Is your retail business missing out on money and even without knowing it?

Cash flow will not be left to a back-office measure this year, but it will be the lifeblood that keeps successful retailers afloat.

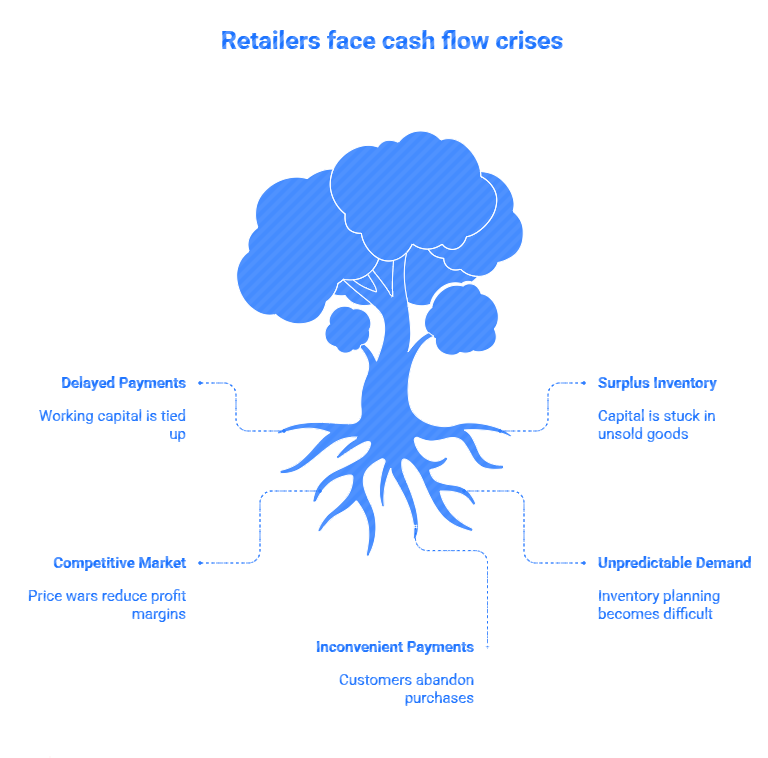

The recent Retail Economics Report indicates that close to 40 percent of small and medium-sized retailers have stated that they are faced with cash crises, to allow them to stock high-demand products, and their delayed payment and surplus inventory are keeping essential working capital tied up.

The actual question is not whether your business can achieve a profit but rather whether you have funds at your disposal to jump at opportunities as soon as they present themselves.

Retail is accelerating at a pace never seen before, with the sudden trends on social media and disruptions in supply. The companies that can manage cash flow proactively do not survive; they grow, invest, and are ahead of other businesses.

Why Cash Flow Matters?

Cash flow is the amount of cash that comes into the business’s bank account as income and is spent by the business on expenses (BIM POS). It refers to the cash available at the business’s disposal, not cash pending collection.

Consider a retail business in the fashion industry facing a surge in demand for a specific product during a peak season. If the business doesn’t have robust cash flow management, it may struggle to secure enough inventory to meet the increased demand.

Without sufficient funds, the retailer might miss out on sales opportunities, lose customers to competitors, and ruin its reputation due to stock shortages.

A negative cash flow impacts the ability of the business to pay its suppliers and invest in growth. A business may be profitable, but if it deals poorly with cash flow management, all the profitability in the world will not avert disaster.

Why is Cash Flow Management a Primary Concern for Retailers?

US retailers frequently face cash flow challenges due to several factors (Paychex). Some factors are within their control. While others are not, such as rising interest rates.

The E-commerce industry is booming (exploding!), making retail unbelievably competitive. Unless your retail business sells proprietary products, selling something is hard these days.

Whatever you are selling, someone else competes at a lower price point. Hundreds and thousands of retailers desperately try to be the customer’s choice. Projections from Precision Reports show that the retail industry will only keep expanding and growing in market size. The competition will get tougher.

With such an ultra-competitive business environment, working to improve cash flow is of paramount importance.

The business needs all the fat trimmed off, keeping only the vital parts and focusing on maximum efficiency. Every last penny counts. The better the business can maintain and grow revenue while controlling costs, the stronger its position will be.

None of us is unfamiliar with the geopolitical turmoil that has become the norm in our daily newspapers. We can never predict when things can go south. As with the pandemic, we saw entire economies crumble in a matter of days. Only the smart retail businesses that focused on their cash flow had the resources to keep the lights on while the world was shut down.

