Managing money in healthcare is getting harder. For many care providers, handling finances takes time away from caring for patients. Outsourcing accounting lets providers focus on patients by handling their healthcare finances.

Outsourced accounting services save money, clarify finances, and manage billing, claims, and payroll. Experts handle healthcare rules to keep billing and reports accurate and legal, so you don’t have to worry.

Healthcare outsourcing is growing fast. Around the world, it’s expected to reach $312 billion by 2025. In the U.S., it could grow to $66 billion by then.

This blog covers outsourcing healthcare accounting benefits, services, and partner selection.

How Does Accounting Outsourcing Help the Healthcare Industry?

Running a healthcare practice today is more difficult than ever. Clinics are merging with hospitals, payments are dropping, and costs are rising. On top of that, healthcare rules and policies are always changing. All this takes time away from what matters most caring for your patients.

Hiring and keeping skilled staff is also becoming harder. Many healthcare teams are busy and don’t have enough time or help, especially with healthcare finances.

That’s where outsourcing accounting can help. A good accounting partner gives you correct reports on time, helping you run your practice better and make smart choices.

According to Forbes, John Donne said, “No man is an island,” meaning no one can work alone. The same goes for businesses. Healthcare providers need customers, staff, and must follow rules to succeed. I’ve worked in healthcare outsourcing for over 10 years and want to share useful insights. Doctors study hard, but running a practice also means managing money, records, taxes, and insurance claims. These tasks take time away from patient care. Doctors can save time by outsourcing these tasks to experts.

Outsourcing lets experts handle tasks so doctors can focus on patients. It also helps follow important rules like HIPAA. Choosing the right partner is key. They must know healthcare laws, use the right tech, have skilled staff, and be financially strong. Outsourcing lets experts handle tasks so providers can focus on care.

How an Expert Accounting Partner Can Help Solve Healthcare Challenges

Healthcare organizations deal with many tough problems. Finding skilled staff is hard, and healthcare rules keep changing. There’s also pressure to use new technology without spending too much. Many practices wait until something goes wrong before asking for help. Getting help early from a good accounting partner prevents problems and keeps things smooth.

A skilled accounting team can make a big difference for your healthcare practice. They help you keep track of your money and show you how your practice is doing. Because they understand healthcare, they can catch problems early before they get worse. They also bring new ideas and help you find ways to save or grow. They offer flexible support, protect patient data, speed up billing, and help you get paid faster. They also take care of taxes, helping you stay on track and even save money with possible credits. Most importantly, with the financial work taken care of, you get more time to focus on your patients.

