It’s the end of the month, and your inbox is full of vendor emails asking for payment updates. Your table is full of invoices, associates are waiting, and the junior accountant found another error. If this sounds like your daily practice, it might be time to consider outsourcing your accounts payable process.

The AP market will rise from $1.41 billion in 2024 to $3 billion by 2032, with an annual growth rate of 9%, according to MRF.

This guide explains AP outsourcing, its benefits, and how it saves time and prevents payment issues.

What is Accounts Payable Outsourcing?

AP outsourcing is when a business employs an external party to manage invoices, expenses, and payments. This lets your team focus on important tasks instead of daily paperwork. It’s a great way to reduce workload, avoid errors, and ensure everything runs smoothly.

According to Forbes, By 2025, businesses will have no geographic limits when building teams. Outsourcing to Latin America boosts competitiveness with tech talent and similar time zones. AI is changing outsourcing by automating tasks like customer support and software development. AI tools, like language translation, will save time and improve communication. Companies are also focusing on sustainability and data regulations when choosing partners. Successful outsourced teams need clear goals, cultural fit, and growth opportunities. Businesses using AI and strong partnerships will thrive.

Why Businesses Outsource AP

Companies outsource accounts payable because managing too many invoices is difficult. With hundreds or thousands each month, it’s easy to miss payments or make errors. Businesses with global vendors also struggle with different currencies and tax laws. Outsourcing can take that intricacy off your plate. Additionally, fast-growing firms often need to scale their processes quickly. Employing and training new staff can be slow and pricey, but an outsourced AP team can evolve with you. Outsourcing digitizes workflows and boosts efficiency.

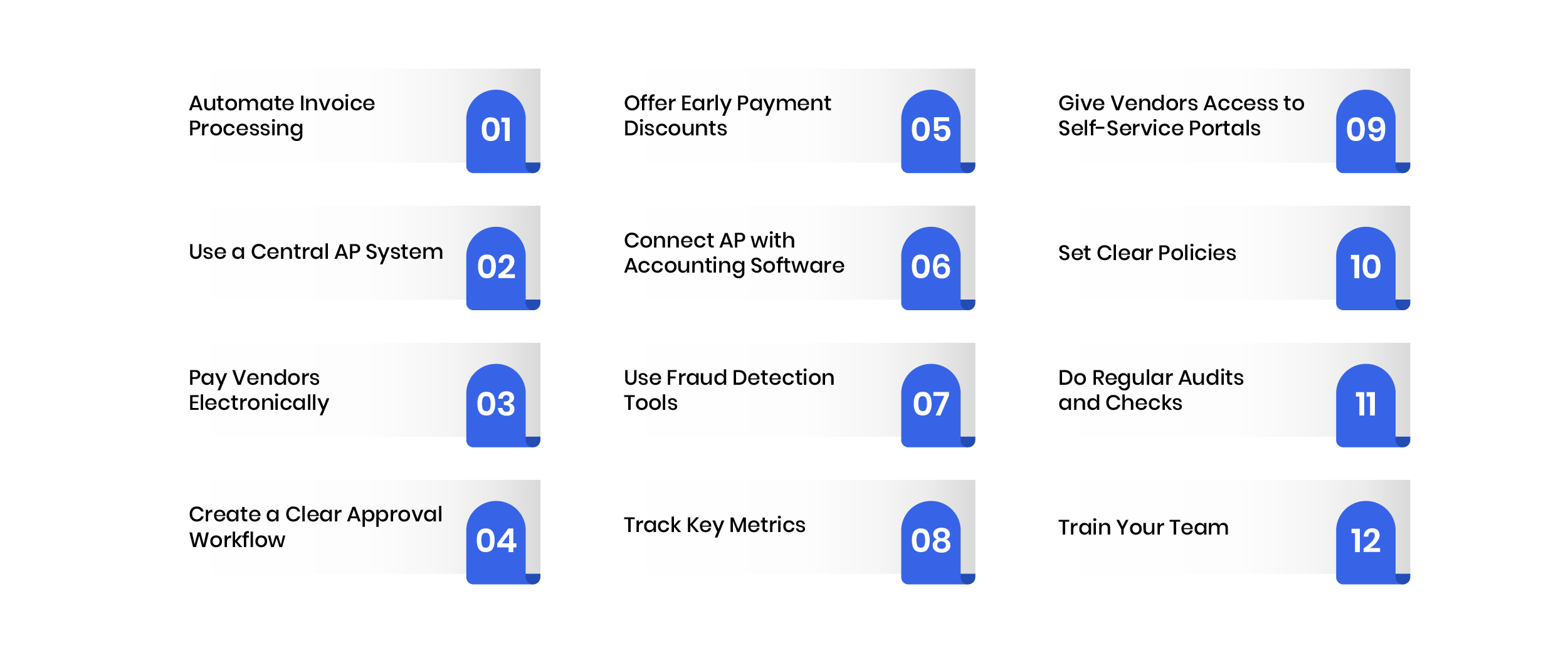

Ways to Improve Your Accounts Payable Process

1. Automate Invoice Processing

Manually handling invoices takes time and causes errors. Use AP software to scan, match, and approve invoices faster. This improves accuracy and saves time.

