Invoice factoring risk means the chance of losing money when selling unpaid invoices for quick cash. Invoice factoring means selling your unpaid invoices to a company to get quick cash. It helps improve cash flow, but you should understand the risks and use it as part of a smart money plan. These risks come from the economy, customer credit, and industry trends.

Managing these risks helps factoring companies keep cash steady and grow long-term.

The global invoice factoring market reached $2T in 2021 and is set to hit $5T by 2031, growing at a 9% CAGR.

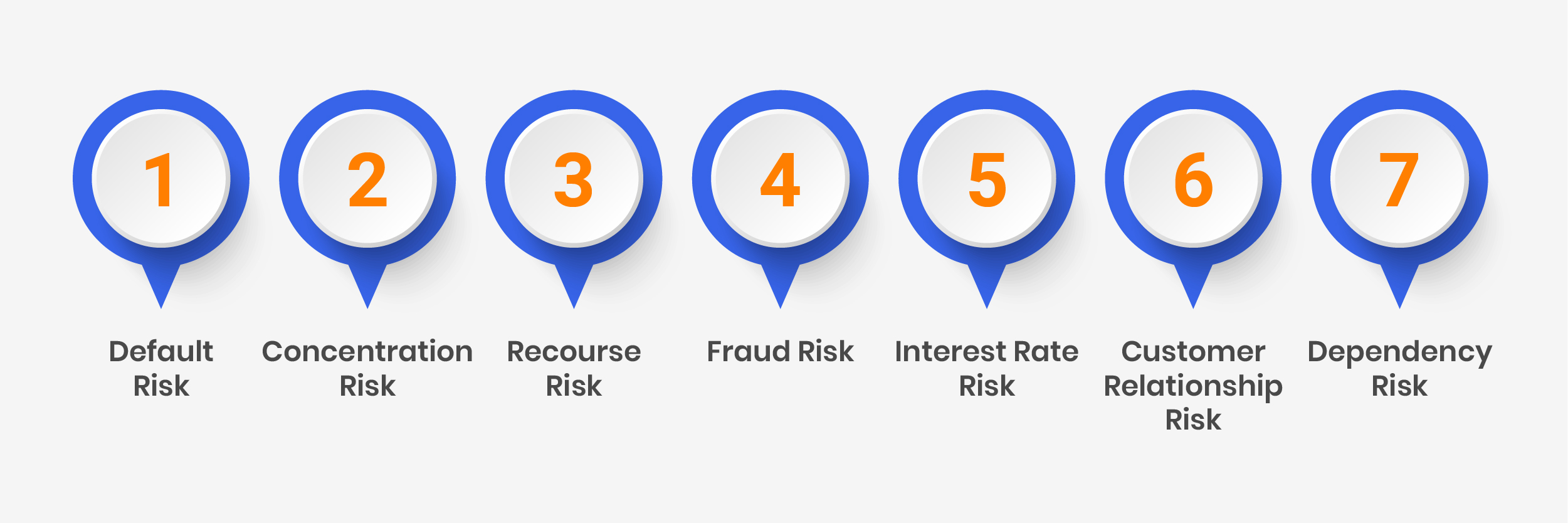

This blog covers 7 key invoice factoring risks and how to reduce them.

Understanding Invoice Factoring

Factoring helps businesses with long payment cycles get quick cash.

Manufacturing, trucking, staffing, construction, and healthcare industries are some of the industries that utilizes factoring. Factoring gives fast cash, easier than loans, and is common in trucking and manufacturing.

If your business needs quick cash, factoring lets you sell invoices for upfront payment. It’s helpful if customers pay late, but it comes with fees and less control. It’s common in manufacturing, transport, and staffing, and works even if you can’t get a loan. To end a factoring agreement, review your contract, give written notice, repay any dues, and take back control of collections. Confirm the termination in writing and plan how you’ll manage cash flow afterward.

According to Forbes, about 1 in 5 businesses (21.7%) fail within their first year. The main reason, according to SCORE, is poor cash flow management. A factoring company helps businesses get quick cash by buying their unpaid invoices. Instead of waiting for customers to pay, the business gets most of the money upfront, and the factoring company collects the payment later. Factoring means selling invoices, unlike financing which uses them as collateral for a loan.

With factoring, the customer’s credit matters more. It’s helpful for new businesses without a strong credit history. The factoring company usually pays 70% to 95% of the invoice value upfront. After the customer pays, the business gets the remaining amount minus a fee. This fee can be 0.5% to 5% per month. To work with a factoring company, apply and show that your customers pay on time. Funding is often quick sometimes in a few days. Some agreements need you to repay the company if the customer doesn’t pay (recourse). Others don’t (non-recourse), but those are more expensive. Choose a factoring company that fits your needs, offers fair terms, and works well with your business type.

