More firms are turning to offshore accounting to reduce expenses and tap into professional talent. There are about 35M small businesses in the U.S., making up 99% of all companies.

The global accounting industry will grow from $652B in 2023 to $804B by 2028, at a 4% yearly increase.

About 40% of U.S. businesses now outsource some of their accounting work to other countries.

This blog tells key benefits and considerations of offshore accounting.

Understanding Offshore Accounting

Offshore accounting is hiring experts abroad to handle tasks like bookkeeping and taxes. It helps businesses save time and money by using secure, cloud-based tools and automation. Offshore firms often charge less due to lower wages and offer services like tax support. To get the most out of it, choose a firm with strong credentials, clear communication, and proven experience.

The accounting industry in 2025 relies on AI, blockchain, cloud tech, and ESG reporting, with strong data security. Cloud accounting is rising too, with 67% of accountants saying it boosts workflow. Financial software adoption is also growing, offering one-click reporting and better decision-making. Offshore staffing and remote work are now the norm, with 80% of CPA firms planning to stay remote. AI is automating tasks like data entry and fraud detection 47% of CIOs say the pandemic sped up AI adoption. Blockchain is making transactions more secure, while real-time payment systems improve cash flow. Data analytics, AI tools, and cloud integration are improving forecasting and client advice. Social media boosts business and online tax filing streamlines compliance. Filing taxes is now easier with online tools like QuickBooks and TurboTax. Small businesses can track returns, automate calculations, and avoid delays. For example, many SMEs use these tools to file on time without the hassle of paperwork.

The role of accountants is also shifting. They’re using tools like Power BI for insights and advice, not numbers. While software does the basic work, expert decisions still need human input. Agile accounting, inspired by tech development, helps businesses quickly adjust to changes. Xero and Zoho Books offer real-time updates, raising accuracy and satisfaction. Advisory services are growing, helping businesses make smarter decisions. Companies use firms like Deloitte for financial planning, saving time, and reducing risks. Personalized financial services are also trending. With AI, businesses can now offer custom budgeting and advice. Apps use secure data to tailor services, boosting customer trust and engagement. Finally, sustainability reporting is becoming key. Tesla shares ESG efforts to boost investor confidence and promote greener, transparent growth.

According to Forbes, Small businesses face increased costs and inflation, with some depending on credit cards or mortgages to endure. As 2025 approaches, concentrating on exceptional customer service, hearing feedback, and using AI is essential. Easing operations and keeping teams small can enrich flexibility and service. Customer service should concentrate on quick, precise contact and build devotion. AI can automate tasks, but it’s useful to try it in small areas first. By focusing on clients and using feedback and tools, small businesses can succeed in 2025.

Types of Offshore Accounting Services

Offshore accounting firms usually offer a wide range of services. Businesses can pick services based on their needs and budget.

Bookkeeping

Outsourcing bookkeeping lets you focus on more important business tasks.

Accounts Receivable/Payable

Outsourcing helps companies manage cash flow and stay organized.

Financial Analysis and Planning

Financial planning is essential. Offshore experts provide insights and forecasts to boost business confidence.

Financial Statement Preparation

Offshore experts can create detailed financial statements for management and external parties. They calculate and report expenses, profits, and financial health.

Benefits of Offshore Accounting

Outsourcing accounting offshore saves money, boosts efficiency, and provides expert support

1.Lower Costs

Labor Costs

Hiring in-house accountants can be expensive. Offshore firms offer full accounting services at lower costs ideal for small businesses.

Office Costs

Outsourcing can lessen the need for furniture, office space, utilities, and other overheads.

Technology Costs

Offshore firms use advanced tools your business might not afford on its own.

Regulatory and Compliance Costs

Offshore experts help you meet financial rules and avoid legal trouble.

Currency Exchange Costs

Some offshore firms cut international transaction costs with better exchange rates.

2. Saves Time

Outsourcing taxes frees your team to focus on strategy and growth.

3. Access to Skilled Professionals

Offshore accounting gives you access to a global talent pool. Offshore pros bring expert skills without high local hiring costs.

