AI is the new frontier of financial development. Gartner reports that 59% of finance teams use AI in their operations while KPMG says that 71% of companies are scaling AI for their finance processes. With 83% of financial instititos observing that AI has become indispensible to forecasting and risk management in finances.

AI is now the future of accounting and bookkeeping services. This acceleration has been occurring at Expertise Accelerated. With AI tools, models, copilots, and analytics systems flooding the market, the discussion has divided into two opposite poles: blind euphoria or outright skepticism.

That is why we created our publication series, not to contribute to the noise, but to provide the finance leaders with clarity, context, and critical thinking. The truth about AI is quite simple: it is powerful, yet it is not understood, is misused, and is still immature.

Adoption, though, is occurring at a rate that we hardly usually see when it comes to new technologies.

According to a recent Nvidia State of AI in Financial Services survey (Nvidia Blog):

- Already, 91% of financial institutions are utilizing AI in one of their business functions.

- Almost 83% intend to spend more on AI in 2024.

- The development of products or services with AI is a major decision today.

- A third of the companies believe that AI is crucial to their competitive advantage in the next 24 months.

It is impressive given that technologies of the same scale, cloud computing, mobile payments, and even the internet itself, took 5-10 years before they became mainstream. It has been reached under two by AI.

But then there is the other side of the tale:

Even now, AI is not anywhere along the way of being fully developed, despite the hype. It is still a young, developing field with unresolved issues of security, governance, accuracy, regulation, and risk in the long run.

It is due to this that we support a balanced attitude:

- Adopt AI, but with intention.

- Evaluate relentlessly.

- Integrate gradually.

- Adapt continuously.

The finance industry can not afford impulsivity, particularly when decisions are involved that will influence compliance, risk management, cash flow, forecasting, and investor confidence.

So we will deconstruct the future. There is an imminent need to get past all the noise and speculation about AI and have a more grounded, data-driven perspective. This is where AI in finance is going in 2026- and the trends every leader must follow.

-

AI not as a Side-Effect but as a Capability:

The finance operation is experiencing the most significant structural change since the inception of the spreadsheets. AI is no longer the experimental side project or the help tool that sits at the periphery of operations; it is becoming the engine behind the current finance.

The top CFOs no longer shape workflows to fit AI but are instead pursuing how to incorporate AI into workflows that are currently obsolete. Artificial intelligence-based forecasting is substituting the old spreadsheet models with systems that crunch through millions of data points and identify patterns that human beings would overlook, and continually update forecasts in real-time.

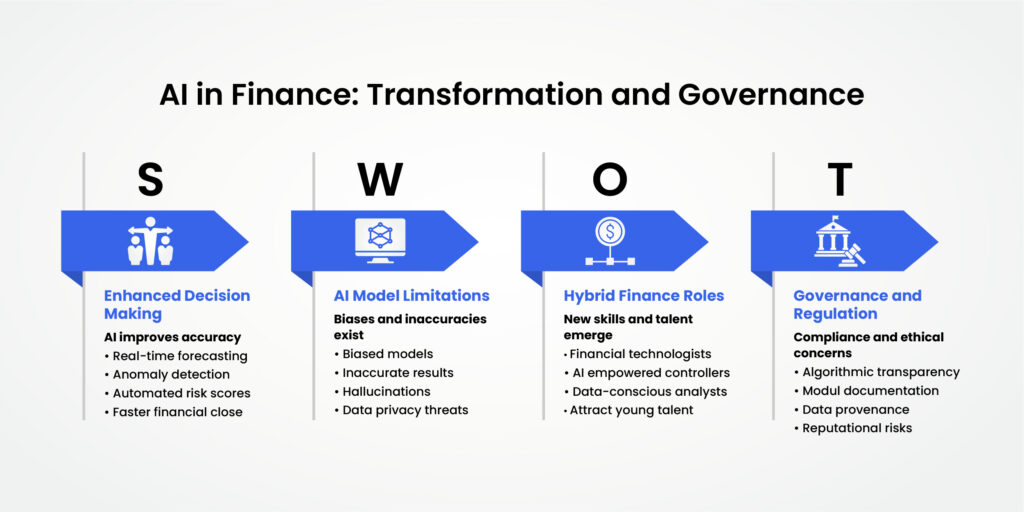

AI in finance teams is being used to detect anomalies in order to detect irregular transactions within seconds, minimizing fraud risk and rendering books clean. Machines are automating risk scores, loan evaluations. And even credit decisions with significantly greater accuracy than human evaluation processes.

Artificial intelligence technology is transforming the financial close on the operational side. Work, which previously took days in the reconciliation process, journal entries, and variance analysis can now be automated, and closing processes would take weeks, but today it only takes hours. Predictive cash flow solutions enable CFOs to anticipate cash flow issues several months in advance and implement countermeasures.

The companies that survive 2024-2025 are not the ones merely utilising AI. It is they who are reorganizing their finance systems to have AI as the foundation of decision-making, effectiveness, and strength. The difference between AI and traditional finance operations in the sphere of competition is increasing very fast.

-

The AI Accountability Challenge, Risk, and Governance:

With AI growing stronger and encroaching more on financial infrastructure, the issue of governance has grown exponentially (IBM). It is now up to the leaders in finance to strike a balance between the speed and automation brought about by AI and the need to ensure accuracy, auditability, and compliance.

There are weaknesses to AI: biased models, inaccurate results, hallucinations, the threat to data privacy, and security threats. The regulators are reacting by tightening their demands regarding algorithmic transparency, model documentation, and data provenance. In particular, in areas with sensitive financial data. This is the environment where finance teams are becoming tools of AI integrity within their organizations.