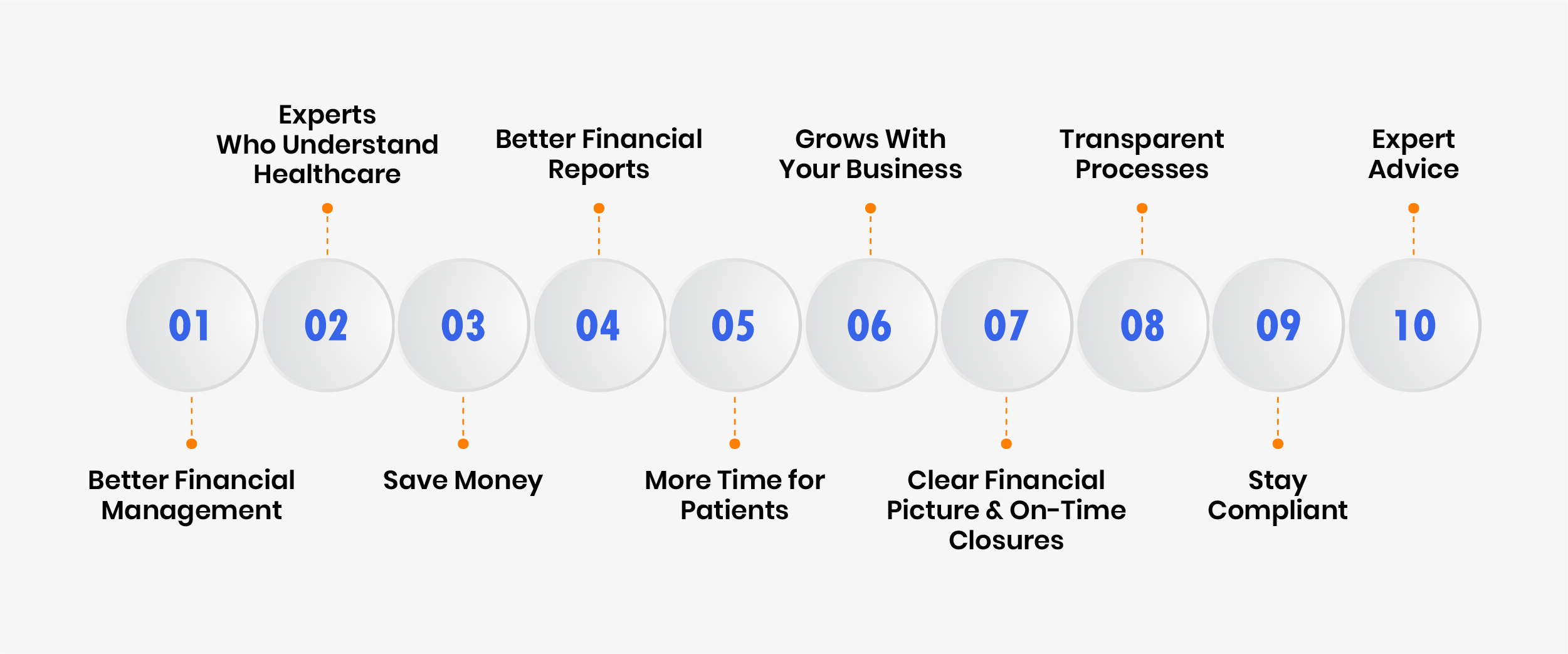

Benefits of Outsourcing Healthcare Accounting

1. Better Financial Management

Outsourcing keeps finances organized with expert bookkeeping, taxes, payroll, and cash flow management.

Want to learn more about financial management. Check out our latest blog: Eye-Catching Finances: Outsourced Accounting for Optometrists.

2. Experts Who Understand Healthcare

Outsourced accounting teams know healthcare rules like HIPAA and billing. Experts understand your needs, making sure your accounting is accurate and your business runs well.

3. Save Money

Hiring and training an in-house team is costly. Outsourcing cuts these expenses with fixed monthly rates, letting you plan your budget better and spend more on patient care.

4. Better Financial Reports

Outsourcing firms use modern tools to give accurate reports that help you decide fast.

5. More Time for Patients

With accounting handled by experts, your staff can focus more on patient care, reducing stress and improving service.

6. Grows With Your Business

As your practice grows or adds services, outsourced accounting scales with you—no need to hire more staff.

7. Clear Financial Picture & On-Time Closures

You get accurate reports and up-to-date records, making planning and audits easier.

8. Transparent Processes

External teams offer full transparency, building trust and accountability.

9. Stay Compliant

Experts keep you up-to-date with tax and healthcare laws, reducing risks.

10. Expert Advice

Access specialists from tax experts to CFO-level advisors who understand healthcare.

What Accounting Services Can You Outsource?

Outsourced accounting helps healthcare providers manage many important tasks. It speeds up insurance claims and reduces delays. It keeps track of money coming in and going out to improve cash flow. It makes sure your bank and credit card records are correct and catches mistakes early. The team handles payroll to pay staff right and on time while following tax rules. You get clear financial reports to help make good business decisions. Experts help plan budgets and forecast future growth. They prepare taxes on time to avoid fines. They handle medical bookkeeping, billing and coding to avoid errors and increase income. They manage the whole payment process, from patient visits to final bills, well. Outsourcing also helps you stay ready for audits and follow rules. It tracks costs to help you save money and keeps an eye on your important equipment.

How to Choose the Right Outsourcing Partner

Choose a provider who knows the healthcare industry and has experience with similar clients. Make sure they protect patient and financial data with strong cybersecurity measures. Read reviews and ask for references. Good feedback from other healthcare providers is a great sign. Your practice is unique. Make sure they offer services that fit your specific needs.

A healthcare provider hired a company to help keep track of patient information and medical bookkeeping. The team made simple screens that showed updates right away, so staff could find problems faster. This shows how using outside help with data can save lives.

Conclusion

Outsourcing healthcare accounting is a smart choice for any medical practice. It reduces costs, enriches accuracy, ensures you follow rules, and gives you more time to focus on patient care. Experts handling taxes, billing, and planning give you reliable support and peace of mind.

Outsourcing makes managing finances easier and lets you concentrate on patients. Want to learn more? Book a consultation with EA. They provide outsourcing accounting services to ease your financial tasks, so you can focus on great patient care.

This guide helps you choose the best path for your care facility’s future.