SME growth will not be dependent on cash flow management. The idea is that SME growth depends on profit, but this is not true! Profits are shown in the report, but cash is an everyday reality. Businesses focus on profit, thinking it proves success, but it only shows that they record revenue each quarter.

Just because you are showing a profit on paper does not mean your company is actually growing. That is why consistently profitable companies are finding it hard to expand, let alone thrive.

Cashflow management enables you to grow your business like a tree, organically, naturally, and whenever possible. It allows you to have money for supply relations, accounts payable, and employee-related management.

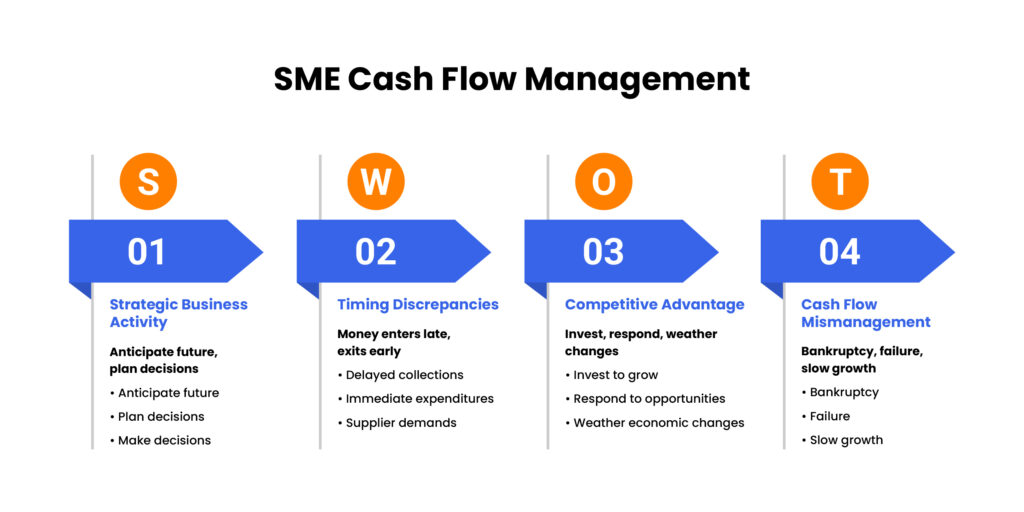

Companies that go from consistent profits to overnight bankruptcy are almost always suffering from cash flow mismanagement. Profitability is not liquidity. So, why will a profitable business suffer from cash flow management problems?

Why Successful Businesses May Struggle with Cash Flow?

Here are a few common ways cash flow management suffers even when businesses are thriving:

- Due date: Salaries should be paid to employees on time, irrespective of when customers pay.

- Suppliers’ demands now: Vendors usually demand immediate payment, and customers often defer.

- This accounting discrepancy poses a serious risk: Profit is on paper, and the only thing that makes the business run is cash.

The Real Problem is Timing:

The problem of cash flow is unlikely to arise if a business has no customers. They occur when the money enters late and exits early. Delayed collections and immediate expenditures on a sale, even when it is strong, pose a cash pressure that can easily get out of control.

This is why cash flow management is not just a bookkeeping activity but a strategic business one. It provides leaders with the power to anticipate the future, enabling them to plan and make decisions without hesitation.

Why Cash Flow Management is More Important than Profit:

Cash discipline is now more important than ever before in the economic environment. Over the last few years, the environment of SMEs has been challenging for cash planning:

- Lending is more difficult and scarce.

Lenders and banks have become more conservative, making it difficult to rely on borrowing to finance the business’s deficits. This augments internal cash visibility requirements.

- The payment cycle is extended due to client payment delays.

Customers tend to lengthen the payment period; this may be due to insufficient cash or a lengthy internal procedure. This implies that it will take a long time to convert revenue into usable cash.

- The unstable economy hinders stability.

The rise in inflation, wages, and supply chain costs increases the cash required to operate, making cash management a prerequisite for survival.

Cash flow management is, in this case, not a luxury- it is the distinction between flourishing and just surviving.

A Powerful Pattern: Cash Problems Lead to SME Failure:

Several reports published by leading banks and economic institutes confirm what most proprietors claim is common knowledge: cash flow issues are the number one factor driving SMEs out of business, despite high demand. Companies do not fail when they lack customers; they fail when they cannot convert sales into cash that is useful enough.

The trend has transformed the cash flow management process, which was previously considered a nice-to-have back-office process, into a significant growth driver.

Real-World Insight:

The most successful leaders do not rely on flawless forecasts; they focus on cash visibility.

When speaking to CFOs and growth executives, a common theme is present. The popular business and finance podcasts are reflective of this. CFO Thought Leader and Masters of Scale often repeat that sustainable growth is based on liquidity discipline.

In a market of uncertainty, cash clarity and control are more effective than aggressive growth pursued by companies lacking financial discipline.

