Would it be possible to have your accounts payable process do more than just pay bills?

What could it do more constructively to enhance your cash flow, minimize mistakes, and liberate your staff to work on growth?

To most companies, accounts payable (AP) is a silent time and resource killer. Incidentally, manual processing of invoices, late approvals, early-payment discounts, and stretched finance departments can silently strangle cash flow and slow down decision-making. However, AP does not necessarily need to be a bottleneck, but it can be a strategic advantage.

That is why the number of companies that are outsourcing AP services is increasing. As a matter of fact, as CapActix indicates, the global accounts payable outsourcing market is estimated to be $914 million in 2030, and it is likely to experience further growth as companies focus on efficiency, precision, and cost management (CapActix).

This explosion is an indication of a wider trend: AP is not viewed by organizations as a back-office operation anymore, but as a service that directly drives financial health and vendor relations.

Outsourcing of accounts payable management helps businesses to make the correct payments promptly, increase the confidence of the suppliers, keep the financial records clean and well organized, and have a better understanding of the outgoing cash.

Most importantly, it allows the internal teams to focus on strategy, scalability, and growth instead of paperwork and follow-ups due to a reduced load on operations.

Here, we are going to discuss what the outsourcing of accounts payable is, how it functions, and the significant advantages that make it a very intelligent decision in the current business world, where businesses are striving to be lean, quick, and efficient in their operations.

What is Accounts Payable Outsourcing?

Accounts payable outsourcing means hiring another company to manage payments and invoices for you. This helps reduce the workload for the business’s team. These providers have the skills and tools to improve accounts payable.

Accounts payable refers to temporary obligations to suppliers. It is listed as a liability on a company’s financial statement. The best outsourcing partners handle these tasks in a better way. Some businesses with sensitive data prefer to handle payments themselves using automation.

According to Bloomberg, Baker Tilly is adapting to three significant changes. First, more customers are using online services. Second, people now value good service and strong relationships more than low prices. Finally, innovation means providing new and customized services to meet different needs.

The Growing Strategic Value of Outsourcing in Business

Outsourcing is now seen as a smart strategy beyond saving money. With a rise in remote work, businesses use outsourcing to enhance efficiency and support growth. According to the HBR, in 2022 (Escalon), 90% of small businesses in the U.S. planned to outsource tasks like tax, accounting, and human resources. They noticed that rather than focusing on expanding their business, they spend about seventy percent of their time on everyday chores.

The global subscription market will reach $1.2 trillion by 2030 as it is growing fast (Senal News). Todd Bernhardt from Baker says outsourcing gives access to experts and advanced tools (Inbound Logistics). He adds that this setup, through subscriptions, helps businesses save on costs. According to the AICPA, outsourcing accounting services for CPA firms will become a significant revenue source in the future (AICPA and CIMA).

As companies move through stages—startup, growth, maturity, transition, or exit—Baker customizes its services to their needs. Startups often handle essential tasks with a small team. Growing businesses face challenges in HR, taxes, and accounting.

These challenges can lead to issues like payroll errors and financial mismanagement. Business owners should focus on their main activities. Baker will handle financial tasks and work with clients to support their goals.

According to CNN, Businesses have long outsourced payroll and tax functions to save time and money. Now, some firms handle all financial tasks below the CFO level, cutting costs by 25 to 40 percent (AB Magazine). The Internet now makes it easier for startups and small businesses to outsource more functions online.

For example, General Motors recently outsourced its financial operations in a $250 million deal (Study Corgi). Additionally, new firms like LeapSource are growing by serving mid-sized businesses. Outsourcing is even developing, regardless of the challenges.

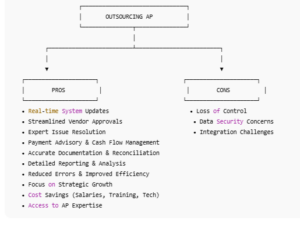

Benefits of Outsourcing Accounts Payable

Outsourcing accounts payable (AP) services has many benefits. It makes managing your finances easier and more efficient (Now CFO).

System Updates

With outsourced services, your accounting system gets automatic updates. This means sales orders, bills, and goods receipts are always up to date, giving you accurate financial data in real-time.

Vendor Approvals

Outsourced providers help manage vendor approvals by checking everything against sales orders. This keeps your business compliant and builds stronger relationships with vendors.

Issue Resolution

Experts handle issues like unauthorized purchases, missing goods, and invoice errors. This reduces mistakes and keeps operations running.

Payment Advisory

Outsourcing gives you access to expert advice on handling payments. Professionals help avoid early payments, secure discounts, and set clear payment instructions. This helps you manage cash flow better.

Documentation and Reconciliation

Outsourced services include drafting important documents, such as credit and debit notes. They also keep vendor accounts accurate and reconcile them. This ensures that your financial records are transparent and correct.

Reporting and Analysis

You’ll receive precise reports on things like aging payables, outstanding orders, and unpaid invoices. These insights help you make informed purchasing decisions, budget, and spot vendor trends.

Focus on Growth

Outsourcing authorizes you to divert your focus back to growing your business. Handling accounts payable consumes resources and time. These resources could be better used for strategic tasks. For example, you could focus on expanding your market or improving customer relationships.

Reduce Errors

By outsourcing, you acquire credentials from experts who specialize in accounts payable with industry knowledge and experience. They use advanced tools to reduce errors like duplicate payments, missed invoices, or wrong entries. This keeps your financial management accurate and protects you from potential losses.

Increase Efficiency

Outsourced services streamline the entire accounts payable process. By automating tasks and speeding up invoice processing, they improve cash flow and ensure timely payments. This not only improves efficiency but also helps maintain good relationships with vendors.

