Cloud accounting has transformed into a niche technology.

More than 60 percent of small and medium-sized businesses are currently using cloud-based accounting solutions, adoption by enterprises is skyrocketing, and investments in AI-based accounting solutions have reached more than 12 billion by 2025 (Market Growth Reports).

The real pioneers? Automation and artificial intelligence. Regular accounting, reconciliation of bank accounts, and even complicated reporting jobs (Eman Research), which previously took hours to complete, can now be accomplished in minutes.

It is important to first stop and admire the fact before we move on to what is next in cloud accounting, why it has become more than just a tool; it is a financial revolution! Because it allows one to be agile, fast, and intelligent, which legacy systems could not achieve. Accounting services have become a game-changer for businesses, enabling them to manage finances with ease and efficiency, far beyond what traditional systems ever offered.

What is Cloud Accounting?

Cloud accounting is the use of accounting software connected to an online server: the cloud. All of the accounting data and financial information is uploaded and stored directly on the cloud. Bookkeeping, invoicing, and almost all other accounting functions are then done on software using that data.

It’s very similar to using spreadsheets for bookkeeping, but unlike spreadsheets, cloud accounting software is fully equipped to handle many complex accounting tasks (Go Cardless). Cloud accounting has been around for a good while now, but until recently, organizations mainly used it for data integrity purposes. Going paperless and preserving data on a server was just more cost-effective and streamlined as a process.

After the pandemic, the big change was the realization that cloud accounting is perfectly set up to integrate with remote work. All of the accounting workload is already on a computer, so why can’t your accountant sit across the globe and do the same work?

The already booming outsourced accounting industry then experienced a meteoric rise. As reported in a previous EA publication titled “Top 5 Challenges in Modern Accounting & Their Solutions: Strategies for Success”, businesses that solely utilize cloud accounting software are experiencing five times the client growth compared to those that do not.

US businesses are investing heavily in offshore accounting resources for various reasons. Let’s examine some of the main benefits cloud accounting will bring in the next few years.

The Benefits of Cloud Accounting Technology:

Cloud accounting offers a slew of benefits that business owners across the US are clamoring to take advantage of. Let’s quickly go over some of these to get a better idea of their mindset:

AI-Driven Insights

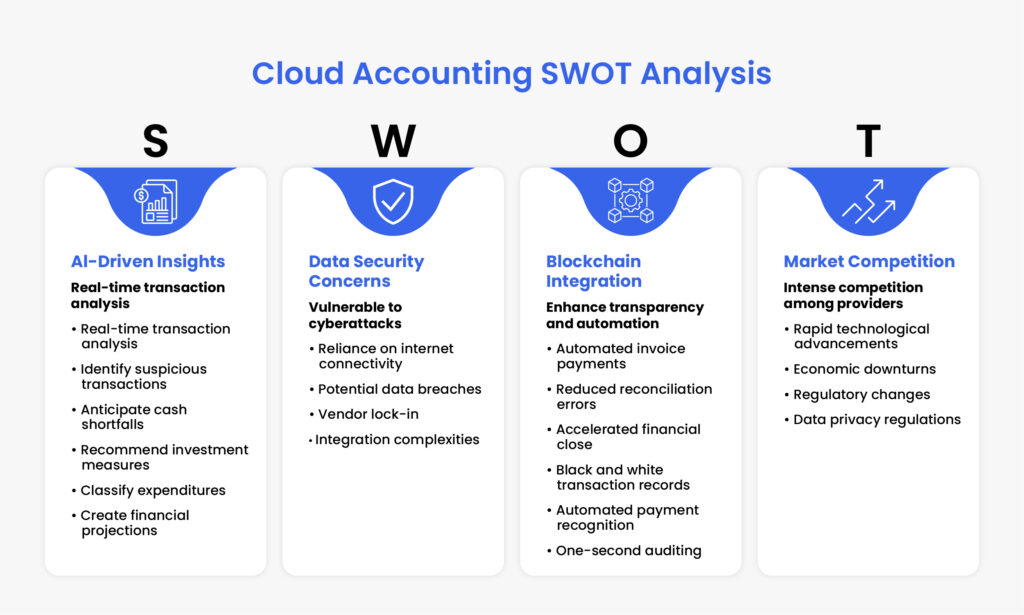

Cloud accounting is not a process of moving data to the internet. It is transforming numbers into insights. Contemporary systems combine AI and machine learning to analyze transactions in real-time (Febi). It enables the user to identify suspicious transactions, anticipate cash shortfalls, and even recommend investment or cost-saving measures.