“The most successful companies prevail because they are seen as having cash, not because they make impeccable predictions.”

Cash Flow Management Is Not a Forecast, It Is a System:

“Forecasts Prepare You for the Situation – Management Prepares You to React.”

A cash flow forecast will be beneficial, but it will not be a conclusion. Forecasting is almost the same as the weather app: it informs you about what might happen, but does not spare you from getting wet. Cash flow management follows the forecast to ensure the business continues operations without interruption by adjusting plans, setting priorities, and ensuring all payments are made as required.

This difference is essential, since most SMEs consider forecasting to be the answer, not the item. An estimate is not enough to stop the cash crunch; a response is.

The Difference Between Information and Action:

Forecasting provides information, while cash flow management is about decision-making and action.

It may be projected that the cash will be depleted in 45 days, but it is the management that turns that knowledge into action; They may speed up the collection process, postpone unnecessary expenditure, or renegotiate with suppliers. Hence, risk predictions are made; cash flow management eliminates the risk.

The Dumping of Annual Budgets in favour of Rolling Forecasts:

Annual budgets are no longer adequate. Business conditions change rapidly, and a plan conceived twelve months earlier is usually outdated before it can be implemented. The strongest of the SMEs now are determined by rolling 3- to 6-month forecasts that are revised weekly. This will enable them to respond to changing circumstances on the ground rather than rely on outdated assumptions.

You must take the weekly updates, as they provide a feedback loop: you make predictions, see the actual performance, adjust your assumptions, and make another prediction. This cycle transforms the cash flow from a fixed forecast to a working management system.

Check-in Weekly Cash, The New Way:

The habit of conducting a weekly cash check-in has become a strong yet simple trend adopted by numerous growth-stage businesses. This is normally a 15-minute overview of receivables, payables, and bank balances. It is not to make an ideal prediction; it is to keep the radar on and identify issues early.

The habit helps to ensure that small problems are not turned into emergencies. When a large invoice is outstanding, or a supplier bill or check arrives earlier than it was due, the business can respond promptly rather than being caught off guard a few weeks later.

Why This Matters for Growth:

Cash flow is a system, and when leaders understand it, they can make faster, more confident decisions. They base their plans on cash availability and avoid unnecessary risks, unlike during a shock-induced cash shortage. This provides an easy way to grow: companies can recruit, invest, and expand without worrying about running out of money.

Real-World Insight:

In the context of the financial leadership discourse and podcasts, the same message is being conveyed: operational finance has become a source of competitive advantage.

For example, the SaaS CFO has consistently highlighted rolling forecasts as a key to scalable growth, and the a16z Podcast has also emphasized that operational disciplines, such as cash visibility, distinguish strong companies from weak ones in unstable markets. This is not merely a trend, but it is becoming a norm for stable businesses.

“Cash visibility is more important in the growth world than perfect forecasting.”

Accurate Books: The Basics of Confident Decision-Making:

“Messy Books Build False Confidence or Unnecessary Fear.”

Failures of cash flow forecasts can be credited to the largest source of failure: the data used in forecasting. Poor or incomplete bookkeeping will lead to unreliable forecasts. This poses two significant dangers: false confidence and unwarranted fear.

False confidence occurs when leaders believe the cash is in better health than it actually is and make risky decisions, such as hiring too soon or investing in expansion before the money is in place. Unnecessary fear arises when leaders assume there is no cash, lack precise information, and make overly conservative decisions that lead to slow growth. Both end up suppressing and undermining the business.

Proper Bookkeeping Means Reliable Forecasting:

Accurate books enable companies to keep records of who owes them, their due dates, recurrent expenses, and customer payment habits. Such transparency helps with sound prediction and decision-making.

That is, proper accounting makes the cash flow management not a guessing game but a foreseeable process.

Why This Matters:

The accounting and advisory models based on CPA heads have been shifting many SMEs out of pure transactional bookkeeping. It demonstrates this change and indicates that business organizations require more than numbers as their strategic direction. Modern-day bookkeeping is not just about recording transactions, but also about making decisions and facilitating growth.

Accounting teams led by advisors help businesses make sense of the numbers, project future cash requirements, and develop systems to avoid cash surprises. That is why cash flow management is becoming more of a strategic partnership than a back-office activity.

Previously, large companies only had large closings every month. Monthly closes are now becoming the norm for SMEs. This keeps the books up to date, and forecasts are made using actual data rather than guesswork. Monthly close will eliminate the risk of overlooking transactions, mistakes, or incorrect information, thereby making cash flow forecasting much more precise and, most importantly, effective.

