Here’s a question that most e-commerce owners don’t think about until it’s too late: Are your numbers working as efficiently as you are?

Sales are growing, traffic is surging, but behind the scenes, financial troubles can quietly strangle growth.

That’s where e-commerce accounting services come in — taking care of the dirty work so business owners can focus on scaling, not spreadsheets.

The stakes are massive. Nix says that the e-commerce market of the world is racing to the trillion mark, and online shopping is comprising 23% of total retail sales. More than three billion online shoppers are today putting their numbers on the internet, which translates to every click, cart, and checkout weighs something. And should you not be tight with your money, it will weigh you down, making you miss taxes, mismanage cash flows, or not get the right price.

It is not only that outsourcing accounting is a time-saving measure, but it is also a powerful move. Specialized e-commerce accounting enables companies to report faster, with fewer errors and more visible cash flow. In an industry where a single erroneous cost may destroy weeks of earnings, personnel who comprehend your figures inside and out are not just desirable, but indispensable.

Consider it this way: marketing will grant you the clicks, operations manages to fulfill the orders, whereas accounting sustains the business. You do not simply want a bookkeeper, but you want a financial co-pilot that will help you identify risks, maximize profits, and make your growth engine run without any hiccups.

E-Commerce Accounting Services: The Secret Weapon for Online Businesses

The reason why modern accounting services are a game-changer for businesses.

Prevents Money Leakage:

Here is a reality check: financial management is one of the greatest unrecognized leaks of a business (Keiser University). You have to juggle various payment systems, changing inventory, international sales, and complicated tax regulations, whether you are B2B, B2C, a startup, or an expanding business, and errors are costly. Specialty accounting services and outsourcing come at that point and make the mess of a reality clearer.

Outsourcing finance not only saves time, but it is opens up strategy, growth, and understanding. Seasoned accountants do not merely follow the figures; they project the cash flow, cut down on expenses, and ensure that different markets and jurisdictions abide by the law.

Why Outsource Accounting:

Even larger companies on the buy-side are offloading trading according to Bloomberg to reduce costs, increase efficiency, and manage emerging markets. The same applies to smaller businesses: when outsourced, the businesses will have access to superior tools, experience, and systems that they would have otherwise lacked.

Of course, it carries trade-offs. The outsourcing implies a reduced level of direct control, a possible decrease in speed, and the necessity to share important financial information with partners.

The good news is that the reward is huge: quicker reporting, reduced mistakes, enhanced visibility of the cash flow, and the opportunity to concentrate on the growth of your business. In this modern-day economy (Forwardly), where markets are rapidly moving and errors are costly, an intelligent accounting strategy is not an option; it is an element of competitive advantage.

Treat it as such: finance is the engine, operations are the wheels, and outsourcing is the turbo boost. When it is done properly, it will enable you to work a bit quicker, climb wiser, and maintain your growth path on schedule, without being buried in spreadsheets.

The challenges of modern business are unique in terms of their financial concerns, which can sometimes be very difficult to absorb using the traditional accounting method, yet they can easily gnaw into profits when there is no prompt action.

Various Payment Methods:

The businesses that are presently involved are not just working with cash and a single bank account. The credit cards, digital wallets, subscriptions, and online marketplaces are only a few examples, but it is possible to follow each transaction across numerous telecommunication platforms, and doing it in its entirety may become a full-time job. Errors in this case can translate to lost sales, late reconciliation, or, in fact, angry customers.

International Sales:

Selling worldwide is a wonderful opportunity to expand, yet it is a nightmare too (Link My Books): exchange rates, foreign taxation laws, and adherence to a continuously evolving set of international laws. Having no specialized supervision, companies may be fined, have unexpected charges, or make expensive accounting mistakes.

Varying Levels of Stocks:

Inventory is moving. Sudden stockouts in the supply chain, seasonal demand, or incorrect stock counting will rapidly convert the profits into losses. Precise accounting that is attached to inventory real-time information is no longer discretionary- it is a survival skill.