Retailers who do not adapt and strive to improve cash flow will soon find that they are riding horseback on a road full of cars. That is to say, reluctance to adapt and change will not stop everyone from changing and overtaking you.

How Can a Retail Business Improve Cash Flow?

Here’s the list of strategies that retailers can take advantage of to improve their cash flows:

1.Revise Payment Collection Policies

The bottom line is getting paid more and faster than you spend. The quickest way to remedy payment woes and ensure regular cash flow is to set up payment collection terms that improve cash flow.

Luckily, retail businesses have a lot of flexibility regarding payment terms. As retailers primarily deal with selling to the masses, they can implement payment policies (BIM POS). Mostly, people will abide by them as long as the product is what they want.

The key point here is to make an effort to implement and uphold strict collection terms.

Many mom-and-pop stores, for example, are known to sell to locals without any proper understanding of the retailer-customer relationship. If we look at the stats reported by Tide, 36% of businesses have a 30–to 90-day collections policy, which is a long period. This forces retail businesses to go into their savings while waiting for payments.

While somewhat admirable and understandable, behavior like this is still detrimental to the business. The most impactful change a business can make to improve cash flow is laying down the law on when payments will be collected. They should actively ensure that collections are done.

For example, the business can put up a notice that it is not selling on credit. The business can also specify that sales on credit are okay, but customers must pay within seven days of the purchase. The policy can be whatever best fits the business, but a policy must be in place.

2.Improve Inventory Management

The inventory management and supply chain sector is the most efficient route to improve cash flow.

The business can only improve its cash flow when operating at its maximum potential. One of the biggest hurdles when managing retail business cash flow is the unpredictability and whims of the consumer base.

A product selling like hotcakes one day can easily be forgotten the next. New stuff is coming out daily, so getting complacent with your inventory stocking is a bad idea.

Then, there is the issue of supply and demand planning. A business that sells clothes has to plan months for what goods will be in demand in winter. But suppose the sales were not as expected. Hence, all that winter inventory the business stocked up ends up in a bargain bin by the end of the season.

While there is no real surefire way to combat this incredible volatility in demand, businesses can mitigate these circumstances by staying in touch with their customer base (Retail News Post).

It’s the age of social media, and trends are defined by TikTok more than brands or celebrities. Stay in touch with the market, and use all the available data when making forecasts and cash flow projections.

Leverage inventory management software solutions. These solutions can instantly process large swathes of data and generate as close to a future prediction as possible.

A combination of market monitoring and forecasting is the best way to avoid stocking mistakes. This positively affects cash flow as goods keep coming and going rather than being deadstock, taking up space, and costing valuable money.

3.Make Payments Easy

According to the National Retail Federation, 97% of customers report that the number one reason they back out from buying a product is that the payment process was too inconvenient. This is a vital area to work on to improve cash flow.

Don’t run a cash and card-only business. Most people favor electronic payment methods like PayPal. Many firms opt for a completely contactless payment experience. Self-checkout at brick-and-mortar stores and streamlined online payments for e-commerce retailers are the way forward.

Another point to focus on in payment streamlining is the possibility of an interest-free installment program. Trends like buy-now-pay-later, for example, are very common among the younger generations today.

In this trend, businesses sell luxury products to customers on the condition that the payment will be collected in installments without interest (Checkout). This is a surefire way to capture a huge demographic of customers who cannot purchase products outright but can do so in installments. These same people will also become the dominant demographic, so businesses would do well to cater to their preferences.

Making payments easy increases the chances of customers spending money. Payments start coming in quickly. Offering discounts when using certain payment methods is also a good plan. It can incentivize customers to pay on purchase rather than delivery, making cash flow into the business faster.

4.Diversify Your Funding Sources

Another good way to improve cash flow is to have multiple available cash sources. By cash sources, we mean ways for the business to still have the cash to continue operations and fulfill its debts.

This can be anything from a cash reserve of a portion of monthly saved income to a business credit card, which allows you to secure time and make purchases during slow business seasons (Order). Bank loans are another avenue to secure cash and prevent yourself from going negative in the cash flow department.

However, treating these alternate cash reserves as emergency backups that will pick up the slack when business isn’t booming is important.

5.Outsource Your Operations

Outsourcing operations where possible is an immaculate way to improve cash flow. You want to cut costs while making more money, and outsourced operations are the perfect solution to meet both of those goals.

