Once upon a time, there was a small manufacturing company that produced specialty parts for airplanes. The company had been in business for several years and had grown steadily, but they were experiencing some financial difficulties. The management had a hunch that their financial reports might be inaccurate, but they didn’t know how to find out.

To help solve the problem, they hired an accounting firm to do an audit of their financial statements. The auditors examined the company’s books, talked to key people, and checked the company’s internal controls.

After the audit was complete, the accounting firm issued them a type of audit opinion known as an unqualified opinion, meaning that the financial statements were fairly presented and in line with International Financial Reporting Standards.

During the audit, the accountants found some mistakes, like the company was overpaying suppliers, and the inventory records were not accurate. The auditors suggested some ways to improve the company’s accounting and control systems, which the management followed.

After the audit and changes, the company’s financial reporting became more accurate and transparent. The management was able to identify areas where they were overspending and take corrective action. Investors were impressed with the improvements in the company’s financial reporting and controls.

The company’s financial performance improved, and they were able to secure additional financing to fund its growth. The successful audit helped them identify and correct serious issues that could have derailed the company’s growth.

Thanks to the audit, the company continued to grow and expand, becoming a leader in its industry.

What is Audit?

Well, well, well, looks like we got ourselves a story above. But wait a minute, what is an audit anyway? Don’t worry, I got you covered.

An audit is basically like hiring a financial detective to snoop around your books and make sure everything adds up. In the case of the company in our story, the audit turned out to be a real lifesaver!

Still confused?! Let us dispense with the frivolities and get down to business. *Ahem* So, what in tarnation is an audit?!

In the above story, an audit is a review and examination of a company’s financial statements and accounting practices by an independent third party, which in this case was an accounting firm.

The audit involves a thorough review of the manufacturing company’s books and records, as well as interviews with key personnel and testing of the company’s internal controls.

The goal of the audit is to identify any inaccuracies or issues with the company’s financial reporting and to make recommendations for improvement.

In the story above, the successful audit led to improvements in the company’s financial reporting and controls, and ultimately contributed to the company’s long-term success.

Differences between Internal Audit and External Audit

| Internal Audit | External Audit | |

| Differences | ||

| Definition | An internal audit is like a check-up that a company does on itself. It’s done by a special team within the company that makes sure everything is done correctly and that there are no problems.

The internal audit team looks at how the company keeps track of its money and inventory, and they make sure no one is doing anything wrong. |

The company hires an outside team of experts to check its financial records. The team makes sure the financial statements of companies comply with the regulatory requirements.

In the story above, the manufacturing company hired an external audit team to check their records. |

| Who performs the audit? | Internal audit department within the company | Independent 3rd-party firm |

| Purpose | To ensure the accuracy of the company’s financial reporting and identify any areas of risk, fraud, or inefficiency. | To provide a true and fair view of the company’s financial statements and provide assurance that they comply with relevant regulations as well as identify any areas of risk and concern. |

| Reporting | The internal audit department provides recommendations for improving the company’s accounting processes and controls. | The audit firm issues a type of audit opinion on the company’s financial statements, indicating whether they are fairly presented in accordance with accounting standards. |

Importance of Internal Control Audit for Businesses

Internal control audit plays a critical role in safeguarding an organization’s assets and ensuring its financial statements are reliable, which helps build trust with stakeholders and investors.

By identifying weaknesses in an organization’s internal controls, an internal control audit can help mitigate risks and prevent fraud, ultimately protecting the reputation and financial health of the company.

“Internal Control: A Study of Concept and Themes” a book by Graham Cosserat and Neil Rodda provides an overview of internal control and its importance in business operations. It highlights the key components of an internal control system and how it helps in achieving organizational objectives.

The book provides in-depth information about the evolution of internal control so readers can understand better the need for internal control and exactly what it is. The authors have described the relationship between internal control and risk management. They have emphasized how businesses can design and implement proper internal control systems to save costs and reduce risks.

What is Internal Control Audit?

Internal audit is a function that helps organizations achieve their objectives by evaluating and improving the effectiveness of risk management, control, and governance processes.