Complex Tax Regulations:

Tax responsibilities are no longer local. There is an overlap of the state, national, and international tax code in a manner that is prone to misinterpretations. Audits, penalties, or reputation damage are just some of the outcomes of minor mistakes.

These are reasons as to why specialized accounting services or outsourcing are not only helpful, but necessary. They not only crunch numbers in real-time, but also offer precise reporting, predictive analytics, and enable businesses to scale at will.

Under favourable conditions, businesses would be able to concentrate on expansion, strategy, and customer experience rather than get caught in the financial quagmire.

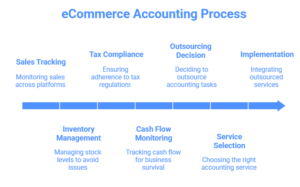

Key Areas of eCommerce Accounting:

E-commerce accounting is a wide scope of activity (WordPress), but here are the major areas where e-commerce accounting is highly needed:

Sales Tracking:

It’s vital to track sales across various media such as Amazon, eBay, or Shopify. eCommerce accountants can assist businesses in tracking their sales in real time.

Inventory Management:

Unlike physical stores, eCommerce businesses often face changing stock. Accounting services can help track inventory levels to avoid issues like overselling.

Tax Compliance:

Tax laws can be complex, especially with international sales. eCommerce accountants ensure businesses follow various tax regulations.

Cash Flow Monitoring:

Tracking cash flow is vital for business survival. Accounting services help manage cash flow fluctuations, especially during sales or seasons.

Why Accounting Matters for eCommerce

eCommerce feels like accounting should not be a problem. Your money is going through an app that is already giving you a record of every penny. But e-commerce means money comes and goes without any planning if you do not keep a record (Sterlinx Ltd.) Customers order, you arrange inventory, sell the product, and soon your budget is suffering. Here are e few reasons why accounting matters in e-commerce:

Large Transactions:

Dozens, hundreds, or even thousands of sales daily on several platforms. The risks of making errors build up without effective accounting, which causes revenue tracking and reporting gaps.

Processing a great number of currencies and payment options, including credit cards and digital wallets, cross-border payments need accuracy. The currency conversions, fees, and refunds should all be well monitored.

Rules on Sales Tax:

The tax is different depending on the state, country, and the type of product (Slide Share). Errors may attract penalties, audits, or late filings, which disorient business activities.

Good accounting is not only maintaining the balance of the books, but also accuracy, compliance, and having a clear view of your finances. In addition to that, it offers the knowledge required in growth planning, inventory optimization, and decision-making. The fast speed of e-commerce compels businesses to know that their numbers are the ones that grow faster and maintain a competitive advantage.

Benefits of Outsourcing Accounting

Here are a few fairly major reasons you should consider outsourced accounting for your SME.

Save Money:

Outsourcing accounting costs less than employing an on-site team. You pay only for needs, like bookkeeping or taxes. You also avoid paying for expensive accounting software.

Get Expert Help:

Outsourced accountants are e-commerce experts. They understand the challenges and can keep your finances in order, stopping expensive errors.

Adaptable and Scalable:

As your business develops, your accounting needs change. Outsourcing allows you to adjust resources and pay only for what you need.

Save Time:

Outsourcing accounting lets you concentrate on business growth, customer service, and marketing.

Key Benefits of Outsourcing eCommerce Accounting

eCommerce accounting comes with its own needs and expectations that are best met with outsourcing. Here is how:

Better Cash Flow:

Outsourcing enables you to track your cash flow, so you know when you have enough money for expenses and development.

Stay Tax-Abiding:

E-commerce tax rules can be illogical, especially if you sell in other locations. Outsourced accountants ensure you follow all the tax laws, so you prevent fines.

Proper Financial Reports:

Outsourced accountants deliver accurate, precise reports to aid you in making better business decisions.

