A business is exciting, but when numbers don’t add up, it quickly turns stressful. Cash flow gaps, tax deadlines, and unclear reports can hold back growth. That’s where small business accounting makes the difference.

Accounting is about monitoring money coming in and going out, managing it, and registering it. For small businesses, it delivers key financial details to tax administrations and investors. This makes it manageable to make ideal business decisions. The right accounting system keeps your business working well.

With the use of accounting software, small business proprietors can handle their finances. Accountants now also need to use this software to sustain businesses with their financial requirements. Accounting helps you plan for the future, not only track the past.

According to Business Dasher, 64% of business landlords manage their bookkeeping. 30% employ an accountant. The IRS observes about 642,603 businesses each year.

Key Takeaways:

- Small business accounting keeps records exact, follows rules, and aids in problem-solving.

- Financial management apps make bookkeeping simpler and quicker.

- Accountants use technology to give better financial advice.

- Good accounting not only checks previous activity but also aids to plan future growth.

“Accounting is more than numbers; it helps solve business problems.” — Anuj Jasani

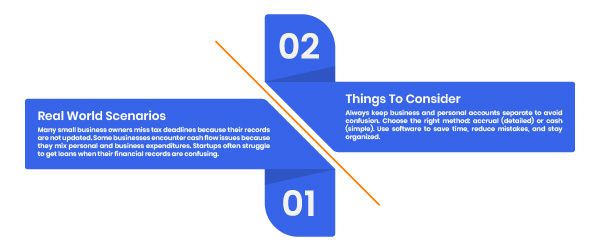

Real World Scenarios

Many small business owners miss tax deadlines because their records are not updated. Some businesses encounter cash flow issues because they mix personal and business expenditures. Startups often struggle to get loans when their financial records are confusing.

Things To Consider

Always keep business and personal accounts separate to avoid confusion. Choose the right method: accrual (detailed) or cash (simple). Use software to save time, reduce mistakes, and stay organized.

Note

Proper accounting records make it easier to pay taxes, get loans, and bring in investors. They also make it easier to see how your business is really performing.

Bonus Point

If handling accounts feels too stressful, you can outsource accounting. This helps save money, gives you access to experts, and lets you focus more on growing your business.

Disclaimer

This infographic shares general knowledge about small company accounting. For taxes and money decisions, ask a professional, small business accountant or tax advisor for help.

Why Is Accounting Essential?

Financial Management is like a guide that helps you follow your business’s financial path. It indicates where your cash comes in and where it went, such as on bills, workers, or supplies. It shows your earnings and savings. Clear financial insight helps you make better business decisions.

To learn accounting, it’s vital to know a few essential terms. Income (revenue) refers to the money your business makes. Expenses are the fees for operating your business, like rent or materials. Profit is what’s left after deducting expenditures from income, it’s your earnings. Assets are what you have; liabilities are what you debt to.

“Accounting is the language businesses use to talk.” — Warren Buffett

What Is Small Business Accounting?

Accounting for small businesses is all about maintaining track of your money. It means registering what you make, what you spend, and how much money your business has at any time. Good accounting helps you organize your business better and stay updated on taxes.

“In accounting, hard work brings success—there are no shortcuts.” — Steven Bragg

How to do Bookkeeping for Small Business

Bookkeeping for small business are foundational processes that not only simplify financial management but also lay the groundwork for long-term success.

Step 1: Manage Financial Trades

Begin by handling economic documents like bank statements, invoices, and receipts. Only include transactions related to your business. For example, keep personal loans and expenses separate. Source documents are the basic papers used to record business transactions.

Step 2: Record Journal Entries

Use a journal to note business transactions as they happen, adding money to one account and subtracting from another. Frequent transactions, like sales and purchases, can go in special journals for simplicity. Less common transactions can go in a general journal.

Step 3: Update the Ledger

The general book groups transactions by cash, sales, or expenses, and shows how each balance changes over time.

Step 4: Make a Trial Balance

A trial balance reviews that all your debits and credits fit. If they don’t, there may be errors to fix before proceeding.

