Handling a restaurant is a difficult job. Managing finances is pivotal to success, together with amazing cuisine, staff, clients, an unforgettable experience, and other duties. On top of that, keeping track of money can be prolonged and confusing. This is where technical bookkeeping services can assist. These services cover all the financial details so you can focus on running your restaurant. They ensure accurate finances, controlled expenses, and readiness for growth.

According to Invensis, The restaurant industry donates 4 trillion dollars, or sixteen percent of the Gross Domestic Product in 2024. It employs over 23 million people and yields $1 trillion in income.

What is Restaurant Accounting?

Restaurant accounting involves addressing your restaurant’s financial records. It involves recording sales, expenditures, and profits while ensuring accuracy.

Good accounting helps you:

- Understand how your business is doing.

- Spot problems early.

- Lessen costs and raise profits.

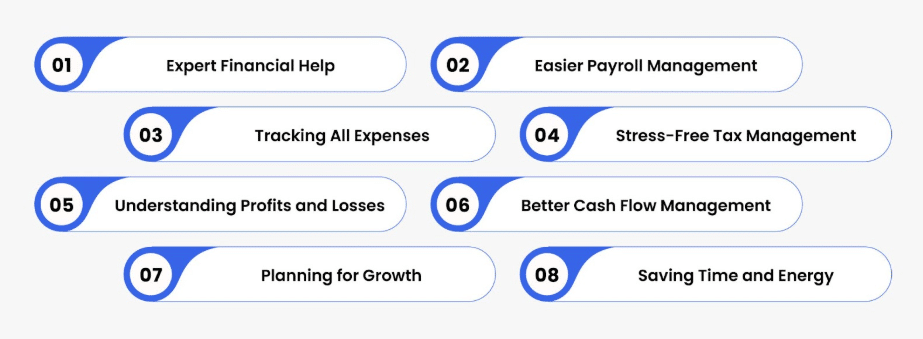

Benefits of Restaurant Bookkeeping Services

1.Expert Financial Help

Bookkeeping for restaurants is distinct from other businesses. It involves handling food prices, team pay, seller bills, and taxes. A specialized bookkeeper knows how to handle all these details. They make sure your financial records are correct and help avoid costly mistakes.

2.Easier Payroll Management

In restaurants, payroll can get tough because of varying staff timetables and pay rates. Bookkeeping services make it manageable to handle payroll, ensuring everyone gets paid on time. They also track how much you spend on salaries compared to your income.

3.Tracking All Expenses

Restaurants have various expenditures such as equipment repairs, food, rent, and utilities. Specialized bookkeepers manage these costs to give you a clear image of your spending. This helps you find ways to save and keep your spending under control.

4.Stress-Free Tax Management

Taxes can be confusing and mistakes can be expensive. Bookkeeping services help you file taxes on time. They keep updated on tax regulations, to ensure the restaurant remains adhered to and prevents fines.

5.Understanding Profits and Losses

Knowing your earnings and identifying deductions is important for running a successful restaurant. Bookkeeping services give you clear profit and loss reports. These reports show what’s working and highlight where you need to make changes, such as adjusting prices or controlling costs.

6.Better Cash Flow Management

With a firm cash flow, paying bills or planning for the future becomes easy. Bookkeepers track your cash flow, ensuring you always know your available budgets.

7.Planning for Growth

Bookkeeping allows handling current finances and preparing for the future. The right bookkeeper examines your financial data and recommends how to extend your business. This could include raising your menu, extending further locations, or financing more useful equipment.

8.Saving Time and Energy

As a restaurant landlord, your time is special. Bookkeeping services take the responsibility of financial management off your hands. This gives you extra time to concentrate on making amazing food, serving clients, and developing your business.

Why is Restaurant Accounting Different?

1.Unique Expenses

Restaurants have costs that are different from other businesses. These include rent, utilities, maintenance, staff salaries, benefits, décor, furniture, and equipment.

2.Different Income Sources

Restaurants earn money in numerous ways, such as catering, dine-in, takeout, and occasions. Each one has its costs, making accounting more complex.

3.Seasonal Changes

Business often varies by season. Busy times mean high earnings, but slow seasons can hurt cash flow. Planning is important.

Main Parts of Restaurant Accounting

1.Choose an Accounting Method

- Cash Accounting: Record sales and expenses as you receive or spend cash. Good for smaller restaurants.

- Accrual Accounting: Record transactions when they happen, even if payment is later. Best for larger restaurants.

2.Keep Records

Bookkeeping is all about recording every financial transaction. It’s the base of all accounting work.

3.Track Revenue

Separate income streams (dine-in, delivery, catering) to see which earns the most and costs the least.

4.Calculate Food Costs

Know your Cost of Goods Sold- the cost of ingredients and supplies used to prepare meals. This shows where you can cut costs.

5.Manage Inventory

Avoid waste and shortages by keeping track of your inventory. This saves money and ensures smooth operations.

Handling Major Costs

1.Payroll

Staff salaries and benefits are one of your biggest expenditures. Ensure payments are valid and on time.

2.Overhead Costs

These include rent, utilities, advertising, and repairs. Track them to avoid overspending.

3.Food Waste

Track on food that spoils or gets destroyed during prep. Reducing waste can save you a lot of money.

Tips for Better Bookkeeping

According to Forbes, Achieving $1 million in annual income is a huge accomplishment for a restaurant. But with growth comes more difficulty in handling finances. What once was easy to keep track of in your head becomes harder to handle as your restaurant expands. Trying to manage it all manually can lead to confusion and mistakes.

This is where better bookkeeping can help. It makes financial management easier and helps you stay organized. If your restaurant has hit the $1 million mark, here are four steps to improve your bookkeeping:

- Pick the Proper Bookkeeping Software

Many bookkeeping tools exist, but the most famous may not be the best for your restaurant. Take time to find software that suits your requirements, objectives, and funding. Ensure it’s simple, doesn’t cost too much, and can rise with your restaurant. If you select enterprise-level software, work with the seller to ensure smooth setup and support.

- Bring All Your Financial Data Together

As your restaurant grows, you’ll likely have more places where financial data comes from, like different locations or online sales. To make sense of it all, it’s important to keep everything in one system. Accounting software helps you see finances and make decisions.

- Check Your Financial Data

It’s not enough to collect your financial data, you need to review it. Try to check it at least once a month. You can establish automated notifications and reminders to make this comfortable. If you don’t have the time, allocate this duty to somebody else in your group. Regular assessments enable detect errors and keep you updated on your restaurant’s financial well-being.

- Get Help When Needed

As your restaurant grows, it may be hard to handle everything by yourself. Hiring an accountant or bookkeeper can help keep things organized. This way, your team can focus on day-to-day tasks while a professional ensures your financial records are accurate. If you want to grow further, consider hiring a part-time CFO for extra financial advice.

Conclusion

Specialized bookkeeping services make running a restaurant easier and more successful. They assist with salary receipts, taxes, expenditures, and growth planning, all while saving you time. At Expertise Accelerated, we provide specialized bookkeeping services for restaurants. Focus on running your business while we handle the finances. Let us assist you in building a successful future for your business!