Internal auditors work as an independent and objective assurance and consulting function within an organization to evaluate the effectiveness of the internal control system. Since the implementation of the Sarbanes-Oxley Act of 2002, which holds managers accountable for the precision of financial statements, internal audits have become crucial in a company’s operations and corporate governance.

For example, suppose a retail store has an internal audit department responsible for reviewing the company’s financial reporting, accounting practices, and internal controls.

The internal auditor may examine cash handling procedures to ensure that there are sufficient controls in place to prevent theft or fraud. They may also review inventory management procedures to ensure that the store is accurately tracking its stock levels and preventing stock loss.

An internal control audit may reveal that multiple departments are performing similar tasks, leading to unnecessary duplication of efforts and increased costs. By streamlining these processes and eliminating redundancies, the company can reduce its operating costs and improve efficiency.

In addition, an effective internal control system can help prevent fraud and errors, which can also save the company money by avoiding losses and legal fees associated with investigations or litigation.

Overall, the internal audit function helps to ensure that the company is operating efficiently, effectively, and within the boundaries of the law and regulations.

What is the Framework for Internal Controls?

The COSO framework is designed to help organizations establish effective internal control over financial reporting and to enhance the reliability of financial reporting. It provides a structured and systematic approach to identify, assess, and manage risks, as well as to design, implement, and monitor internal control.

Types of Audit Reports:

There are several types of audit reports that auditors can issue depending on the findings of their audit. The most common types of audit reports include the following:

An Unqualified Opinion

An Unqualified Opinion is the most desirable type of audit report as it indicates that the financial statements are presented fairly in all material respects and comply with generally accepted accounting principles (GAAP). This type of audit opinion contains no exceptions or qualifications and provides reasonable assurance to users of the financial statements.

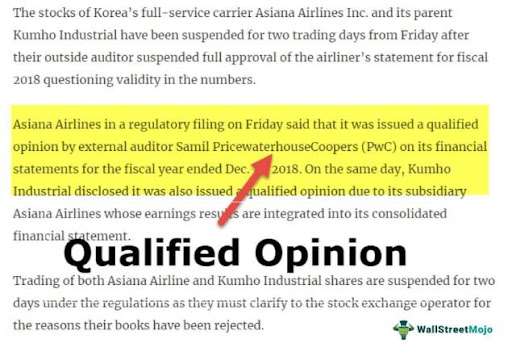

A Qualified Opinion

A qualified opinion is issued when the auditor identifies a material misstatement or limitation in the scope of the audit that affects the financial statements but is not pervasive enough to warrant an adverse opinion. This type of audit opinion or report contains exceptions or qualifications that are specified in the report.

The following is a real-life example of a qualified opinion:

Source: Audit Report Qualified Opinion

An Adverse Opinion

An adverse opinion is issued when the auditor determines that the financial statements are materially misstated and do not comply with GAAP. An adverse opinion will contain a statement that the financial statements are not presented fairly in accordance with GAAP.

A Disclaimer of Opinion

A disclaimer of opinion is issued when the auditor is unable to express an opinion on the financial statements due to a lack of sufficient evidence or limitations in the scope of the audit. Here the auditor is unable to form an opinion on the financial statements and so he will mention this in his report.

Premium CFO Solutions

At Expertise Accelerated, we believe that every company deserves top-notch financial management, regardless of its size. That’s why we are proud to be the best provider of outsourced premium CFO solutions.

Our team of experienced and dedicated CFOs is ready to help your business grow and thrive. Whether you need assistance with financial planning, budgeting, cash flow management, or other financial matters, we have the expertise to guide you every step of the way.

Our solutions are tailored to your specific needs, and we work closely with you to understand your business and its goals. We believe in building strong relationships with our clients, and we’re committed to providing exceptional service and support at every turn.

So, why choose us as your trusted financial partner? Because we deliver results. Our track record speaks for itself, and we’re confident that we can help your business achieve the financial success it deserves.

Don’t settle for mediocre financial management. Contact us today and discover how EA can help take your business to the next level.