2.Use a Central AP System

Keeping AP data in different places is confusing. A central system eases invoices, vendors, and payments for faster, clearer management.

3.Pay Vendors Electronically

Stop using paper checks. Use ACH, wire transfers, or virtual cards to make payments quicker, cheaper, and safer.

4.Create a Clear Approval Workflow

Unclear approval steps cause delays. Set clear rules for who needs to approve what and use software to make the process smooth and fast.

5.Offer Early Payment Discounts

Some vendors give discounts if you pay early. Use automation to spot these deals and save money while improving vendor trust.

6.Connect AP with Accounting Software

If your systems don’t work together, it creates extra work. Linking them reduces mistakes and gives you real-time updates on cash flow.

7.Use Fraud Detection Tools

Fraud can be hard to spot. Tools with alerts can catch fake invoices and suspicious payments early.

8.Track Key Metrics

Track invoice speed and discount frequency. These insights show where to improve.

9.Give Vendors Access to Self-Service Portals

Let vendors check their payment status themselves. This cuts down on calls and emails, freeing your team for more important work.

10.Set Clear Policies

Make sure everyone, staff and vendors knows the rules. Clear policies reduce mistakes and help keep everything running smoothly.

11.Do Regular Audits and Checks

Look over your AP records. Catching errors early helps keep your books accurate and builds vendor trust.

12.Train Your Team

Teach your team how to use new systems and follow best practices. Trained workers make fewer mistakes and work well.

Benefits of Outsourcing AP

It can save your firm cash by reducing the need for a large on-site AP team. Outsourced teams use automation tools to process invoices faster and with fewer errors. This aids lessen expensive blunders and delayed payment fees. Your team can concentrate on strategic tasks instead of data entry. Outsourcing lets you scale services based on your needs. Outsourcing experts help ensure compliance and reduce fraud or audit risks.

It lets you focus on important tasks while experts handle payments. Third-party providers keep your financial information safe with strong security measures. Communication improves, and any issues are quickly addressed. The transition to outsourcing is smooth, with training for your team. Outsourcing also helps track payments better, giving you real-time updates.

Outsourcing vs. Automation

Outsourcing means employing a firm to manage your accounts payable. Automation uses software to speed up the process in-house. If you want to control your data and use tools like QuickBooks or NetSuite, automation is a better choice. Each approach has its strengths, and the right choice depends on your company’s size, goals, and resources.

Real-life examples of Firms outsourcing their Accounts Payable

McDonald’s outsourced to save cash and speed up invoicing and payments using cloud-based automation. Walmart outsourced to reduce costs and improve accuracy. They used automation and data security, reducing costs by 30% and speeding up processing by 50%. General Electric centralized and automated its AP processes, reducing costs by 30%. This improved compliance and allowed them to focus on digital transformation. Pfizer outsourced to handle more transactions, freeing up resources for innovation. This helped them grow operational revenue by 92% and improve cash flow.

Why Choose Expertise Accelerated for Accounts Payable Outsourcing?

Consider Expertise Accelerated for efficient AP management. Their services manage invoices and payments, boosting accuracy, compliance, and visibility, letting you focus on growth. Expertise Accelerated offers reliable AP outsourcing, ensuring efficient, accurate transactions. With advanced, secure technologies, they streamline operations and protect financial data, boosting productivity. They also understand that every business has unique needs. They offer tailored AP solutions to optimize workflows, cut costs, and improve finances. Their scalable services boost cash flow with accurate payments and strong vendor relations.

Check out how our experts resolved accounts payables process disarray for a NASDAQ listed CPG enterprise here.

Conclusion

The future of AP outsourcing looks great. More businesses are trusting Expertise Accelerated to handle their accounts payable. New technology like AI and automation makes offshoring quicker, safer, and more reasonable. By working with the correct AP partner, you can save cash, and ease your financial tasks. It’s a wise move that lets you concentrate on growing your business while professionals take care of the paperwork.

Expertise Accelerated is your trusted AP outsourcing partner, delivering good service and results. Let us ease your finances, contact us today!