Step 5: Adjust Accounts

At the end of a reporting period, you’ll need to make adjusting entries. For example, you may note income you earned but haven’t written yet, or costs like equipment that loses value gradually.

Step 6: Draft Financial Statements

Make financial statements from your logs, such as the Balance Sheet, Cash Flow, and Income Statement. These give you a precise view of your business’s performance.

Step 7: Close the Books

At the end of an accounting period, close temporary accounts like income and expenses. The remaining accounts, like cash, carry over to the next period.

“Accounting is the base of every business.” — Tiffany Johnson

Tips to Set Up a Small Business Accounting System

A guide for a small business accounting is much more detailed but here are the main tips that a small business can follow .

Open an Independent Business Bank Account

Owning a reliable business account keeps your private and business finances detached. This makes it manageable to handle your money and track expenditures.

Pick an Accounting Method

Decide how to record your business’s income and expenses by choosing between two methods. The cash-based method records transactions when you exchange money, simplifying bookkeeping. The accrual method records transactions when they happen, even without money exchanged. This method is simpler for small businesses.

Record Transactions

You can employ a small business accountant, use accounting software, or register trades by writing. Use a chart of accounts to manage trades into classes.

Set Payment Terms and Invoicing

If you let clients pay afterward, fix precise payment terms and make a system for transmitting invoices. This enables you to get paid on time and keeps your cash flow stable.

The Need For A Small Business Accountant

Any business needs an accountant for

- Writing a business plan.

- Choosing the right business structure.

- Handling taxes and compliance.

- Setting up your accounting system.

- Managing payroll and inventory.

If you can’t employ an accountant, SaaS accounting software is a superb choice. It handles invoices, tracks expenses, and makes reports, giving you a clear view of your money for easier work and smarter choices.

E-Commerce Accounting

eCommerce is growing fast, and keeping track of money is important. Businesses need the right accounting method, must handle taxes, and watch their cash. Good tracking helps plan growth and follow rules. You can use an app or employ an expert.

eCommerce accounting tracks sales, expenses, taxes, inventory, and returns. Tools like FreshBooks, Wave, and Zoho Books make it manageable. Spreadsheets can work at first, but software or an accountant is more precise and saves time. Platforms like Shopify, WooCommerce, Wix, Squarespace, and Amazon Marketplace aid in managing sales and growing your business.

Accounting Tips for Beginners

- Stay organized by keeping all receipts and invoices.

- Update records, don’t wait until the last minute.

- If it gets too difficult, employ a bookkeeper or an accountant.

- Look at your statements monthly to see how your business is performing.

Why Financial Tracking Matters

Without proper financial records, small businesses face risks like:

- Overspending: Spending too much on things such as stock or wages can yield cash flow issues.

- Tax Problems: Inadequate records may result in underpaying taxes and encountering fines.

- Bad Decisions: Without clear financial information, making smart business choices becomes harder.

- Losing Loans: Lenders may reject you if your finances aren’t organized.

- Personal Risks: If your business struggles, creditors may go after your investments.

“Accounting shows the truth in finance—you can’t fake it.” — Robert Kiyosaki

Conclusion

Handling your finances doesn’t have to be unendurable.Expertise Accelerated offers skilled accounting services to address your bookkeeping, taxes, and more.

By outsourcing your economic duties, you conserve time, prevent errors, and concentrate on operating your business. Reach us today to learn how we can help you!

FAQs

How do I do small company accounting?

Accounting for a startup means reviewing all the cash coming in and moving out. The primary reports are the balance sheet, income statement, and cash statement. You can address this manually, use an application, or employ an accounts manager.

Is a CPA fundamental for a business?

Not all small businesses need a CPA. Sole proprietors often handle without one, but LLCs and corporations can benefit from having one. A CPA assists with payroll, taxes, reports, growth advice, and even IRS representation.

What is basic accounting for a small business?

Basic accounting is about handling finances. It means recording every transaction, preparing reports (like profit and loss statements), and keeping cash flow under review. A software or a tax professional can make this more manageable.

How do I start accounting for a new business?

Set up a system early. Choose the right software, create a chart of accounts, and decide how to check revenue and costs. Check cash flow, and if uncertain, get guidance from an accountant to prevent errors.