There is no longer a need to have strong AI governance structures as an option. Companies need to trace the performance of models on a constant basis, verify the sources of data, record assumptions, and ensure a rigid human control over automated decision-making. Such tools as human-in-the-loop controls, rollback capabilities, and audit trails. It makes sure that AI is not a source of uncontrollable risk.

The potential of AI is massive, whereas unregulated AI brings financial, legal, and reputational risks. The victorious ones will be the companies that instill responsible AI in their infancy stages – creating systems that are quick, scalable, and reliable.

-

Human + AI: The Future of Finance Workforce and New Skills:

Although there is the fear of people losing their jobs, AI is not stealing the jobs of finance professionals, but it is transforming their jobs into becoming more strategic and more impactful. The manual work is taken away by AI, but the decision-making, morals, interpretation, and strategy of the financial professionals cannot be automated. The future of the human finance workforce is not human, nor AI, but a combination of human and AI.

Accountants and analysts are becoming AI-fluent. Who can make sense of the machine-generated information, justify the results, and apply automated guesses to make strategic decisions?

New hybrid jobs are coming into being, such as financial technologists, AI empowered controllers, and data-conscious financial analysts, combining essential accounting skills and analytical and digital skills.

The younger generation of talent is coming into the workforce with a demand for modern systems, automation, and real-time tools (Nexford University). Companies that hang on to old technologies and dogmatic work processes are not able to attract and keep this generation.

In the meantime, those companies that have invested in AI training, digital literacy, and redesigned career paths are creating agile, empowered, and future-ready teams. The future finance role is not only quicker, but it is also smarter. And it will have professionals who will know how to work with AI.

-

The Prevalence of Generative AI

In Nvidia’s report, 55% of respondents pointed toward generative AI and Large Language Models (LLMs) as areas of interest in AI in the finance industry. Using AI, accounting and finance experts are striving for accurate and consistent synthetic data generation, report generation. This means pretty much anything to do with processing and categorizing large amounts of data.

On top of that, the pros in the finance sector also realize the massive potential for AI. Especially when it comes to customer interaction and enhancing customer experience. 34% cite the customer care aspect as a pain point that artificial intelligence can address. Many have already implemented some form of AI chatbot or assistant to facilitate client relations.

This trend will stay on the rise through 2026. One of the big concerns is, of course, the dangers of data-bias and privacy concerns. When it comes to surrendering to a program that we cannot guarantee is secure, millions of bytes of financial data in 2026.

-

Bolstering Operational Efficiency with AI

The finance function is the beating heart of a business. It falls to them to properly manage and deploy resources to get results. With AI, this job becomes far easier and streamlined. By implementing AI strategically in key places where human intervention is at best mitigative and at worst destructive.

Places like bookkeeping, accounts payable and receivable, financial forecasting, and cash flow projections, for example, are key processes that dictate operational efficiency. These processes are also very open to automation and AI integration.

We have seen institutions, like Sage, report very positive results by implementing AI in their processes (McKinsey & Company). This results in an overall business operational efficiency boost.

Finance services and firms in particular sang the praises of AI and its immaculate ability to speed up tasks like application development. Experts at Sage highlighted how they were learning newer and better coding languages in days thanks to ChatGPT. Plus, the program was invaluable for developing their proprietary software.

So, we can expect going into 2026 much wider implementation of AI. There will be a lean towards using AI in the finance industry. This will bolster operational efficiency and create a sort of chain reaction. At first, it may seem stressful. But these are all growing pains that firms have to endure in order to succeed.

-

Curbing Burnout and Staffing Shortage with AI

The accounting profession is approaching dangerous territory when it comes to staffing. 31% of accounting professionals plan to outright quit the profession in the next 12 months.

There is really no recourse from this impending exodus other than improving industry conditions and fostering an environment conducive to accounting and finance work.

Artificial intelligence can do a lot of good as far as countering and eliminating dissatisfaction and burnout. With AI, all the menial tasks like manual data entry, bookkeeping, and financial reporting can be left to computers to handle. Leaving finance professionals with a much less physically taxing job and unveiling fertile soil to cultivate mental exercise.

Above all else, finance professionals are hired for what insights and analysis they can provide. We depend on them to help with decision-making, and often, it comes down to the CPA in the room to approve or reject a business project.

Read more about Will AI replace accountants here.

-

Potentially Incoming Regulations

No surprise to anyone, despite being widely accepted and adopted, there still remains a lot of ethical ambiguity in the use of AI in the finance industry. Just take the matter of customer payment information, for example. If that were pushed into AI hands, who is to say it would not end up in the hands of malicious actors?

White House Office of Science and Technology Policy, for this very reason (National Archives), laid out what they call the “AI Bill of Rights”. This is a set of guidelines for the ethical use of AI and protections from AI that every American citizen has a right to.

While these are more of a warning and boundary drawn by the government, we can expect a much heavier and legally binding regulatory act down the road for the security of financial data in 2026.

For this reason, it may be prudent to limit AI to tasks like bookkeeping and forecasting that utilize publicly available data. This will prevent the need for significant changes should any strict regulation come forward, which is likely to be the case.

Conclusion

There is a lot we can glean about trends in AI in finance and accounting going forward. However, we must not lose sight of the fact that the technology is still largely in its infancy. A lot can change very quickly should a breakthrough or setback happen in 2026. Accounting and finance firms must maintain the delicate balance of AI integration.

So that AI is more of an extra tool to boost efficiency on top of everything else, and not the foundation on which the finance function is built. And for those who cannot leverage all these new, shiny, and expensive artificial intelligence and automation software, there is still the option of retaining outsourced accounting services to bring down costs and promote efficiency.

Just because there is a new player in the game does not mean everything that came before is rendered moot. Keep doing what you are doing and above all else, stay informed.