good management. To fix this, DCL uses U.S.-based project managers to oversee offshore teams, making sure the work is better and faster. Fawad Saleem from SolutionInn noticed that many outsourcing companies don’t offer help 24/7. He created a platform that provides tutoring help anytime, hiring a team from all time zones.

Eli Willner said language and cultural gaps can create issues between offshore teams and U.S. employees. He hired American professionals living in Israel, where wages are lower but quality is high. This made communication better, sped up projects, and cut costs. In my business, ensuring team members speak fluent English prevents misunderstandings.

Finally, Marilyn Tyfting from TELUS explained that outsourcing can affect a company’s brand. To avoid this, TELUS aligns outsourced teams with clients’ values for better results. By doing this, they create custom training and workspaces that match the client’s brand.

Outsourcing succeeds with good management, 24/7 support, and clear communication.

1. Simplify Invoice Processing

An accountant processes around 30–40 invoices a day which can add up to 800 a month. If done manually, it’s easy for 2–3 invoices to contain mistakes.

Even a small error in the account number or payment amount can cause major trouble. Paper invoices can get lost in transit or forgotten until it’s too late to process them. And without proper tracking, it’s easy to pay the same invoice twice.

Expertise Accelerated automates the entire invoice process to reduce these issues.

Invoices capture data, reducing errors. The system flags mismatches or suspicious entries.

Fake invoices? Duplicate payments? You won’t have to worry. The system labels paid invoices so they don’t pop up again. Each bill includes all details, eliminating back-and-forth between departments.

Scan and upload the invoice, and let Expertise Accelerated handle the rest. Your business gets a stress-free, reliable system for tracking and processing invoices.

2. Make Approvals Faster and Smoother

It’s surprising, but 37% of companies still use manual approval processes. Approvers receive email or memo notifications, causing delays and follow-ups. Accountants end up chasing people for responses to move one bill forward.

And when different payments need different approval paths, the confusion multiplies.

Expertise Accelerated changes all that.

You can set up automated workflows with single or many approvers. Admins can customize workflows, ensuring payments move forward only after full approval. Approvers get push notifications and approve many payments at once, with no missing files.

You don’t need to carry documents across offices or stack paper on someone’s desk. Everything is digital, visible, and easy to manage with Expertise Accelerated.

3. Avoid Manual Data Entry Errors

Handling numbers all day makes mistakes easy, and even small errors can be costly.

Manual data entry isn’t time-consuming. It can lead to compliance issues, fines, and reputational damage. Research shows that up to 4% of manually entered data contains errors.

But there’s an easy fix: automation.

Expertise Accelerated transfers invoice details and accounting data, eliminating typos and mistakes. Bills process on their own, saving time and preventing payment delays.

Expertise Accelerated also integrates with your existing accounting software. With its open API, data syncs in real-time. Expenses auto-categorized, keeping records clean and accurate, no matter your business pace.

4. Simplify Money Transfers

At the heart of accounts payable is money movement and managing this can be tricky.

Many businesses still rely on traditional methods like ACH or checks. That’s okay if you’re making a few payments. As your company grows, you’ll manage payments, payroll, transactions, and fees.

These old methods can’t always keep up. They’re slow, inconsistent, and often expensive.

Expertise Accelerated makes money transfers faster and easier.

Bill Pay lets you pay vendors and transfer funds globally at competitive rates. Want to pay employees? Set up recurring payroll payments. Need to pay by card? Use secure virtual cards built right into the platform.

Unlike basic online banking, EA tracks every transaction in real-time, all in one place.

5. Never Miss a Payment Deadline

Most accounts payable tasks are time-sensitive. Miss a due date, and you risk damaging your reputation and vendor relationships.

But delayed payments aren’t always the accounting team’s fault. Without strong tools and clear processes, even the best team can struggle.

Many companies still work without proper reminders, leading to missed or lost invoices. And once late payments pile up, teams scramble to fix the problem instead of preventing it.

Expertise Accelerated helps you stay ahead.

You can schedule payments ahead of time and line them up for processing on the due date. Set up reminders and get alerts, so nothing slips through the cracks.

Vendors love early payments, some even offer discounts for them. And if there’s an issue with a payment, scheduling it early gives you time to fix it.

With EA, you’ll build stronger relationships and maintain trust with your partners.

Bonus Tip: Early Payment Discounts

Paying invoices early can earn you supplier discounts often 1–2% off if paid within 10–15 days. But you need to balance those savings with your cash flow needs. AP automation helps ensure you meet discount deadlines without hurting your working capital.

How Expertise Accelerated Can Help?

Expertise Accelerated eases accounts payable by improving accuracy, ensuring compliance, and saving time. We help manage messy invoices and follow-ups without adding more work to your team. No matter what you use now, switching to Expertise Accelerated is easy. It only takes a few days to get started.

Curious how it works? Join a free demo and see how Expertise Accelerated can transform your offshore accounting services.