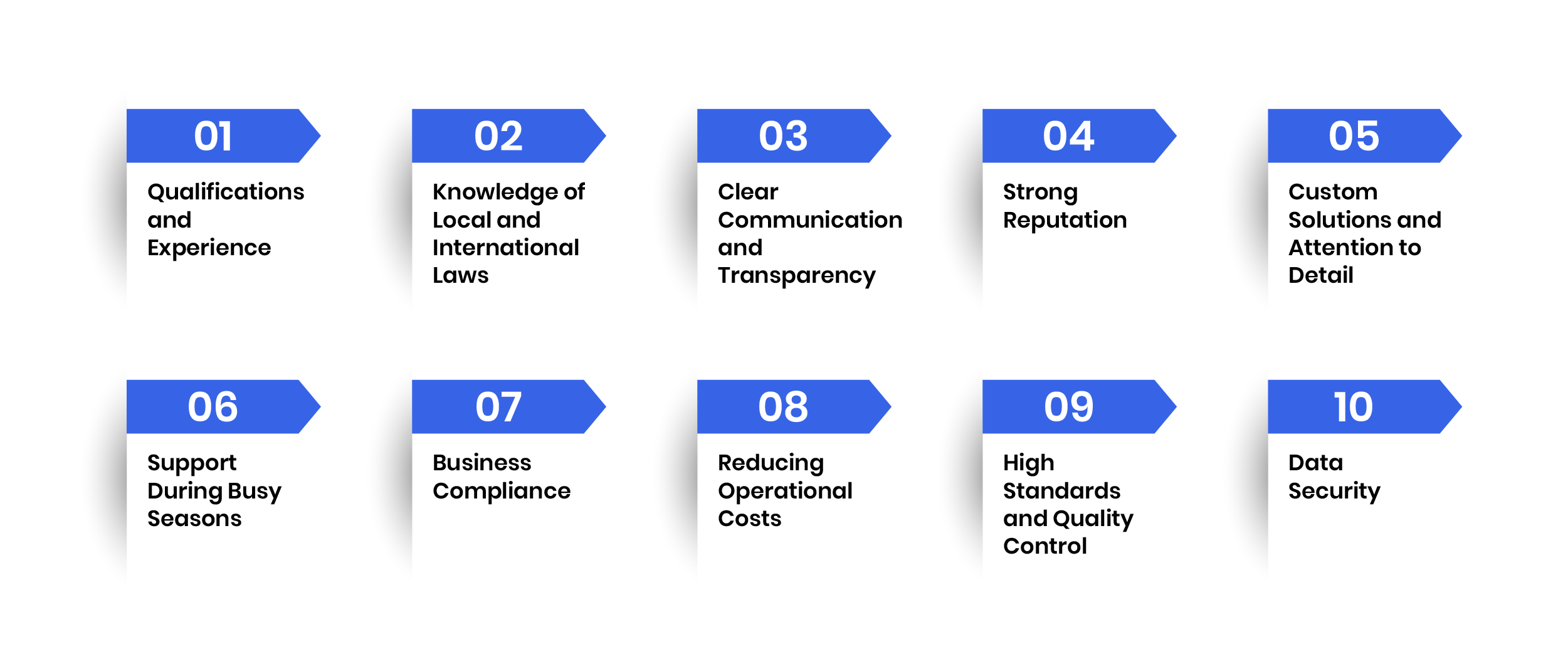

Tips When Hiring an Offshore Accountant

1. Qualifications and Experience

1. Qualifications and Experience

Choose certified professionals, like CPAs or chartered accountants, with industry experience.

2. Knowledge of Local and International Laws

They should know both their country’s regulations and international financial laws.

3. Clear Communication and Transparency

Choose a firm that communicates well, provides updates, and is clear about costs and services.

4. strong Reputation

Check reviews, testimonials, or ask for references to verify their reliability.

5. Custom Solutions and Attention to Detail

The right firm will tailor services to your business and focus on your financial needs.

6. Support During Busy Seasons

Offshore firms can manage extra workload during peak periods, easing pressure on your in-house team.

7. Business Compliance

These overseas firms can help you meet U.S. deadlines and regulations.

8. Reducing Operational Costs

Outsourcing avoids the cost and effort of hiring, training, and managing a full accounting team.

9. High Standards and Quality Control

Offshore firms often have strict quality checks to ensure your finances are accurate and up to date.

10. Data Security

Ensure your offshore accountant uses secure systems and complies with data privacy rules.

Tip: You can work with a freelancer, accounting company, or staffing agency.

Why Hire EA for Offshore Accounting Services

At Expertise Accelerated, we provide customized offshore accounting services tailored to your needs. Our team of experts covers accounting, auditing, finance, and more. We ensure clear communication and detailed planning. Additionally, we concentrate on compliance with both U.S. and offshore laws. From daily bookkeeping to tough audits, we offer safe and professional services you can depend on.

Conclusion

Offshore accounting aids businesses to save cash, access professional talent, and concentrate on growth. Picking the good offshore partner aids to overcome challenges like communication and compliance. Research and select a trusted provider with clear processes and a strong track record.

EA offers efficient offshore accounting solutions for less workload and peace of mind. Take control of your financial future with experienced professionals. About 40% of U.S. businesses now outsource some of their accounting work to other countries.