AI can raise red flags over anomalies, classify expenditures, and automatically create financial projections instead of having accountants manually sort through the invoices to find anomalies.

In the case of small businesses, it will result in more rapid decision-making and more intelligent approaches without the need to employ a massive financial team. Businesses are now able to plan the risks, optimize the inventory, and even modify pricing strategies based on the insights they are able to draw from their cloud accounting system.

The ultimate benefit? Accounting becomes a response action, a back office operation, and becomes a proactive tool that can be used to propel business.

Smooth Integration with Other Business Systems:

The other pros of cloud accounting that are underestimated are the fact that they can be combined with other business tools. Cloud accounting can make all financial processes based on one of the central hubs through CRM systems and ERP platforms, payment gateways, and project management tools (Emerald).

This integration enables:

- Live financial monitoring within the departments.

- Workflows of automated billing and collections.

- Proper cost tracking and profit analysis of the project.

Silos not only disrupt operational efficiency but also allow leaders to see the business as a 360-degree view to enable them to identify trends, ensure resources are well allocated, and make data-driven decisions faster than ever before.

Cloud Accounting, Blockchain, and Smart Contracts:

Cloud accounting has now arrived at the door of the future: blockchain and integration of smart contracts are going to transform transparency, safety, and automation in financial management. Smart contracts may be used to automatically pay tokenized invoices, which would remove reconciliation errors and significantly accelerate the financial close process (SZFP Tech).

Blockchain-powered cloud accounting can deliver to those businesses who are comfortable taking risks:

- Black and white transaction records minimize fraud.

- Automated payment and revenue recognition.

- One-second auditing and compliance reporting.

The early adopters of these technologies will not only achieve efficiency but also be in a position to be innovators in financial transparency and trust, which is a major differentiator in the current competitive market.

A Cost-effective Accounting Option for Everyone:

Cloud accounting and remote work make for a dynamic duo that small businesses just cannot ignore. With how complex financial work can get, not to mention the volatile economy and sky-high inflation, financial help is a must. Unfortunately, funding an in-house accountant and covering the associated overhead costs have long barred the way.

With cloud accounting software, small businesses now have the ability to access this coveted financial help (SSRN eLibrary). Remote professionals and offshore accounting services are offering top-quality accounting at incredibly affordable rates. All thanks to cloud accounting technology and everything it enables.

Gone are the days when SMB owners were forced to burn the midnight oil reconciling the books. Now every mom-and-pop store and local business can have a professional accountant guide them through the financial maelstrom of the coming years.

Airtight Security and Data Integrity:

Cloud accounting platforms are equipped with state-of-the-art security features. Everything from data encryption to multi-factor authentication and strict access control is available in cloud accounting. On top of that, accounting software is very difficult to tamper with, leaving no room for any mistakes or fraud to go unnoticed.

The data storage capacity of cloud accounting platforms is also vital for maintaining data integrity (SSRN eLibrary). Going paperless or even going beyond Excel spreadsheets is a massive step in the right direction. Accounting software is built-to-purpose for accounting, with everything set up to deliver the most secure accounting experience.

With data hacks and social engineering attacks increasingly common now, cloud accounting is a stalwart defense against malicious actors. The software comes with numerous features to ward off unwanted visitors and keep you and your customers’ data safe and sound.

Breaking Down Business Silos:

You can integrate cloud accounting into the business’s ERP system, breaking down many business silos in one go (SSRN eLibrary). The accounts department must deal with every part of the business at some point, given that everything takes money to run. By breaking down the silos between the accounting and other functions, collaboration blooms among the team, leading to productivity boosts.

Sustainability and a Green Workplace

Climate change and environmental concerns are at the center of social conversation these days. Customers want to support businesses actively trying to save the planet. The sustainability mission is in full swing, and going paperless and shifting to remote work are steps in the right direction.