According to Bloomberg, When a business needs cash quickly and can’t get a bank loan, it might use factoring. This means the business sells its unpaid invoices to a factoring company to get money right away. The factoring company then collects the payment from the customers. For example, if a business has $100,000 in invoices, the factoring company might give them 75% to 80% of that amount upfront. Once customers pay, the factoring company sends you the remaining amount after fees.

Factoring is helpful because you can get cash in a few days. Your credit matters less factoring companies mainly check your customers’ ability to pay. But, factoring can be expensive. Some companies charge high fees, want direct payments, and need least monthly invoices, like $75,000. To get better rates, try trusted firms or use sites like The Receivables Exchange where companies bid on your invoices. Factoring isn’t perfect, but it’s a good option if you need cash fast and can’t get other financing.

7 Invoice Factoring Risks and How to Reduce Them

While invoice factoring can help with cash flow, it has its downsides. Factoring fees can be high and hurt profits. It may strain customer ties and lead to overreliance, hiding deeper issues like low sales or profits. Some factoring agreements include long-term contracts or least invoice amounts, limiting your flexibility. You’ll also have to share financial details and customer data, which could be a risk if not properly handled. If your customers have poor credit, you may face rejections or higher fees. With recourse factoring, you must repay if they don’t pay.

1. Default Risk

The risk that the debtor won’t pay the invoice. It hurts cash flow, cuts profits, and strains investor trust.

2. Concentration Risk

When too much of a portfolio depends on a few clients or industries. One big client default or industry slowdown can hurt your finances.

Tips:

- Expand client base across regions and industries.

- Use invoice verification tools like Apruve or Fundbox.

- Integrate predictive analytics into onboarding.

- Reassess and update client concentration limits.

3. Recourse Risk

The factoring company may have to repay the funds if the invoice remains unpaid. Links client problems to the factoring company, risking cash flow.

Tips:

- Check financial health in real-time.

- Define recourse terms in agreements.

- Use AI for better credit risk predictions.

- Choose appropriate factoring types based on client profiles.

4. Fraud Risk

Clients may fake invoices or give false data. Causes losses and hurts credibility.

Tips:

- Use strong KYC and AI tools.

- Integrate secure, encrypted payment systems.

- Encrypt data (AES-256) and use blockchain for secure, transparent deals.

5. Interest Rate Risk

Interest rate changes can raise funding costs. Rate changes cut into profits and may ruin deals.

Tips:

- Use C2FO or Taulia for discounts.

- Use fixed-rate factoring to avoid rate changes.

- Track interest rate trends with real-time AI tools.

6. Customer Relationship Risk

Outsourcing collections may hurt customer relationships. Aggressive collections can upset customers and reduce future sales.

Tips:

- Pick a factoring company known for professional, and accessible service.

- Align communication expectations with your factoring partner.

- Consider confidential factoring (Customer unaware of factoring).

- Check in with customers about their experience during the payment process.

7. Dependency Risk

Risk of over-relying on factoring for daily cash flow. Overuse of factoring can mask weak sales or margins and trap you in a tough cycle.

Tips:

- Use factoring short-term, not as a long-term fix.

- Review profits and cash flow plans.

- Explore credit lines or cut costs.

- Consult a financial planner.

Invoice Factoring Misconceptions

It’s the same as a loan: It’s not. Factoring involves selling receivables, not borrowing.

Only for struggling businesses: Many stable businesses use it to boost cash flow.

Damages customer relationships: Professional factors manage communications smoothly.

It’s too expensive: When factoring in immediate cash flow and no late penalties, it can be cost-effective.

Only for certain industries: Any business with receivables can benefit.

Conclusion

Invoice factoring holds threats, but you can control them with the right techniques. As the industry changes, businesses must adapt with active monitoring, diversification, and tech. These steps save finances and maintain factoring operations.

Use invoice factoring to help your business grow. Get paid faster and keep your cash flow strong with our expert help. Work with us to get steady payments and focus on what matters growing your business. Feel confident with a partner you can trust. Improve your finances and see your revenue rise. Let’s begin today!

FAQ

Q: What is a factoring agreement?

A: A factoring agreement is when a business sells its accounts receivable to a third party (a factor) at a discount for immediate cash. The factor then collects payments from the business’s customers.

Q:How to apply for factoring?

To get approved for factoring, apply with your business details. The company checks your customers’ payment history and credit. If approved, you’ll get a contract and read it carefully. Poor customer credit or invoice issues can lead to rejection. Factoring costs more because the company takes on risk, handles collections, and runs credit checks. Higher fees apply if your customers have poor credit or invoices are small. Still, it offers fast cash without needing a loan or collateral.