With outsourced remote operations, businesses can have the same employee roles but pay a fraction of the in-house cost, allowing for more savings. The saved cash can then be spent to optimize and improve other areas of the business, such as fixing a physical store or building a better e-commerce platform, etc., which will go on to aid in increasing revenue.

10 Cash Flow Tips for Retail SMEs:

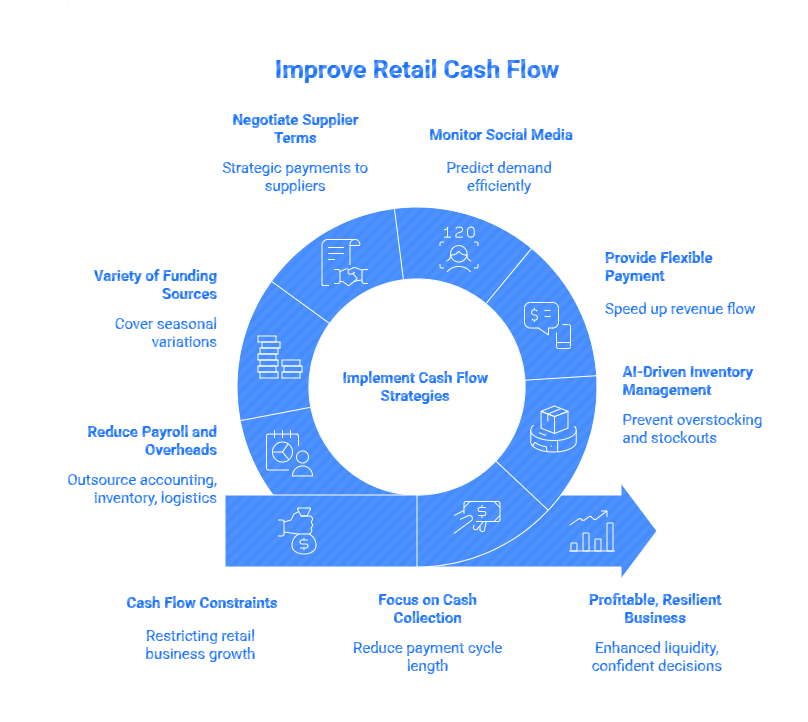

We will discuss 10 tips now that are effective in cash flow strategies, financial friction strategies. They will help make your retail operation a profit-pulling powerhouse.

- Focus on Cash Collection to reduce the length of the payment cycle and implement strict terms to receive payment sooner and stay in the flow.

- Use AI-Driven Inventory Management to exploit smart forecasting devices and prevent

- overstocking and stockouts to release working capital.

- Provide Flexible Payment and implement contactless, online, and installment-based payment to speed up revenue flow (Credilinq).

- Monitor Social Media, online searches, and POS data in real-time sales and trends to predict demand and allocate cash most efficiently.

- Negotiate Supplier Terms to make payments to suppliers in a strategic manner without overloading them to ensure they have cash.

- A Variety Of Sources Of Funding, and emergency cash reserves, credit lines, or small business loans, to cover seasonal variation.

- Reduce Payroll and Overheads through the outsourcing of accounting, inventory, or logistics services.

- Optimize the Pricing and Discounting by applying dynamic pricing or other time-related discounts to clear inventory, which can be turned into cash very fast.

- Audit Cash Flow regularly and review monthly to find the bottlenecks, slow-paying customers, and cash traps on inventory (Bharat Next).

- Invest in Cash Flow Forecasting by preparing in advance for the seasonal demand.

Unexpected costs and even expansion possibilities to eliminate surprises.

Conclusion:

Cash flow is not a metric; in fact, it is the life of your retail business. Even profitable businesses cannot withstand the strain of making payments, especially those due in seasonal demand. It is there that Expertise Accelerated (EA) comes in.

Through EA and its outsourced cash flow projection and accounting solutions, retailing companies can obtain the experience and capabilities of an accounting team of highly qualified professionals worldwide at a small portion of the expense of having permanent staff.

Whether it is planning seasonal spikes or fostering the unexpected changes in the market, EA keeps you informed on the latest news, working strategies, and resources to make confident decisions.

Quit letting cash flow constraints restrain your growth. Join forces with EA to simplify things, enhance liquidity, and turn your retail enterprise into a profitable, resilient industry giant.

Book your free consultation; begin to address cash flow issues.