Also Read: The Impact of Sustainability on Sales in the CPG Industry

Remote work means businesses consume fewer resources. This indirectly impacts power usage and reduces the carbon footprint (SSRN eLibrary). Meanwhile, cloud accounting adoption is effectively going paperless, saving trees and the environment. Businesses looking to do their part in saving the world will find cloud accounting and remote work well within their power. Change begins with small steps, so why not start with your accounting?

Challenges Facing Cloud Accounting

Although cloud accounting is the most convenient, efficient, and insightful solution that has ever existed, it has its own challenges. These challenges are important to understand to implement the technology in organizations successfully and to utilize its potential to the maximum.

Concerns in Data Security and Privacy:

Despite the high encryption, multi-factor authentication, and limited access, there are still numerous businesses that are apprehensive about keeping sensitive financial information on the internet (Data Guard).

The threats of cyberattacks, phishing, ransomware, and insider threats are also here to stay in the digital world. Companies should properly screen cloud providers to ensure that they comply with an industry standard of security, conduct frequent penetration testing to identify security vulnerabilities, and comply with privacy regulations such as GDPR, CCPA, and other local regulations.

Furthermore, access control, user permissions, and frequent monitoring should be introduced as internal policies by the companies to reduce the risks further.

Over-reliance on Technology:

The automation and remote possibilities within cloud accounting are simply amazing, though there is vulnerability when linked to technology (ProQuest). Even a temporary blockage to the access of vital financial data can stop the workflow due to internet outages, server failures, or software bugs.

Companies require strong contingency strategies, which include backup systems offline, mirror databases, system architecture redundancy, etc. Employees should be trained on accessing and operating offline or in emergency mode so that accounting processes will not be halted in case of technical interruptions.

Problems of Integration and Compatibility:

Most companies have several systems in operating departments, including CRM and payroll systems, to inventory systems and project management (Sync Matters). Cloud accounting systems that are not integrated in a seamless way may lead to data silos, manual reconciliation, and the possibility of error occurrence.

It is necessary to choose solutions that have flexible APIs, pre-built integrations, and custom connectors to ensure the fluidity of the data flow. Moreover, a correct mapping of financial processes and standard data formats can also decrease friction and make cloud accounting the main point of all business activities.

User Adoption and Change Management:

The movement of spreadsheets or old accounting systems to cloud systems is not merely a technical improvement, but a change of culture (Ness Digital Engineering). The resistance to change may occur because employees are afraid of the complexity, might feel that their jobs are not safe, or they may not be familiar with new tools.

The firms will have to invest in training, gradual adoption, and support, and promote the advantages of cloud accounting. The adoption can also be encouraged by celebrating small wins and early stories of success to enable the teams to take the change positively.

Compliance and Regulatory Risks:

Cloud accounting makes accounting easier, yet the businesses remain responsible for complying with the standards of local, federal, and international accounting. Automated workflows may either result in misreporting or break the rules in case of misconfiguration.

Organizations have to audit automated processes on a continuous basis, keep smart rules current with accounting standards, and seek the advice of regulatory specialists to make sure that they are complying and taking the best advantage of cloud technology.

Having these factors considered, businesses will be in a position to overcome obstacles and leverage the power of cloud accounting to its full capacity to simplify business processes and enhance precision, and make more prudent business choices with the security of the most confidential financial information.

Mastering NetSuite, QuickBooks, Xero, and More

EA’s team has extensive experience with leading cloud accounting platforms, including NetSuite, QuickBooks Online, and Xero, ensuring seamless implementation, reporting, and ongoing financial management.

Conclusion:

Cloud accounting has opened up many new doors for businesses of all stripes. Accounting services in the USA are all moving towards cloud accounting, with remote accounting a highly coveted service by small businesses.

Only time will tell if cloud accounting is just a flash in the pan or the start of a technological shift. All we can do for now is wait and see. Our recommendation will be to invest in basic cloud accounting and give remote accountants a shot.

You would be surprised at the level of professionalism and talent on display in the global talent pool. Expertise Accelerated offers a doorway into the magical world of remote accounting and cloud financial management. Take a step across the threshold and see what awaits you on the other side.