Strong Q2 sales should feel like a win. Instead, your gross margin is down to 2.3%, and no one can explain the drop. That’s the chaos CPG leaders face every day.

Here trade promotions go rogue, chargebacks pile up without warning, and landed costs spike overnight. That’s why choosing the right accounting firm is a strategic move. You need a partner built for the complexities of CPG finance.

According to industry data, trade spend now accounts for 15–20% of gross sales for most CPG brands. Yet over 70% of companies say they struggle to measure its ROI accurately.

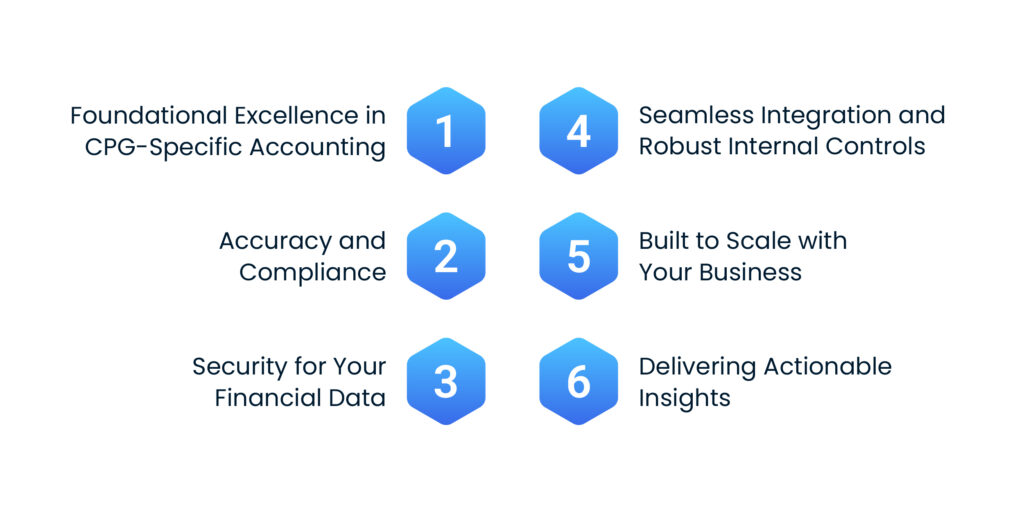

Let’s break down the top 6 qualities of a CPG-focused accounting firm and how to find one that thinks like a CFO.

Foundational Excellence in CPG-Specific Accounting

In CPG, basic bookkeeping won’t get you far. You need an accounting outsourcing firm that truly understands how your business runs.

When inventory is always moving, your partner should know how to track landed costs and provide accurate COGS reporting without fail. That data drives your pricing, margin, and planning decisions.

Then comes trade spend. From MDFs to promo accruals, every dollar must be tracked. If it’s not, you’re flying blind.

Lastly, mastering the deductions. A reliable firm won’t just log your deductions, they’ll investigate, dispute invalid chargebacks, and help recover what’s rightfully yours.

Accuracy and Compliance

Trust starts with accuracy. In CPG, a single error in sales tax or revenue recognition can snowball into costly consequences. That’s why your accounting services provider should be led by experienced CPAs who understand what’s at stake.

A firm that enforces GAAP compliance, understands revenue timing, and manages multi-state tax nexus with precision.

When an auditor asks about internal controls or tax positions, your partner should have airtight processes, clear documentation, and built-in review checkpoints.

After all, if the numbers can’t be trusted, what else matters?

Security for Your Financial Data

Your financial data is among the most sensitive assets your company holds. That’s why your accounting outsourcing firm must treat security like a non-negotiable priority.

Look for enterprise-grade protection:

- secure cloud platforms

- encrypted data transfers

- access controls

- a solid disaster recovery plan.

If they’re not talking about SOC 2 compliance or secure ERP systems like NetSuite or QuickBooks Online, they’re not ready!

At Expertise Accelerated, security is our top priority. EA’s offshore teams work only in the environment our clients provide us with. We ensure that the access is controlled by our clients. Our teams do not have rights to transactions and, when needed, have read-only access to payroll, banking, or credit card platforms. Your financial data remains private, secure, and under your control.

Seamless Integration and Robust Internal Controls

Technology is the infrastructure that supports accuracy, reduces risk, and keeps your finance operation audit-proof.

Your outsourcing partner must integrate seamlessly with your ERP, inventory, and sales platforms. This creates a single source of truth across your financial operations.

Equally important are internal controls. You need structured workflows, proper segregation of duties, and audit-ready documentation, especially across functions like accounts payable and payroll.

Built to Scale with Your Business

The CPG industry moves fast. And your accounting partner should scale with minimal friction.

A reliable accounting outsourcing firm provides on-demand support without the cost of internal hiring. You get elastic capacity when you need it, and efficiency when you don’t.

Need to ramp up support during peak season? They’ve got the strength. Want to streamline during slower quarters? No problem.

Delivering Actionable Insights

The best and most reliable accounting vendors don’t just execute, they advise.

They help you:

- Analyze gross margin by SKU, customer, and sales channel

- Gain visibility into your cash conversion cycle, from payables to collections

- Support budgeting and forecasting with accurate, real-time financial data

For you, they are not just a service provider. They are your co-pilot; an extension of your leadership team.

Difference Between a Generalist Accountant and a CPG Specialist

A reliable accounting outsourcing partner doesn’t just keep your books clean, they understand your business inside and out. For consumer packaged goods (CPG) brands, this distinction is critical.

While a generalist accountant focuses on compliance, bookkeeping, and high-level expense tracking, a CPG-specialized accounting firm dives much deeper.

A CPG-specialized accounting firm knows the mechanics of trade spend, chargebacks, and slotting fees, and they track profitability down to the SKU level. Instead of recording trade spend as a single line item, they analyze deductions by retailer, promotion type, and timing, often recovering 0.5–0.75% of sales in unauthorized deductions, a $50K–$75K impact on a $10M brand.

A CPG accountant also builds rolling forecasts that factor in seasonality, retailer commitments, and promotional activity, achieving 85–90% forecast accuracy compared to the 70% typical of generalists. This level of industry-specific insight transforms accounting from a compliance function into a growth engine. Companies can improve their cash flow, and uncover hidden profits.

Finding CPG Accounting Talent Is Tough

Have you noticed how hard it’s getting to hire accountants lately? Up to 84% of CFOs face talent shortages. The effort companies are putting into keeping their staff these days is downright draining.

There is a general shortage of talent. Within the CPG world, this talent shortage issue becomes even more acute because CPG accounting is nuanced and unique. It requires specialists who understand the details for areas like trade promotions management, cost of manufacture, inventory valuation and other areas unique to the CPG world.

We’ve saved businesses 30-50% by outsourcing to qualified CPG accountants. Our clients rarely let us go. Because our people become part of their team.

Choose an Engine for Growth, Not Just an Outsourced Service

Selecting an accounting outsourcing firm is an investment in your company’s future. The right accounting firm gives you more than clean books. You gain a specialized team that understands the complexities of CPG, a secure and integrated tech stack, and real-time insights that drive smarter decisions.

With the right partner in place, your internal team can focus on high-impact initiatives: shaping strategy and enabling growth.

To see how a finance partner built for the C-suite can transform your CPG operations, explore our dedicated outsourcing accounting services.