Better Inventory Management:

They also assist in handling your inventory, so you don’t overload or run out of products, maintaining a beneficial cash flow (Findex).

Reduce Fraud Risks:

Outsourcing adds security to your finances. Experts set up inspections to lessen the chance.

Understanding Outsourcing in E-Commerce

Outsourcing in eCommerce involves engaging external service providers to manage typical business processes. These operations include accounting, customer support, digital marketing, order fulfillment, and website development. This permits eCommerce businesses to concentrate on their main activities. Meanwhile, professionals manage tasks that need specialized skills, efficiency, and expertise.

Outsourcing eCommerce tasks can assist you:

- Conserve time and resources: Concentrate on your business while professionals manage accounting, customer service, and inventory.

- Access expertise: E-commerce professionals bring expertise in digital marketing, Search Engine Optimization, and platform management.

- Scale easily: Outsourcing lets you adjust resources during busy seasons for growth.

- Improve efficiency: Specialized providers use advanced tools, ensuring better performance and fewer errors.

Challenges for eCommerce Businesses

While outsourced ecommerce accounting comes with many benefits, it also has its own set of challenges. Here are a few major challenges you should always watch out for:

Inventory Management Across Many Channels:

Managing stock levels across various sales platforms can be complex. eCommerce accounting helps prevent issues like overselling (Outserve).

Selling on Many Platforms:

E-commerce businesses often sell on websites, marketplaces, and social media. Each platform has its own rules and fees, making tracking finances harder.

Dynamic Pricing:

eCommerce businesses often adjust prices based on demand and competitor pricing. Accounting services help businesses keep track of these changes in real-time.

Promotions and Discounts:

Flash sales and promotions complicate financial management. Professional accountants track the impact of discounts to ensure accurate financial reporting.

Picking the Right Outsourced Accounting Service:

Here are a few ways you can ensure that you choose the right e-commerce outsourcing firm for accounting.

Look for Experience in eCommerce:

Choose a provider familiar with e-commerce platforms like Shopify or Amazon and online transactions.

Find Customizable Services:

Seek a service that provides adaptable packages to satisfy your business’s needs. Whether you require bookkeeping or tax help, they should offer the proper services for you.

Check Reputation:

Before employing, go through reviews and ask for referrals from other businesses. You want to perform with a reliable vendor.

When to Outsource Accounting?

Outsource accounting when your business expands, and financial tasks become too intricate to handle on-site. If you are unable to have expertise in accounting or financial management, offshoring can support you. It provides you with access to experienced professionals who can handle these areas.

Outsourcing permits you to concentrate on core business activities such as sales and marketing. Meanwhile, experts handle your accounting. If you need help with taxes, compliance, or financial reporting, offshoring can simplify these tasks. It also lessens the chance of mistakes. Offshoring accounting saves time and allows you to concentrate on growing your business.

Accounting Tips for an eCommerce Business

These are some tips when using outsourced accounting services:

- Use software to handle invoicing, taxes, and expenses to save time and avoid mistakes.

- Keep an eye on all sales and payments. Outsourced accountants can help with this.

- Make sure you always have enough money to pay bills. Outsourced services can help you manage this (Sonary).

- Use different accounts for business and personal expenses.

- Follow tax rules to avoid fines. Outsourced accountants can help keep you on track.

- Keep track of inventory expenses, such as storage and shipping costs.

- Save receipts and invoices. Outsourced services can keep everything organized.

- Set aside money for taxes. Outsourced accountants can help you estimate this.

- Predict your income and expenses. Outsourced accountants can assist with planning.

Conclusion

Outsourcing eCommerce accounting reduces cost, offers expert support, and enriches cash flow management. It lets you focus on business growth while the professionals manage the finances. With a good outsourced accounting service, your business operates well.

Ready to begin? Know how our eCommerce accounting services can boost your business. Outsourcing is not about time-saving; it’s about making wise financial choices for lasting success.