Save Costs

Outsourcing can help save money by reducing costs associated with maintaining an in-house AP team. This contains salaries, technology, and training expenses. It also permits companies to take advantage of earlier payment deals and avoid late payment fines. Both actions further boost their financial position.

Access to Expertise

Outsourcing accounts payable gives you access to expert teams who stay updated on the latest changes in rules and best practices. This ensures that your AP function operates well and meets industry standards. It is particularly valuable for SMEs. These businesses might not have the budget to hire permanent financial professionals.

Drawbacks of Outsourcing Accounts Payable

Loss of Control

Outsourcing can help you control spending better. To keep things running well, stay in touch with your outsourcing partner and get regular updates.

Data Security Concerns

Sharing financial data with another company can raise security concerns. To protect your information, choose a provider that follows strict security guidelines.

Integration Challenges

Adding outsourced AP services to your current systems can be tricky and may cause temporary issues. Choose a provider experienced in smooth system integration to make the process easier.

Accounts Payable Outsourcing versus Accounts Payable Automation:

Accounts payable are also important in the management of healthy cash flow and good relations with the vendors. Nowadays, companies have a decision between outsourcing their AP department or automating it through software. Although both methods are geared at eliminating manual labor and errors, they operate at extremely diverse levels.

Accounts Payable Outsourcing

Accounts payable outsourcing refers to the process of giving your whole AP process to an outsourcing vendor. Under this partner, all the tasks, such as invoice receipt, approvals, and payment, are handled through their own systems, tools, and trained teams.

Businesses that desire to have AP off their internal workload usually opt to outsource. Daily operations, compliance, and accuracy are left to the service provider, and internal financial departments are freed to do other, more valuable processes, such as planning and analysis.

Before choosing an AP outsourcing partner, it is worth considering:

- Models of pricing and contract flexibility.

- Invoicing Scope of services offered (invoice processing, vendor management, reporting)

- Data protection and standards of security.

- Responsiveness and customer service.

An effective outsourcing partner pays on time, enhances cash flow visibility, minimizes late fees, and also increases vendor relationships due to proper, consistent, and accurate handling.

Automation of the Accounts Payable:

Accounts payable automation, however, does not move AP off-site, but substitutes manual labor with automated programs. AP automation systems can work alongside your existing accounting or ERP system and automate daily processes without handing the reins over to a third party.

More modern AP automation software usually comprises:

- A vendor portal to deal with vendor information and communication.

- Online invoice capture, scanning, and safe document storage.

- Robotic approval processes to do away with email trails and time wastage.

- Checking for fraud and validation.

- Acceptance of local and international payments.

- Live Dashboard and payment reports to manage cash.

Automation would suit those companies that desire to be faster, transparent, and accurate, yet they would still need to have direct control of their financial activities.

Which Option Is Right for You?

AP outsourcing is the option to choose in case you want a minimum of internal involvement and maximum operational relief. Select AP automation under the consideration that you need to retain control but enhance efficiency via technology.

It happens in most instances that the expanding companies do go ahead and integrate the two, one through the application of automation software that is facilitated by the outsourced specialists to gain the benefits of efficiency and scalability.

Accounts Payable Outsourcing- How to select the correct partner:

The choice of accounts payable (AP) outsourcing partner can have a direct effect on your cash flow, relationships with vendors, and your general financial effectiveness. The correct provider does not merely make invoices- they are a part of your finance department. The following are the main tips to consider to make a sound, confident decision:

Find Previous Experience and a Good Track Record:

Find a provider that has a track record of experience in dealing with accounts payable and, hopefully, in your industry. The industry-specific knowledge will assist them in interpreting familiar billing models, compliance rules, and expectations of vendors, making these mistakes less frequent and shortening the time to enter the new job.

Assess their Technology and Security:

The AP partner must be capable of utilizing state-of-the-art technology like automation, digital invoice processing, and real-time reporting. Information protection is also vital. Ensure that they engage in stringent cybersecurity measures such as secure access controls, encryption, and system audits.

Assure Scalability and Flexibility:

The growth of your business will alter your AP needs. The provider must be in a position to scale services up or down without interruption, it may have more invoices, more vendors, or seasonal fluctuations.

Confirm End-to-End AP Coverage:

Identify a partner with a full set of AP services, such as invoice receipt and processing, approval process, payments, vendor communication, and reporting. End-to-end coverage minimizes transfers, waits, and lack of accountability.

Focus on Value, Not Just Price:

Although it is a cost-based business, the lowest cost is not necessarily the best. Freud questions how the provider can enhance efficiency, minimize payment errors, seize early-payment discounts, and enhance cash-flow management. Short-term savings do not have value over the long term.

Evaluate Customer Support and Communication:

There must be clear and consistent communication. Select a provider who is easily accessible, updates proactively, and responds when problems ensue. Having transparency in reporting and having a point of contact can go a long way in day-to-day operations.

Check Compliance and Regulatory Knowledge:

When your business happens to be regulated, make sure that the provider adheres to the existing laws and accounting standards. They also need to be conversant with the audit requirements and must have documentation that contributes towards compliance and accuracy of reporting.

It is not just that the right AP outsourcing partner helps cut down workload- the partner assists in establishing a more controlled, efficient, and scalable finance operation. The time to consider experience, technology, flexibility, and communication will be rewarded with increased cash flow and less problematic relations with vendors.

Conclusion

Outsourcing accounts payable saves money, enriches operations, and sustains company objectives. By choosing the right provider, businesses can improve their accounts payable. Using the right technology also helps improve the process. Managing the outsourcing relationship well turns accounts payable into a competitive advantage.

To see how our AP outsourcing helps, schedule a call with Expertise Accelerated. We’ll work with you to create a strategy that meets your unique needs.