The Visibility of Cash Flow and Sustainable Growth:

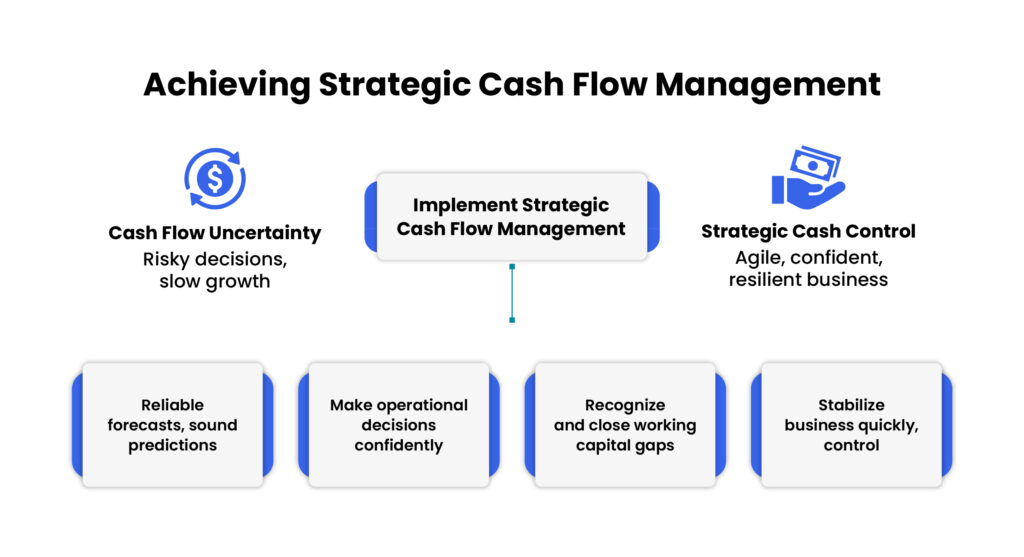

The visibility of cash flow is not a financial luxury- it makes actual operational decisions. By knowing cash flow timing, leaders can make good decisions about when to hire, the level of inventory, expansion, and vendor negotiations. Such decisions are guesses without clarity of cash, and guesswork is costly.

Growth Can Create A Cash Strain Even As Revenue Increases:

It is a common paradox that many businesses grow but become cash-poor. The growth may involve expenses that need to be paid upfront before the revenue sets in, such as staffing before sales level off, stocking in advance, and paying suppliers and marketing costs. All these require a cash outlay, and revenue can still lag.

These conditions are a state of affairs in which growth is a cash sink rather than a cash generator.

The Real Issue: Gaps in Working Capital:

Working capital gaps- the difference between cash outflow and cash inflow is usually the core issue. A cash gap can even occur in profitable businesses when customers pay late, suppliers pay early, and inventory is purchased before the sale.

There is a concern about cash flow visibility, as it helps recognize and close these gaps before they become crisis-prone. It enables leaders to know the location of cash tied up and act to free it.

Why This Matters:

Cash flow strain has become increasingly prevalent due to recent business conditions. The length of receivable cycles is growing, upfront costs are increasing, and payment delays are increasing. That is why nowadays many SMEs negotiate their payment terms with the help of cash forecasts, plan their growth purposefully, and decrease risk.

Real-World Insights:

Advisory-based accounting and cash management are becoming the keys to SME success. Podcasts such as the Accounting Today Podcast and Grow My Accounting Practice highlight that advisory services cannot rely on simple bookkeeping as the key to sustainable growth. These voices prove that cash flow management is no longer a back-office activity; it is a part of strategic leadership.

Conclusion:

Dealing with Uncertainty- From Cash Stress to Strategic Control

Cash flow management is not just knowing how much cash you have today.

It is a matter of being ready for what might occur the next day. Uncertainty is an issue SMEs have to deal with in myriad ways: seasonal demand spikes, supply chain shocks, unexpected cost increases, and even macroeconomic conditions. It is dangerous that in this environment, only one forecast can be used. One prediction is that the world is stable, yet in reality, it is seldom stable.

A healthy cash flow system is not just a prediction system; it also helps you spot warning signs before they turn into a crisis. Once cash begins to tighten, it typically shows up in the operational stress area: payroll strains, vendors are late, or there is an opportunity the business cannot afford because it does not have the cash to invest.

The presence of such signals can be addressed through a structured triage strategy that quickly stabilizes the business. This entails making the necessary payments, securing the required cash, and developing a short-term plan to eliminate the problem. Triage is not panic control; it is control.

Cashflow Management is the key to revenue growth

Call now and EA will upgrade your cashflow management now!

The biggest psychological change in cash flow management is the realization that it is not about making predictions, but about preparing. A company oriented on liquidity and resilience will be able to change more rapidly in a changing environment. This preparedness helps leaders react to disruptions without scrambling and make strategic decisions with confidence, even when the future cannot be predicted.

Cash mastery is indeed a competitive advantage in the modern world. Firms with high cash visibility respond more quickly, secure more favorable agreements with suppliers and lenders, act more rapidly, and experience downturns less often. When a business has a clear idea of its cash position and can project it, it will be more agile and more confident.

“Cash flow management not only secures the business but also provides the leaders with the ability to take risks.”